We are officially halfway through 2023 – a perfect time to reflect on what has happened in the economy and markets this year and preview what is ahead.

Let’s begin by reviewing some quotes from January 2023 regarding the outlook for the year:

- “We expect economic growth and market performance to improve in 2023 compared with 2022. But things may get worse before they get better.” – Charles Schwab

- “2023 Market Outlook: Stocks Set to Fall Near-Term as Economic Growth Slows” – JP Morgan

- “A recession is foretold; central banks are on course to overtighten policy as they seek to tame inflation.” - BlackRock

So, how do things look today?

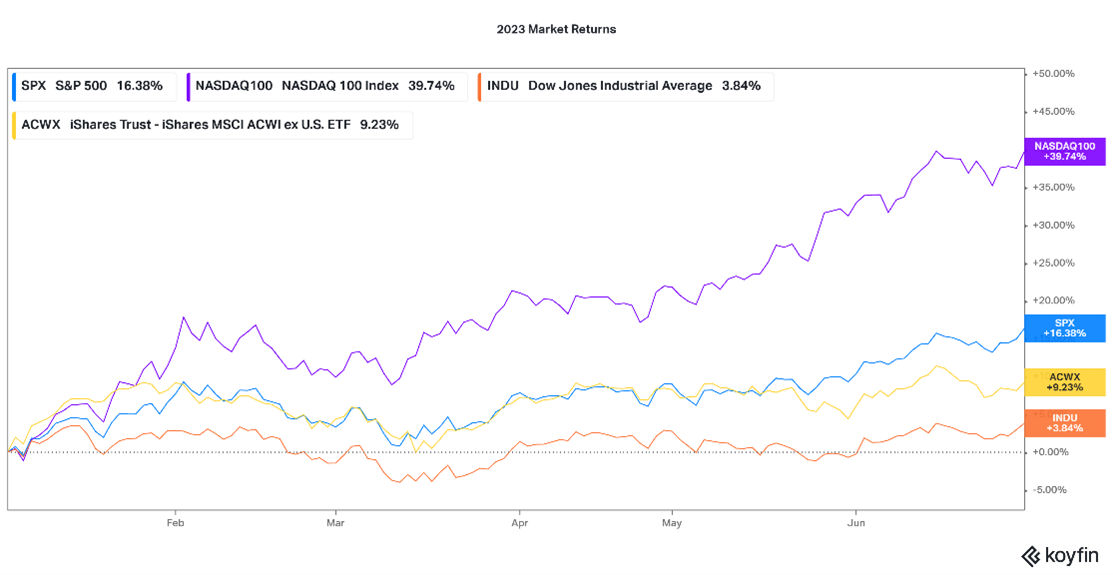

- US & International indices are strongly positive for the year (total return %)

- NASDAQ: +39.74%

- S&P 500: +16.38%

- Dow Jones: +3.84%

- MSCI All World ex US Index: +9.23%

- The unemployment rate is incredibly low – 3.7%

- Inflation down to 4% over the last 12 months BLS

- The US economy has fought off a recession with a revised economic growth rate of 2.0% in Q1 - BEA

Charles Schwab, JP Morgan, and BlackRock were certainly not alone with their inaccurate predictions. A volatile year capped off by a recession at some point seemed to be the majority opinion for 2023. Luckily, we have been able to skirt a recession to this point and, the economy and markets seem to be on strong footing, despite major headwinds.

Looking Ahead

As I just pointed out, predicting the future is impossible, so I am not even going to attempt it. However, I believe it is helpful to look at what history tells us and review what investors will be looking for as we head into the second half of 2023.

- When reviewing US stock market returns over the past 94 years (since 1928), not only are positive annual stock market returns much more common than negative ones (postive 73% of years vs negative 27% of years), we are more likely to see a 20%+ annual return than a negative return or single digit return. NYU

- 20%+ increase: 35.8% of years

- Return of 5-10%: 9.5% of years

- Down years: 27.4% of years

- Second-half story lines

- Recession fears – seen as a less likely scenario for 2023, investors are always looking forward and will be keeping an eye on the data to see if or when the recession may come.

