What does it mean for the markets that the US national debt has surpassed the value of US gross domestic product (GDP)? There is a lot of debate about this with some crying that the sky is falling and others saying there isn’t anything to worry about. As with most issues, we believe that reality is somewhere in the middle. Many countries have had their debt at levels above their GDP for extended periods of time and have had positive stock market returns. One study from Dimensional Fund Advisors lists Italy and Belgium as examples of countries with debt over 100% of GDP in 30 of the past 48 years while also having average annual stock market returns of 10.8% and 12.0% respectively. They also mention Japan as having debt at 200% GDP with average annual stock market returns of almost 6%. But can we compare the US which is the largest economy in the world to Italy, Belgium, and Japan? www.dimensional.com

This US Bank article (usbank.com) states that the US debt has doubled in less than 15 years. And with interest rates higher than they were before, servicing the debt is getting more expensive. Per the US Treasury as of October 2023, the cost to service the national debt is at $89 billion annually which is about 19% of federal spending. As Treasuries mature, new borrowing will be at current interest rates and the carrying costs will increase. We do believe that interest rates will start to come down sometime in 2024, most likely starting next summer, but we don’t think they will come down to the levels seen during the pandemic. If you add increasing national debt and higher carrying costs together, it seems that we may have something to worry about. U.S. Treasury Fiscal Data

What are our options? We can believe the studies that national debt over 100% of GDP is not necessarily a bad thing. We can reduce government spending. We can increase government revenue. Or some combination of those options. Economic growth could help too, if the economy grows faster than our spending increases, that will reduce our debt to GDP ratio. The debates about this will continue and we expect the rhetoric to increase especially as we approach the election next year and the deadline for the sunsetting of the “Tax Cuts and Jobs Act” provisions at the end of 2025.

Penn Wharton Budget Model (upenn.edu)

China’s Credit Rating Issue: Moody’s changed their outlook on China from stable to negative due to concerns about China’s level of debt. China is the second largest economy. Even though they changed China’s outlook, Moody’s kept their credit rating for China at A1. As a frame of reference, the US has a credit rating from Moody’s of AAA with an outlook of negative. Moody’s downgraded the US outlook from stable to negative in November due to political disfunction. The scale starts at AAA, with AA1, AA2, AA3 and then A1. Fortune (nytimes.com)

Financial Planning/Investment Strategy Corner:

We have often written about how to give to charities in tax advantaged ways. Here are several of the options we have covered:

- Giving low-cost basis stock (robinsonsmithwealth.com)

- Giving from your IRA with QCDs (robinsonsmithwealth.com)

- Giving with a Donor-Advised Fund (robinsonsmithwealth.com)

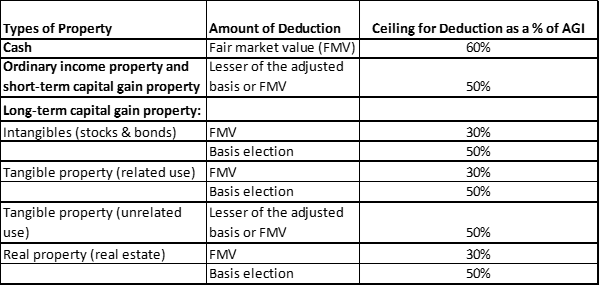

We love helping clients make the most of their charitable giving. We believe that if it’s done in a tax efficient way, everyone wins. The client can save on taxes and can often give more to charity. The tax implications of giving can be relatively complicated. The amount you can take as a deduction is dependent on your income and the value of the donation. The income amount you use is your Adjusted Gross Income (AGI). The amount of the deduction is based on the fair market value (FMV) or the basis of the gift. Here is a (hopefully) simple primer.

A couple of clarifiers:

- FMV vs Basis – FMV is the value on the date of giving. The basis is the cost of the gift when originally purchased. So, if giving a stock the FMV is what the stock is valued by the market on the day of the gift and the basis is the cost of the stock when purchased.

- Related use vs unrelated use – will the charity use the gift in a manner that is consistent with its purpose. An example is if a piece of artwork is given to a museum, and it’s displayed – that is related use. If that same piece of artwork is given to a food bank and the food bank sells the painting – that is unrelated use.

Most people do not hit the deduction ceilings but it’s important to know they exist. And if your gifts are large enough to hit the ceiling, you can carry forward any remaining balance for five years. When planning large gifts, it’s advisable to touch base with your CPA and/or your financial advisor.

Quick Hits:

- Virgin Atlantic makes first transatlantic flight using biofuels: (msn.com) (bbc.com)

- Something to think about when trying out new hobbies – it’s ok to not be good at first: You’re not bad at everything. Embrace the suck. - Vox

- Nutritional myths - I have to admit it but I love #6! 10 Nutrition Myths Experts Wish Would Die

- Letters from Santa with a little help from AI: Axios Austin

- Hanukkah started last night – to all of you that celebrate, Happy Hanukkah. Here is a little information about the festival of lights (msn.com)

- Best Christmas movie list – not sure about a lot of the movies on this list but I like that the first two are set in New England: The 65 Best Christmas Movies of All Time | Vanity Fair

CVS to Change to “Cost-Plus”: This may be the start of something interesting. CVS has announced that they will change their prescription drug pricing model to be a “cost-plus” model. They say this will make the cost of prescription drugs more transparent. CVS did say that some drug prices may increase. (axios.com)

And a Little Year-End Fun: I had to laugh when I read this article. It has 2024 stock market predictions from many of Wall Street’s biggest banks. I think I may keep it and look at it next December to see who was close and who was not! Here's a Complete Rundown of Wall Street's 2024 Stock Market Predictions (businessinsider.com)

Quote: “I wish I knew how we achieve the goal of world peace. My bumper sticker reads ‘Just Another Version of You.’ The sooner we agree that we’re just other versions of each other – we human beings – the sooner we will find some sense of world peace.” Norman Lear – he died this week at 101!

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!