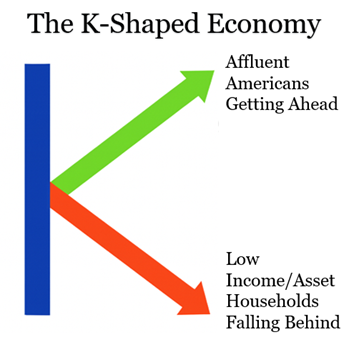

Perhaps the term getting the most run in financial news headlines and on corporate earnings calls over the past few months is: “K-shaped economy.” The hot button term is being used to describe the current state of the economy that seems to be diverging sharply depending on one’s financial situation.

According to this reporting, and backed up with some anecdotal and empirical data, affluent Americans are pulling ahead, while much of the population faces mounting challenges from a softening job market, persistent inflation, and elevated interest rates that strain household finances. Delta Airlines, for example, has reported record demand for premium seating, while fast-casual restaurants like Chipotle have seen demand soften as consumers feel the squeeze. How can thousand-dollar seats be selling out while $10 burritos are stretching wallets? That contrast has many questioning the true health and long-term sustainability of the economy.

Two areas most often cited in explaining this divergence are the stock market and homeownership. Let’s take a closer look at each and how they influence consumer behavior.

The Stock Market

Just recently, the Wall Street Journal ran a story titled “Feeling Great About the Economy? You Must Own Stocks.” WSJ The article highlighted that soaring markets have added trillions to household wealth and boosted investor confidence. For those without stock exposure, however, optimism is fading, and economic sentiment has fallen to its lowest level in decades.

With U.S. stocks returning 26% in 2023, nearly 25% in 2024, and roughly 16% so far this year, it’s clear that those invested in the market are in a stronger financial position than those who aren’t. But there’s a silver lining: according to the latest Gallup report, 62% of Americans own stocks, meaning a majority of Americans have participated and benefited from this growth. The challenge remains, how will the remaining 38% catch up?

Homeownership

Homeownership is a more complicated part of the story. Buying a home has long been viewed as a cornerstone of financial stability and a key driver of long-term wealth. But for younger or lower-income Americans, rising prices and high borrowing costs have pushed homeownership out of reach.

Still, there is another bright spot. Many younger would-be buyers who have delayed purchasing a home have instead funneled their savings into the stock market in an effort to build future financial security. WSJ - Where Have All the Young Home Buyers Gone? Check the Stock Market

While homeownership can be great financially, personally, and psychologically, it isn’t always the best investment (I wrote a little bit about this back in June: RSWA Blog). Renters may not be building equity, but they also avoid the financial strains that come with ownership: maintenance, repairs, and decreased flexibility, to name a few. For those investing funds that would have otherwise gone towards a down payment and ongoing upkeep, the long-term financial outcome could end up being even better in the long run.

2026 Retirement Contribution Limits Announced

The IRS has released the 2026 contribution limits for many employer-sponsored retirement plans and Individual Retirement Accounts (IRAs). Here are the key figures:

401(k)s, 403(b)s, 457s, & TSPs:

- Regular contribution limit: $24,500

- Catch-up provisions for savers 50 and older: $8,000 (total of $32,500)

- Catch-up provisions for savers age 60-63: $11,250 (total of $35,750)

- These savers must be turning 60, 61, 62, or 63 in 2026

Individual Retirement Accounts (IRAs):

- Regular contribution limit: $7,500

- Catch-up provisions for savers 50 and older: $1,100 (total of $8,600)

Source: IRS.gov

Financial Planning Corner:

Mission Statements in Estate Planning

Leaving an inheritance is a meaningful gift to future generations. Yet we’ve all heard stories of families torn apart by disputes over assets or wealth that quickly disappears once passed down. To help prevent these outcomes, many affluent families are now adding a new tool to their estate plans: family mission statements. WSJ - Wealthy Families Are Writing Mission Statements to Avoid Fights, Lost Fortunes

Family mission statements are becoming increasingly popular as a way to protect wealth while keeping family relationships strong across generations. While not legally binding, these statements outline shared values and long-term goals that guide decision-making, reduce conflict, and help heirs manage inherited wealth responsibly. Common themes include stewardship, legacy, generosity, curiosity, and personal growth.

Often, the most powerful part is not the statement but the process itself. Families typically gather in relaxed settings, sometimes with a facilitator, to talk openly about what matters to them, define their shared purpose, and prepare younger generations for responsible leadership. Many families revisit the mission annually, pairing it with financial transparency and education. Taken together, these practices help families stay aligned, maintain strong relationships, and increase the likelihood that their wealth will endure for generations to come.

Many of these mission statements are created by ultra–high–net–worth families with significant multigenerational wealth. However, whether you’re passing down billions, millions, thousands, or even just a few hundred dollars, there are valuable lessons for any family looking to transfer assets to the next generation, along with best practices to help avoid conflict and tension along the way.

Quick Hits:

- Tired of the same old Thanksgiving meals? Try these non-traditional ideas Delish

- Not all sugar is created equal: are “natural” sweeteners really better for you? New York Times

- Ken Burns’ latest 12-hour, 6-part PBS series dives into the real story of the American Revolution Smithsonian Magazine

- Winter is here early in New England: ski hills are opening (Jay Peak in VT already has 93 inches of snow! JayPeakResort) and mornings are frigid. What’s in store for the rest of the season? AccuWeather Farmers’ Almanac

1929

I recently finished 1929, a book by financial journalist Andrew Ross Sorkin (well… the audiobook, because I don’t have the time or attention span to read a 592-page book). The book dives into the stock market crash of 1929 that triggered the Great Depression, and despite being nearly 100 years in the past, it offers lessons that are still relevant today.

My biggest takeaway is that there wasn’t a single catastrophic event that caused the crash, it was simply the culmination of years of speculation, excessive leverage, and blind faith in endless market growth. Once panic set in, the house of cards collapsed. Human psychology played a central role: greed and herd mentality drove the boom, and fear and loss of confidence prolonged the downturn. After the crash, widespread bank failures and economic uncertainty led people to hoard cash rather than invest, stalling recovery. While today’s markets look very different, many see parallels in the strong faith that technological advancements will continue to drive economic growth, leading some to warn that a bubble may be forming.

That said, there are major differences between then and now. Modern regulations and protections help safeguard investors and the broader economy. Many protections we take for granted, like FDIC insurance on bank accounts, didn’t exist until 1933. Also, only about 2% of Americans were invested in the stock market in 1929, compared to the 62% cited earlier, and international and institutional investors add significant liquidity today. When investors sold back then, there were far fewer buyers to step in. In more recent crises, such as 2009, these protections and structural improvements played a crucial role in the markets’ and economy’s recovery.

Quote: “Good mashed potato is one of the great luxuries in life.” — Lindsey Bareham

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!