- Inflation & Fed interest rate decisions – Federal Reserve President Powell seems keen on keeping pressure on the market through interest rates. Who will blink first – the economy or the Fed?

- Increasing geopolitical turmoil – how does it impact global markets?

- Surprises – while identifying and understanding potential risks are helpful, often the biggest risks are those nobody anticipates. black swan events

Biden’s Student Debt Relief Plan is Shot Down

The US Supreme Court overturned the program Biden announced last August to help millions of Americans get relief on their student loans. I’ll leave the legalities and political debates for the news networks. We will focus on what it means for borrowers and potential ramifications for the economy:

What borrowers should know: CNBC – 5 Steps to Consider CNN Washington Post

- After a three-year pause, borrowers with federal student loans will resume payments in October, with interest beginning to accrue on September 1. CNBC

- Get in contact with your loan provider:

- Make sure your information is up-to-date.

- If you are enrolled or interested in enrolling in an income-driven repayment plan, reach out to your provider as soon as possible.

- Estimate your monthly payment & begin to budget accordingly.

Potential economic impacts:

- With an estimated 40 million Americans no longer set to get up to $20,000 of debt written off, there are bound to be consequences for the economy.

- Borrowers (new and old) have had a three year reprieve from making regular monthly payments and have enjoyed more discretionary spending opportunities.

- The Federal Reserve estimates that the typical monthly payment to be between $200 and $299 per month. This could lead to household budget cuts and less money flowing through the economy.

Financial Planning/Investment Strategy Corner:

The Risks of Concentrated Stock Positions and How to Mitigate Their Impact on Your Portfolio

Back in the spring, when major banks Silicon Valley Bank and First Republic Bank went under, nearly all of the attention (rightfully so) went to whether depositors and creditors would be made whole. An overlooked result of the fallout was their employees’ investments vanishing overnight, alongside the banks. As with many large public companies, employees of Silicon Valley Bank and First Republic Bank were encouraged to participate in company stock purchase plans, and top employees were awarded big chucks of company stock as part of their compensation package. WSJ While this is obviously an extreme example, and we believe participating in these programs are often very beneficial to our clients, it does serve as a great reminder that lessening your exposure to one particular company (especially one you also work for) and continually diversifying are key components to risk management with your investments.

We have written extensively about concentrated stock positions in the past (7 Strategies for Dealing With Your Concentrated Stock Position & Using an Exchange Fund to Diversify Concentrated Stock Risk) and continuously search for solutions to help our clients through these risks. Most define a concentrated stock position as any position greater than 10-20% of a portfolio. We also view it through the lens of a client’s financial plan and place an emphasis on any position that could have a material impact on the success of their plan. When we identify these potential risks, we look to strategies that include – structured/systematic selling, gifting to charity or family, and using options strategies for value protection.

Quick Hits:

- Children are cutting their parents off… of their Netflix subscription WSJ – The Impact of Netflix’s New Password Sharing Policy

- The Tour de France is currently winding its way through France. Racing their way through villages all over the countryside, the Tour brings excitement and big revenues for the local economies lucky enough to host a stage Delano – The Economic Benefits of Hosting the Tour de France

- While averaging 125 miles per day for 21 out of 23 days may not be your thing, there is no doubting the health benefits that come along with cycling BetterHealth

Benefits of Working Part-time in Retirement

With retirement years becoming longer and longer, goals have shifted as retirees search for ways to occupy their time. Working part-time has its financial perks – extra spending money, less stress on the nest egg, and potentially adding to savings. The benefits extend beyond finances, though. Those who continue to work in some capacity keep their brain healthy, build a sense of community & social relationships, ease boredom, and allow them to have an identity. Retirement is also a great time to get creative and try something you’ve always wanted to do but didn’t have the chance to while working full time. Entrepreneur

It is important to consider the potential downsides as well. The work could cause unneeded additional stress, and you will likely have less free time. There are also financial decisions to consider, including the impact on your Social Security benefit, income taxes, and insurance.

Quote: “I think my body was built to eat 68 hot dogs. It’s natural.” – Joey Chestnut

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!