This article was originally posted in March 2018 and has been updated on December 28, 2022, to reflect new changes.

What is an Exchange Fund?

Exchange Funds or “Swap Funds,” are private placement limited partnerships or LLCs. An Exchange Fund allows an investor to “exchange” an individual stock for shares in a fund of many pooled stocks. Here are some of the key benefits and drawbacks to an exchange fund:

Benefits:

- Provide immediate diversification

- Allow a larger investment amount to grow (stock owner avoids selling stock, paying taxes, and reinvesting lesser amount in diversified investments)

- Potential increase in value if the Exchange Fund outperforms the original stock

- May accept contributions for restricted securities

Drawbacks:

- Stock contributed to the Exchange Fund is locked up for a minimum of 7 years

- Dividends may be given up

- Fund management fees

- Potential decrease in value if the Exchange Fund underperforms the original stock

- Complication of estates if the owner passes away before the lockup period expires

- Acceptance of stock into an Exchange Fund is determined by the fund manager

- Stocks that have tenders or mergers can be put back to the investor

- Potential taxable income allocation without a guarantee for off-setting cash distributions

Many executives acquire company stock or stock options as compensation for performance. The higher level of the executive and the longer their tenure, usually the more stock they accumulate. This type of compensation can be great when a company is successful and grows, however, it can be challenging for the stock recipient when a large portion of their net worth is concentrated in one company. Sometimes, their future financial well-being is at risk. And it’s not just executives, any investor who accumulated or inherited large stock positions could be at risk as well.

There are different metrics used when calculating overexposure to one stock/company. A rule of thumb is that any position more than 10% or 20% of a portfolio is too much in one security. One could argue that once a single security can derail your future financial goals, it is too great a position to hold, whether that is 5%, 10%, or 50% of a portfolio.

There are not a lot of options to reduce risks associated with exposure to one stock. Selling highly appreciated stock can create a capital gain nightmare for the client. Executives in the highest tax bracket pay upwards of 23.8% federal tax on long-term capital gains. In addition, some states and municipalities may apply their own additional tax driving the total tax rate to up to 30%. To avoid these taxes when selling stock, an Exchange Fund could be a solution.

Diversification

Since an Exchange Fund allows an investor to swap individual stock for a diversified stock fund, the investor receives immediate diversification. They will still have market risk but will remove the individual risk of a single company. Another benefit is the investor defers taxes they would have incurred by selling the original stock to diversify. Due to more diversification, the investor can delay selling and incurring taxes, maybe forever. They can also wait for a better time to sell, such as during retirement when they may be in a lower tax bracket and capital gains tax may be lower

Deferring Taxes

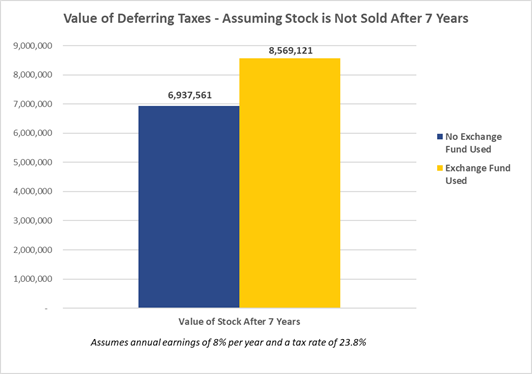

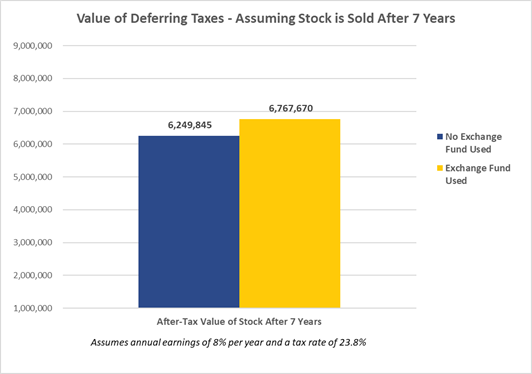

Deferring taxes also allows for the higher original value to compound and grow. This can make a huge difference in value over time. For example, let’s take an executive in the 37% tax bracket who wants to diversify $5M in long-term stock holdings with a cost basis of $1M. If the executive sells all $5M, $4M would be taxed at 23.8% (federal) and $952,000 would be owed in taxes. The executive would now have $4,048,000 remaining to invest. If the executive used an Exchange Fund, the full $5,000,000 would continue to grow. The difference after seven years can be stark. These charts illustrate how deferring the federal taxes of 23.8% will increase the value after seven years.

