With the debt ceiling deadline of early June looming closer, Congress and the White House finally made some progress over the last week on raising the debt ceiling. But a deal is far from done. As of midweek, there was agreement on about 50% of the legislation but on the other 50%, the sides were far apart. As with any legislation, it’s the final items negotiated that are the stickiest. As of right now, almost no other economic items matter as much as getting the debt ceiling raised. The debt ceiling has been raised 78 times since 1960 and most market watchers believe it will be raised again, probably at the last hour. We are cautiously optimistic that history will repeat itself and after a lot of hyperbole and hand-wringing, a deal will get done. That being said, there is no guarantee of an agreement because this is DC we are talking about. Business Insider Greg Valliere

What is the Debt Limit: If you want to understand the debt limit and the history and issues surrounding it, listen to this podcast. Thank you to the reader who forwarded it to us!

Life And Debt: Unpacking The Federal Debt Ceiling: 1A : NPR

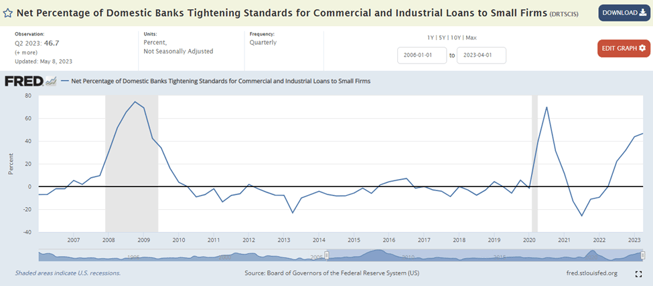

Are Banks Tightening Credit After Recent Bank Failures? When an economy slows, economic conditions deteriorate, or if the Federal Reserve hikes short-term rates, banks will curtail lending. If you look at the chart below, you can see that banks tightened lending in 2008-2009 during the Great Financial Crisis and during the first year of the pandemic in 2020. You can also see that bank lending started tightening in mid-2021 as the Federal Reserve started aggressively raising short-term rates. Economists and investors were looking to see if the March bank failures had caused banks to tighten even further. And the answer so far, is no. You can’t quite make it out from the chart but the net percentage of banks tightening lending from March to April increased by only 1% from 45% to 46% respectively. That is good news for the economy because if the bank failures had caused lending to become much more restrictive, it could have led to a sharp slowdown in the economy increasing the chances of a tough recession. St. Louis Federal Reserve (FRED) GSAM

Retail Sales Are Softening But the Cost of Goods Are Lessening: Retailers such as Home Depot, Target, and TJ Maxx are reporting that sales are down from consumers. Home improvement, apparel, and home goods demand is down. The slowdown was expected this year across retailers as consumers grappled with higher costs in food and energy leading them to cut back on discretionary spending. The silver lining for retailers is that prices for goods are dropping which could lead to higher profits later this year and next year. HD – WSJ TGT – Yahoo Finance TJX- Reuters

Atlanta GDPNow Estimate Showing Growth: The Atlanta Fed creates an indicator to try to gauge the current economic growth in real-time. The latest reading this week indicates the US economy is growing 2.6% in the second quarter. So far, the economy has been able to weather aggressive Fed hikes, a few bank failures, and softening retail sales. GDPNow

Financial Planning/Investment Strategy Corner:

Health Savings Account Limits Increased for 2024: We have always professed our love for Roth IRAs (RSWA Blog), but there is one other account type that could steal our hearts – Health Savings Accounts (HSAs). HSAs are the only triple-tax-free savings account available. This means the deposits are income tax deductible, the earnings are tax-free, and the withdrawals are tax-free when used for approved expenses – wow a triple-tax-treat! And the IRS just approved a big increase in the 2024 annual funding limit to $10,300 for couples older than 50. Many investors view HSAs as just a checking account for medical expenses, but they can be so much more. Funds in HSAs can be invested in stocks and bonds too. If your cash flow allows it, you can max out the HSA savings, invest it for the long term, and pay out of pocket for medical expenses using other funds. Using this strategy allows for the accumulation of additional retirement investment assets in a very tax-efficient manner. If you are employed and eligible to contribute to an HSA and have questions about how to integrate it into your long-term retirement plans, please contact your RSWA advisor. WSJ Society for Human Resource Management

Quick Hits:

- Summer is coming, it’s time to get your vacation and summer reads ready: Water Street Bookstore – Exeter, NH Longfellow Bookstore – Portland, ME B&N

- What happens to your body when you eat spicy food? NYT

- High in protein, healthy, and affordable. How come we aren’t eating more beans? Vox

- Why you want to take your workout outdoors: VeryWellFit

- Recommendations for summer 2023 wines: The 15 Best Wines in 2023 So Far Wine Enthusiast – Summer 2023–10 Porch Pounders to Watch the Days Go By (Porch Pounders?)

- It’s asparagus season, so here are some tasty recipe ideas: Allrecipes

Compartmentalizing Stress: Let’s face it, we probably all deal with a decent amount of stress but sometimes it’s worse. Whether it’s work, relationships or just seeing the daily news - and it’s hard to get away from the 24-hour news cycle which does not exactly report positive things. There are many things we can do to reduce stress such as exercise, meditating, and socializing (and turning off the news!). But compartmentalizing stress is another option that can be useful if it’s done healthily. This is accomplished by setting boundaries, prioritizing tasks, and scheduling time for yourself, but also seeking help when needed. VeryWellMind

Quotes, More Quotes, Plus Even More Quotes: Many quotes came out of the recent Berkshire Hathaway annual meeting and I couldn’t just give one! The indomitable heads of the firm, 92-year-old Warren Buffet and 99-year-old Charlie Munger always have great quotes. Enjoy!

“What gives you opportunities is other people doing dumb things.”

“Bankers should be more like engineers… avoiding trouble instead of trying to get rich.”

“Old-fashioned intelligence works pretty well (in regards to questions about AI).”

“U.S. – China trade tensions are stupid, stupid, stupid.”

“The world is overwhelmingly short-term focused. I’d love to be born today and go out with not too much money and hopefully turn it into a lot of money.”

Berkshire Hathaway 2023 Annual Meeting Highlight Video WSJ Recap

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!