For much of the last decade, stock market gains have been driven by a narrow segment of the market – the largest, most established companies, particularly in technology. You know the names well by now: Apple, Microsoft, Google, Amazon, Facebook, and a more recent addition, Nvidia, now the largest company in the world by market capitalization. For much of this period, investors who owned meaningful allocations outside this group likely underperformed.

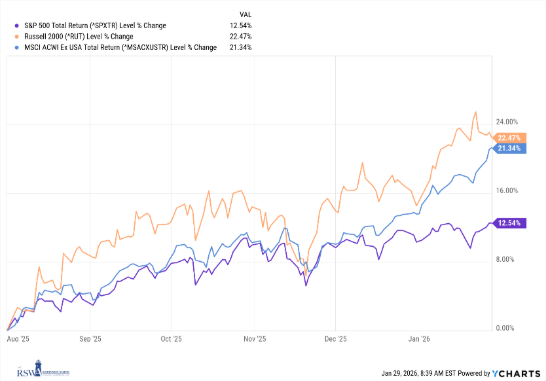

In 2025, however, international stocks, companies based outside the US, bucked this trend, outperforming the US market for the first time since 2017. And over the past six months, another previously beaten-down segment has quietly and handily outperformed the largest US companies represented by the S&P 500.

Welcome back, small-cap stocks.

“Small cap” refers to a company’s market capitalization. The Russell 2000, the most commonly used benchmark for US small-cap stocks, is made up of nearly 2,000 companies, with the average company currently valued at around $4 billion. While that may still sound large, it pales in comparison to companies like Google and Nvidia, each valued at over $4 trillion (more than 1,000 times larger).

As shown in the chart above, the Russell 2000 (orange line) has outperformed the S&P 500 (purple line) by about 10% since August 1, 2025. That momentum has continued into the start of 2026, with small-cap stocks already up over 7% in January alone.

This resurgence has been a welcome development for investors who have grown increasingly concerned about the concentration of market gains in just a handful of companies, and a positive outcome for those with more broadly diversified portfolios (more on that shortly).

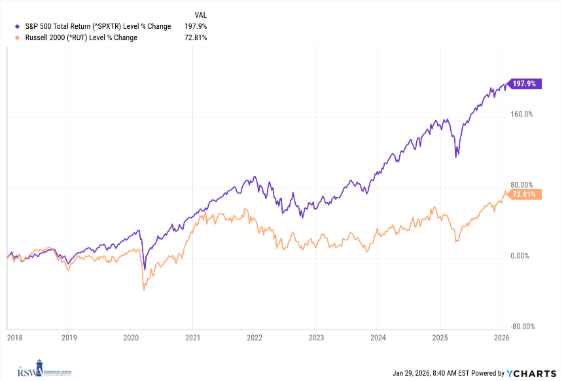

That said, long-term investors in small caps have had to be VERY patient and have waited a while for this moment:

When we zoom out to the start of 2018, the chart above highlights just how far behind small-cap stocks had fallen prior to this recent run. While small caps can play an important role in a diversified portfolio, their higher volatility and risk profile generally make them better suited as a smaller, complementary allocation.

AI Spending & GDP Growth

A new look at the US economy in 2025 challenges the headline story that AI was the sole force behind growth. According to recent analysis, while corporate investment in AI (especially software and tech infrastructure) contributed meaningfully to GDP, it was not the biggest driver overall. After adjusting for imported high-tech equipment, AI-related spending accounted for only about a fifth of GDP growth, with consumer spending—everyday people buying goods and services—remaining the largest driver of expansion. In short, AI is an important and growing piece of the growth story, but most of the economy’s expansion still comes from everyday spending and activity. CNBC

AI Spending & the Stock Market

While AI may represent just one component of overall economic growth (and I just spent six paragraphs hyping up small companies), the companies leading the charge in AI investment still make up a significant portion of the US stock market.

This week, Microsoft, Meta (Facebook), and Apple reported earnings, with Google and Amazon scheduled to release their results next week. Together, these five companies now account for just under 25% of the S&P 500. To put that in perspective, these five companies alone have a combined market value of approximately $15.5 trillion, while all nearly 2,000 companies in the Russell 2000 combined are worth roughly $3 trillion.

As a result, this stretch of earnings reports represents an important moment for market sentiment and expectations as we look ahead.

Financial Planning Corner:

The Value of Rebalancing & Diversification

As we begin 2026, our team is rebalancing client portfolios, making this a good time to revisit why diversification and rebalancing are so important to long-term investing.

As markets shift, certain areas naturally outperform others. When those leadership trends persist, parts of a portfolio can gradually grow beyond their intended size, increasing risk in subtle ways. Rebalancing helps realign portfolios with their long-term targets, keeping risk levels aligned with goals rather than recent market performance.

Diversification complements this process by spreading investments across asset classes, regions, and company sizes. While it does not eliminate volatility, it reduces reliance on any single area of the market and can help smooth outcomes over time.

Last January, I examined how diversification and rebalancing affected outcomes across two different 10-year periods. Rather than repeat that analysis here, I’ll link to it below and share the key takeaway:

“These strategies help you capitalize on favorable market conditions while providing protection during downturns. Although maximizing investment returns is always a priority, doing so at the cost of significantly increased risk is not a sound approach and could jeopardize your entire financial plan.”

RSWA Blog – Rebalancing & Diversification – Why We Do It

Quick Hits:

- The absolute best French fries in every US state (arguably the most important ranking of the year) Chowhound

- I start each morning by checking my Garmin to see how I slept (then let that dictate how much coffee I need), but how accurate are sleep-tracking wearables? AP News

- America’s healthiest states, ranked (New England is doing something right) Visual Capitalist

- My trick to survive the cold winter? A heated blanket. WSJ

- Procrastination isn’t laziness, it’s just your brain sending mixed signals Meaningful Money

RSWA Webinar – Fritz Meyer

We hope you’ll join us Tuesday afternoon at 4:30 pm Eastern as fan-favorite economist and market analyst Fritz Meyer reviews the key economic and market developments from 2025 and the trends shaping 2026.

There’s still time to register using the link below, and a replay will be available for those unable to attend live. Feel free to share the invitation and reach out to your RSWA contact if you’d like a copy of the slides. RSWA Webinar Series - Fritz Meyer Q1 2026

Quote: “The stock market is filled with individuals who know the price of everything, but the value of nothing.” – Philip Fisher

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!