After seven years, the executive would have $1M basis in the stocks distributed from the Exchange Fund. If the executive doesn’t have to sell for liquidity or diversification the portfolio can continue to grow, and it is now more than $1.6M larger using the Exchange Fund than if selling, paying taxes, and then investing. If the stocks were all sold after 7 years, the executive would still be ahead by over $500k. This illustration does not consider any state or municipal taxes which can increase the effect. Even though executives have been used in this example, any investor can have similar benefits using an Exchange Fund.

Qualifying Stocks and Fund Mandates

The asset manager of the Exchange Fund manager must first approve the inclusion of the stock in the Exchange Fund. A fund management company will not accept just any stock. The stock must meet the minimum investment, usually $500,000 or $1,000,000, and qualify for the fund’s investment mandate that requires certain types of securities are held to maintain diversification. The Exchange Fund mandate can be a benchmark or asset category such as large-cap or multi-cap companies.

It may be more difficult to find an Exchange Fund that accepts the stock of smaller companies. Stocks that have a market capitalization of $2B or greater are more likely to be accepted. Also, Master Limited Partnerships (MLPs) and Real Estate Investment Trusts (REITs) are usually not acceptable investments. Stocks accepted that have tenders or mergers could be put back to the investor as well.

Exchange Funds tend to have low turnover and may even be passive. After all, the objective is to keep taxes low. The investor will receive a K-1 from the asset manager for their tax filing.

Qualified Purchasers Need Only Apply

Only Qualified Purchasers can participate in Exchange Funds. For an individual to qualify as a Qualified Purchaser, you must have at least $5M in investable assets exclusive of personal residences.

Hard Assets as Part of the Fund

The IRS mandates that 20% of the portfolio be invested in “qualifying assets” which are non-stock investments. Usually, this results in real estate comprising at least 20% of the fund. It is important to understand the makeup of the real estate portfolio, who manages it, and their performance track record.

Bye-Bye Dividends

More than likely, you will not receive dividends from the fund. The dividends go toward the management of the fund and real estate. If there is any cash left over after paying fees, the fund may distribute some cash, but for the most part, dividends will go away.

There is the potential to have taxable income reported on the investor’s K-1 from dividends or other corporate actions. The Exchange Fund may allow clients to take an annual cash distribution to help offset the tax liability, but that may not be guaranteed. If so, the investor will be liable for the tax and have to cover it out of pocket.

Seven-Year Wait

The IRS mandates that the investment period in the Exchange Fund for the original stock must be a minimum of seven years. At the end of seven years, the investor has the option to receive a basket of stocks, none of which is their original stock. The number of stocks received varies by each fund but is usually at least 20-25 securities. There is no way of knowing which stocks you will receive until near the end. The fund will give redeeming investors stocks that help keep the portfolio in balance with the investment objective. The investor may also have the option to stay invested in the fund if they wish to do so.

What if an investor should want or need their investment back before seven years? There could be some penalties or redemption fees. And the investor will probably receive the lesser value of their original stock or fund shares. This prevents investors from wanting their original stock back if it should outperform the overall fund.

Fees

Usually, when owning a single stock, there are not a lot of fees to hold the stock. With an exchange fund, there are management fees set by the fund company. The fees can be for both managing the stock portfolio and a separate fee for managing the illiquid securities. The fees can approach 1.00%.

