As the year winds down, market analysts are busy sharing their predictions for 2026, complete with year-end price targets. Conveniently, their estimates usually hover near the long-term historical average return of the U.S. stock market – around 10%.This year is no different, with the consensus forecast from major Wall Street banks calling for… you guessed it: a positive 10% return next year. Morningstar

While forecasts can be informative, predicting stock market returns over a single year is incredibly difficult. There is so much we can’t predict. The past few years have shown just how unpredictable markets can be, with major shocks ranging from tariff announcements that rattled markets, to the launch of OpenAI’s ChatGPT in 2022 that sparked a rally, and, of course, the global pandemic.

At the same time, we’ve also experienced events that seemed likely to spark widespread panic but ultimately had limited market impact, including the failures of Silicon Valley Bank and Signature Bank in March 2023, ongoing global conflicts, and even the U.S. bombing Iran this past June.

We don’t know what those surprises will be, or when they’ll happen, but 2026 will undoubtedly bring events that catch investors off guard, both positively and negatively.

Rather than trying to predict the future, a more useful exercise is often to look back at history to understand what markets have delivered over time. So, let’s do that.

Bull Markets Don’t Die of Old Age

There’s no question that U.S. stocks have been on an impressive run since October 2022. The S&P 500 gained 26% in 2024, nearly 25% in 2025, and is currently on pace for another 15%+ return in 2026. Runs like this naturally make investors uneasy and lead to the big question: how much longer can this last? More specifically, what are the odds of seeing a fourth consecutive year of positive returns?

Historically, a four-year streak of positive returns is far from unusual. Since 1980 alone, the stock market has experienced four separate streaks of five or more consecutive positive years:

- 1982-1989 (8 years)

- 1991-1999 (9 years)

- 2003-2007 (5 years)

- 2009-2014 (6 years)

What sets the current bull market apart is the magnitude of the returns. If we reframe the question and ask, what is the likelihood of a fourth consecutive year with returns of 10% or more? the answer changes meaningfully. Since 1928, that has happened only twice:

- 1942-1945 (4 years)

- 1995-1999 (5 years)

So, strictly from a historical perspective, another positive year for stocks would not be out of the ordinary. However, another year with returns north of 10% would be far more the exception.

The Odds are Stacked In Your Favor

We are strong proponents of long-term investing, and for good reason. The longer your holding period, the more the odds tilt in your favor for generating a positive return. But even over a single year, history shows the odds are generally on your side.

Since 1928, the stock market has experienced 26 negative years, and only 11 of those fell by more than -10%. On the flip side, there have been 31 years where the market returned over 20% in a single year. In other words, historically, you’ve been more likely to see a 20%+ gain than a negative year.

It’s human nature to fixate on the negative years and constantly wonder when the next one will arrive. Yet the reality is that positive years are far more common - they’re the norm, not the exception. (all return data from NYU Stern)

Mid-Terms & Rate Cuts

Two major forces could shape markets in 2026, both of which have historically had a measurable impact. First, 2026 is a midterm election year, which historically brings noise and plenty of information for investors to sort through. Since 1950, there have been 19 midterm elections. In 12 of those instances, the market produced a positive return—about 63% of the time. However, the average return for midterm years has been 8.3%, slightly below the roughly 10% historical average for all years. Volatility also tends to be higher, with an average pullback of -17.65% compared to -14.1% for any given year since 1980. MarketWatch

Second, the Federal Reserve is also actively cutting interest rates. Historically, rate cuts that aren’t paired with a recession have tended to support positive market returns. Research by Adam Turnquist, LPL’s Chief Technical Strategist, found that “since 1984, the Fed has cut rates 28 different times when the S&P 500 was within 3% of an all-time high. After the cut, the broader market traded higher by an average of 13% 12 months later, with 93% of periods producing positive returns.” MarketWatch

In summary, 2026 could be choppy due to election-related noise, but supportive Fed rate cuts could help smooth the ride. As always, markets will surprise us, but keeping a long-term perspective grounded in historical data can help cut through the noise.

Financial Planning Corner:

0% Capital Gains Tax

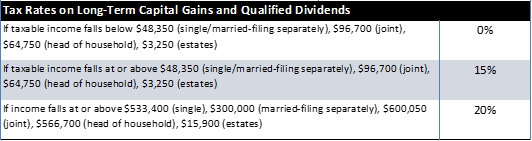

I’ll fit one more tax tip in before year-end. When you sell investments you’ve held for more than one year, any gains are taxed at long-term capital gains rates, which are generally lower than ordinary income taxes. Those rates are 0%, 15%, or 20%, depending on your income.

If your taxable income is low enough, you may qualify for the 0% capital gains tax bracket, meaning you could sell investments at a gain and owe no federal tax on those gains. These thresholds are based on taxable income, not just salary, so deductions and other income sources matter. This is especially useful in lower-income years, such as retirement or years with reduced earnings.

As with any tax strategy, it’s best to check with your accountant first. State taxes may still apply, and selling investments can affect other areas of your financial picture, such as Medicare premiums or health insurance subsidies.

Quick Hits:

- Yoga, walking, and resistance exercises come in as the best exercises to improve sleep ScienceAlert

- Meet Buttercup, the most dominant ultra running mini-donkey 5280

- Father of 10, Quarterback Philip Rivers rejoined the NFL after a 5-year break, boosting his retiree health benefits NYT

- Merriam-Webster’s word of the year: Slop CNBC

- Here are the best free attractions in each state Voronoi

Retirement Is a Sprint, Not a Marathon

When it comes to retirement planning, many people think of it as a long, drawn-out marathon, something that requires careful pacing over decades. Retirement blogger Fritz Gilbert would disagree, and we tend to be on his side. In his blog, The Retirement Manifesto, he challenges the long-held belief that retirement should simply be viewed as 20–30 years of playing it safe and being overly conservative with your finances.

We often think about retirement in three phases: the Go-Go years, the Slow-Go years, and the No-Go years. The Go-Go years are typically the most active, healthy, and opportunity-filled, making them the ideal time to prioritize experiences, adventures, and long-held goals. Rather than pacing yourself during this phase, it can be more rewarding to pursue what matters most with intention and energy. Approaching retirement with a sense of purpose and urgency can lead to a far more fulfilling life after work.

That mindset can also change how we think about planning. Instead of focusing solely on making money last as long as possible, it’s about building a plan that supports living well right away. Whether that means traveling more, picking up new hobbies, or spending extra time with family, having the right financial structure in place can help turn those plans into reality, without sacrificing long-term security.

Quote: “The guaranteed safe bet is to go home or to not go for it, and the other one is, ‘Shoot, let’s see what happens.’” – Philip Rivers

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!