The CPI numbers came out last week and overall, the report was good. It showed a month-over-month increase in overall prices at 0.1% which is 1.2% annualized. One month is in no way enough data to signal a long-term trend, but it was encouraging. CNBC

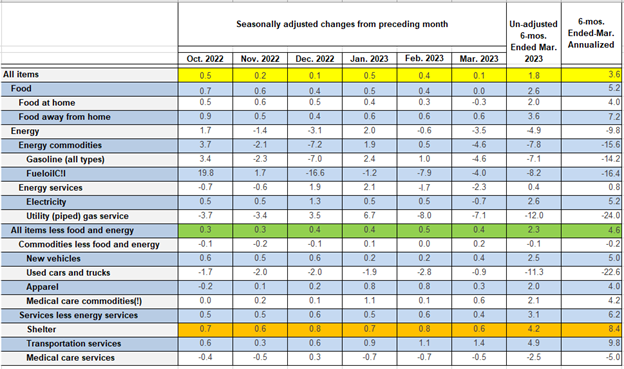

The height of inflation was last summer. Therefore, looking back at the twelve-month inflation readings show high numbers. So, let’s look at six-month, three-month, and one-month data and annualize the inflation numbers to get a feeling for where inflation may be trending. The chart below contains the information though due to space, I only annualized the six-month data. The focus will be on all items of CPI (headline CPI) and all items of CPI less food and energy (called core-CPI) which are highlighted in yellow and green respectively.

Data - Bureau of Labor Statistics

Six-month:

- Headline CPI: Up 1.8%, annualized at 3.6%

- Core CPI (All items less food and energy): Up 2.3%, annualized at 4.6%

Three-month:

- Headline CPI: Up 1.0%, annualized at 4.0%

- Core CPI: Up 1.3%, annualized at 5.2%

One-month:

- Headline CPI: Up 0.1%, annualized at 1.2%

- Core CPI: Up 0.4%, annualized at 4.8%

As you can see from the Headline-CPI data highlighted in yellow, the data is volatile. Food and energy prices are volatile and while food has moved up in cost 5.2% annualized over the last six months, over the same period energy is down 9.8% on an annualized basis. Still, overall Headline-CPI has consistently been lower than Core-CPI, mostly due to energy prices dropping.

Now look at the Core-CPI data highlighted in green that excludes food and energy. It has barely budged over the last six months – and this is whether you annualize the numbers over the last six months, three months, or one month. Eliminate the volatile readings of Headline-CPI and everything else has remained high and there is no sign yet of it coming down. The Fed has used the phrase “stubbornly high inflation” and this is what they are referring to. They are also drawing a straight line from the tight labor market to elevated core prices. The Fed is looking for the labor market to ease which should translate into lower Core-CPI price increases.

One Counterargument Why Core-CPI May Be Artificially High: One caveat against the whole stubbornly high Core-CPI scenario is the reading for shelter. It consists of various components of renting a residence and it comprises a whopping 32% of the CPI index. It is also a very high reading, as indicated in orange on the chart. But when calculating the data, rental leases are analyzed that are in place, not just the new ones signed that month. Therefore, the data has a lag effect since leases and rental agreements are generally in place for twelve months or even longer. The most recent data indicates that rental prices are coming down in many cities. As rental leases expire and then new ones are signed, if the prices are lower, they will be reflected in the data. In the coming months, if rental prices end up lower, it will go a long way into bringing Core-CPI closer to the Fed’s 2.0% inflation target.

Redfin: Rents Post First Annual Decline in Three Years (redfin.com)

Economics Uncovered: Shelter and the CPI: everything you need to know

The American Economic Miracle: There is a lot of negative press about the economic decline of America, the death spiral of manufacturing, and the hollowing out of the middle class. But there is a problem with this argument – compared to its peers, economically, the U.S. is doing better than ever. Since 1990, the share of the U.S. GDP in the G7 (a group of the seven biggest advanced economies) has risen from 40% to 58%. On an individual level, income per person in America was 24% higher than in Western Europe in 1990, and today it is about 30% higher. It was 17% higher than in Japan in 1990 and today it is 54% higher. A trucker in Oklahoma can make as much as a doctor in Portugal. America has achieved this by having a strong educational system, higher productivity by innovating technology and using it across industries, workers being highly skilled and willing to change jobs to growing industries and localities, and higher investment in industries. This is not to gloss over the problems the U.S. has with income inequality, working a lot of hours, gun violence, poor communities doing worst in almost every life category, political infighting, and the recent decline in life expectancy (and that’s the shortlist), but the rest of the G-7 economies have problems too. Of course, money doesn’t mean everything, as life satisfaction and work-life balance are incredibly important, but now and again, it’s good to look at some positives. The Economist – America’s Economic Outperformance is a Marvel to Behold

Congratulations, Donovan! Earlier this week was the running of the 127th Boston Marathon and our own Donovan Ingle ran and CRUSHED it! He finished the 26.2 miles in 2 hours and 49 minutes which translates into less than a 6:30 per mile pace! Way to go Donovan! Boston Athletic Association

Financial Planning/Investment Strategy Corner:

Learn to Love Bonds: Several years ago, we decided to hold an event on investing in bonds. We had a fantastic speaker who gave a great presentation. But later that year at another event, more than one client came up to us and jokingly said “You know how you can ruin this event? Start talking about bonds!” We get the joke. Compared to stocks, bonds are boring and can be quite complex. But boring can be beautiful if it helps your portfolio. With the rise in inflation and Fed rates in the last few years, bonds are yielding more than they have in 15 years with some interesting opportunities. We still want to keep clients tied to their stock and bond allocation targets, but the bond side of the portfolio looks more interesting than in a long time. So, get to know bonds a little better. But we promise never to put you through another bond presentation again. 😊 Investing in Bonds is Trendy Again—But It’s Not Simple - WSJ

Quick Hits:

- Here’s why your body stores more fat in certain places: Get Pocket

- How to get better at putting on the green: WSJ Golf Digest

- Should you buy an electric vehicle now, or wait? Wash Post

- Saving Money: 34 Tricks to Live the Good Life for Less: WSJ

- How to give yourself time to think, reflect, and open your creative thinking: Beside

Exercise Can Ward Off the Effects of Aging: Research indicates that only about half of fitness losses suffered by endurance athletes as they get older are attributable to aging. The other half of the losses were attributable to less training. Said another way, training cuts performance due to aging in half. Although the research was on performance athletes, the implications can also be applied to less serious athletes and those who exercise occasionally. There are also encouraging signs that it doesn’t matter what age you start at, you will receive benefits from consistent, and even low-impact moderate exercise. Most People Get Slower with Age. But Is That Inevitable? - Outside Online

Self-Improvement and Being Better: Whether it’s watching a movie, reading a book, or making a lifestyle change many of us are looking for ways to improve. A lot of folks use podcasts to learn new things and we often highlight one now and again. This week’s recommendation is Huberman Labs which is a show focused on science, education, and health & fitness. The most recent episode was on Enhancing the Human Brain. Thank you to the client that offered this as a suggestion for the newsletter. If you have any suggestions that others may be interested in, feel free to pass them along. Axios Huberman Lab

Quote: “There is nothing noble in being superior to your fellow man; true nobility is being superior to your former self.” Ernest Hemingway

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!