With the federal government shutdown in its 3rd week, the typical economic data releases from the Department of Labor (initial jobless claims released weekly), Bureau of Economic Analysis (jobs report released the first Friday of each month), the Bureau of Labor Statistics (BLS) (key inflation data released multiple times throughout the month) and many more, have been delayed. These releases are crucial – as the breadth and depth of the government releases trumps anything the private sector produces. However, for economic nerds like me, if you want to find alternative ways to gauge the overall health of the economy, Schwab posted an informative article on different, less cited sources Alternatives for Data During Shutdown | Charles Schwab. However, with a crucial Federal Open Market Committee (FOMC) meeting scheduled for next week, the BLS has called back some of their employees to compile the necessary data to release the consumer price index (CPI) for September this morning. This should allow the FOMC to digest up-to-date inflation numbers prior to their rate decision on the 29th.

Earnings Season Has Started Out Strong…

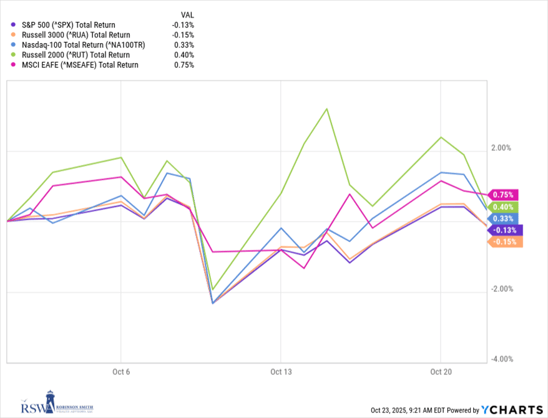

While most major tech companies have yet to report, earnings season has started out strong. As of last week, 86% of S&P 500 companies who have reported earnings have beaten estimates (above the historical average of 78%). However, we still have a long way to go, and it will be interesting to see whether companies can continue to deliver over the next couple weeks. FactSet Earnings Insight (fascinating statistic – since the government shutdown on October 1st, the S&P 500, as of Wednesday, is basically flat - continuing to show resiliency).

Financial Planning Corner:

SIMPLE IRAs Offering Roth Option in 2026

SIMPLE IRAs (Savings Incentive Match Plan for Employees) were established in 1996 as a way for small businesses and their employees to save meaningfully more for retirement than what was otherwise available in a Traditional IRA, without the added cost and complexity of administering a 401(k) plan. However, the SIMPLE acronym doesn’t necessarily jibe with “simple” when it comes to the nuanced rules of these plans. One of these nuanced rules was the inability of employees to make Roth (after-tax) contributions to these plans. Starting in January of 2026, if you have a SIMPLE IRA and your employer has decided to allow Roth contributions in your plan, you can begin to do so. If you currently participate in a SIMPLE IRA, check to see if your plan will be adopting the Roth feature. For employers who administer their SIMPLE IRAs, the deadline to elect to add a Roth component to SIMPLE plans is November 1, 2025. Payroll elections and new Roth account numbers will need to be provided before January 1, 2026. If a Roth component is added, employees should also be notified of the Roth option for contributions.

Medicare Open Enrollment Has Begun

If you are on Medicare, it’s that time of year again to review your coverage, and make sure your current plan continues to work for you. The window, known as the Open Enrollment Period, began last week and runs through December 7th. While the staff at RSWA are not Medicare experts, we have developed great relationships with people who are. If you would like a referral to a local Medicare specialist, please let us know.

Quick Hits:

- Less than two weeks away: How to Prepare for the Start and End of Daylight Saving Time

- Also right around the corner (and with my Vols almost all but out of the college football playoff picture, it’s a bit easier for my focus to shift to basketball): 2025-26 Men's College Basketball Rankings - ESPN

- Updated fall foliage map - Fall Foliage Map 2025: Daily Updates and Forecasts!

- Best recipes for the colder weather approaching (I don’t cook, so if anyone wants to invite me over, let me know 😊) 35 Lazy Winter Recipes to Make All Season Long-

Self-Awareness and the Impact on Relationships

I will preface this by saying it is a continued work-in-progress personally, but being self-aware in all situations is critical. I was recently having a conversation with a colleague, and we were discussing the different personalities within our family. It got me thinking about how almost every situation could benefit from having the opinion/views/demeanor of both Type A and Type B individuals. Diversity of all kinds makes us great. Knowing your strengths, weaknesses, how you act/behave/tone, and the impact it has on others is paramount to building successful relationships/teams etc. I’m grateful for the diversity of opinion/views/lived experiences of our clients, and it presents an opportunity for me to grow each day.

Quote: “Whenever you are about to find fault with someone, ask yourself the following question: What fault of mine nearly resembles the one I am about to criticize?” – Marcus Aurelius

Thank you for reading RSWA Financial Advisor Insights!! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!