Tax Cost Basis

What happens to your original cost basis? The original basis is assigned to the basket of stocks you received. This task is performed by the client's CPA, not the fund. It is important that the investor's CPA is involved throughout the process to ensure proper filing and tracking.

If the investor decides to receive a basket of stocks after seven years, there will be a tax due on realizing any gains. But with a diversified pool of investments, there may not even be a need to sell. The investor can hold on to them forever and incorporate them into their overall portfolio.

Estate Impact

If the original investor should pass before the seven-year window is complete, it can complicate the estate. The estate may be forced to withdraw the investment, incurring any fees or lower valuation that comes with it.

Executives Still Working at the Company

If an executive is still working for the company in which they own the stock, it is critical that their compliance department is involved. The timing of the commitment or exchange will have to be coordinated with the company’s compliance procedures and may have to occur within the trading “window” for the company.

Tax Law

The tax law can always change. Even though Exchange Funds have been around for decades, Congress could change the law. If that were to happen a fund could be grandfathered, or possibly, the original stock position could be given back to the investor. An investor and their CPA will have to stay attuned to any tax law changes.

Other Options

An Exchange Fund is just one option for an investor to diversify their stock holding and lower their risk and other options should be explored. For example, using highly appreciated stock is a favorite way to donate directly to charity, a Donor-Advised Fund, charitable trusts, and family. Here is a link to more information about using Donor-Advised Funds: Charitable Giving Made Easy with Donor-Advised Funds

An investor may be able to purchase options or securities as a kind of insurance to help protect losses in value for an individual security or sector. However, purchasing options can be costly and a drag on performance. Also, if the investor is still affiliated with the company from which they received the stock, they will be restricted from purchasing securities that go up in value if the company value goes down. Therefore, this tends to be an option for only those with short time frames and no restrictions or limitations.

Lastly, the IRS allows a “step-up” in the basis for inherited assets. Depending on the life expectancy of the stock owner, holding on to the stock for the next generation may be a viable option. So, any consideration of an Exchange Fund should occur within the larger Estate Plan of the investor.

Conclusion

Exchange Funds offer diversification and tax-deferred investing. There are many considerations such as the seven-year lock up, Exchange Fund management and performance, real estate holdings and management, fees, etc. But for those who qualify and are looking to diversify concentrated low basis stock, they are a worthy consideration.

Disclosure

Robinson Smith Wealth Advisors, LLC ("RSWA" or “the Firm”) is an SEC registered investment adviser with its principal place of business in the State of Maine. Registration does not imply a certain level of skill or training. RSWA may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from the notice filing requirements. For information pertaining to the registration and notice filings status of RSWA, please contact the Firm or refer to the Investment Adviser Public Disclosure web site (www.adviserinfo.sec.gov).

RSWA has prepared this material for the purpose of providing general information regarding its investment advisory services where providing such information is not prohibited by applicable law. The information contained herein should not be construed as personalized investment advice and should not be considered as a solicitation to buy or sell any security or engage in a particular investment strategy. Any subsequent, direct communication by RSWA with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration where the prospective client resides.

The information contained herein is based upon certain assumptions, theories and principles that do not completely or accurately reflect your specific circumstances. Certain examples of general client situations, challenges, solutions and outcomes are provided for illustrative purposes only. Any references to clients’ experiences should not be considered to be representative of RSWA clients and their experiences. Your experience may vary according to your individual circumstances. As such, there can be no assurance that RSWA will be able to achieve similar results for all clients in comparable situations or that any particular strategy or investment will prove profitable or equal the results portrayed herein. No portion of these examples is to be interpreted as a testimonial or endorsement of the Firm’s investment advisory services.

RSWA does not make any representations as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether referenced or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This material should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without prior notice.

Past performance is no guarantee of future results. Investing in the stock market involves gains and losses and may not be suitable for all investors.

For additional information about RSWA, including fees and services, send for our disclosure statement as set forth on Form ADV from RSWA using the contact information herein. Please read the disclosure statement carefully before you invest or send money.