The latest Consumer Price Index (CPI) report came out this week and it showed inflation continues to slow across the economy. The headline number for the last 12 months of 6.5% is still high, but it’s the lowest annual number since October 2021. And the more recent news is much better. Inflation dropped 0.1% in December from the previous month. And December’s report was a continuation of recent monthly CPI reports showing that the edge is coming off high inflation. For the last six months, the CPI has risen only 0.9% which annualizes at 1.8%. A big reason for the lower numbers is a big drop in energy prices (remember $5 gas during the summer – ugh!). Core inflation (all items less food and energy) is still high. December’s reading was up 0.3%. and the last six month’s core inflation annualizes at 4.6%. We are not quite there, but the trend is our friend as the core and overall CPI numbers move closer to the Federal Reserve’s target of 2.0% annualized inflation. These latest readings should give the Federal Reserve the data it needs to slow rate increases. The next Fed announcement regarding short-term rates is on February 1st and the markets now expect an increase of only 0.25%. CNBC Bureau of Labor Statistics

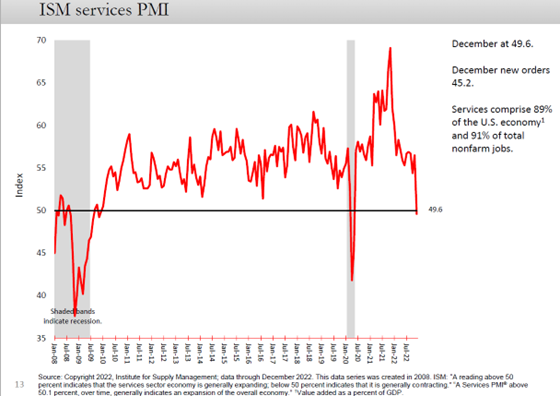

More Signs Inflation and the Economy Are Slowing: Last week, the December jobs report showed hiring is moderating and more people are back in the workforce. That is a very positive development if it continues because it would help slow wage growth. One of the Fed’s biggest worries is that super-low unemployment will create large wage gains, leading to more inflation as businesses raise prices to offset the higher costs of wages. The most recent wage growth reports do show rising wages moderating as well. Axios Also, last week the Services Purchasing Managers Index came out and showed a big drop off in economic activity. The report is an indication of economic activity for the services sector which represents almost 90% of the economy. A reading above 50 means the services sector is expanding and below 50 means it is contracting. For the past year, the index had been in the mid to high 50’s indicating strong growth. The reading last month dropped like a rock to below 50 (see chart below). Statista

RSWA Quarterly Webinar, Fritz Meyer on January 26th at 4:30 PM: It’s a new year, and it's time to turn the page on what lies ahead (especially after last year’s markets). As we have for several years now, we will kick off the year with Fritz Meyer, noted economist and market strategist. Fritz will give a recap of what’s been happening in the markets with an eye toward what to expect for 2023. Look for the invite in your email. And yes, he will use a few charts! 😊

RSWA Events Are Back! Get Ready for the Winter Wine Festival! Three years ago was the last RSWA in-person event and we are happy to announce it’s time to bring them back! We have secured a limited number of tickets for the Wentworth-by-the-Sea Winter Wine Festival Big Tasting on Friday, February 10th. Look for the event invite in your Inbox. We look forward to seeing you there - it’s good to be back!

Wentworth Winter Wine Festival

Financial Planning/Investment Strategy Corner:

SECURE Act 2.0: At the end of December, Congress passed a whole host of tax changes. In 2023, Required Minimum Distribution (RMD) ages will be pushed out to age 73 and age 75 later down the road. There are higher amounts for catch-up contributions for retirement plans and expanded Roth IRA opportunities, including leftover college 529 funds. Another item is student loan repayment provisions. The list is long and we are still unpacking all the details. But Donovan Ingle penned a blog article (can I use the word penned for a digital article?) that highlights the most pertinent changes for high-net-worth investors. If you’d like to know more about the changes or want to discuss opportunities or strategies, please reach out to your advisor. RSWA Blog – The SECURE Act 2.0 – What It Means for Savers and Retirees

Quick Hits:

- Byron Wien came out with his 38th edition of economic and political surprises for the coming year, including a mild recession: BlackStone

- Some good news – the Earth’s ozone layer is set to recover over the next few decades: Axios

- Are you struggling with your New Year’s resolution? Maybe you should just drop them: WSJ

- Looking for a winter activity? The Ice Castles are back in N. Woodstock, NH: NH Magazine

- It’s cold and flu season. Here are some recovery tips if the bug gets you: WSJ – Here’s How Doctors Treat Their Own Colds and Flus Healthline

- According to some researchers, focusing on fun over happiness is the key to long-term satisfaction: Well + Good

Atomic Habits: I keep hearing the term Atomic Habits. It led me to find a podcast with the author, James Clear, and I was impressed. He proposes that small habits can lead to big changes, you just have to get started. For example, give a new habit just five minutes to start. It doesn’t matter if it’s meditation, exercise, etc. You can accomplish a lot in five minutes and if you do it consistently, you’ll build a good habit and can enhance it later after the habit is routine. He also proposes that your current behaviors are a reflection of your identity and an image of the type of person you believe you are. To change your behavior for good, you need to start believing new things about yourself. For example, “I’m the type of person that doesn’t miss workouts,” or “I’m the type of person that’s on time.”

After the interview, I ordered the book and can’t wait to read it. Has anyone read it, and, if so, have any of his suggestions worked for you? Tim Ferriss Podcast with James Clear Atomic Habits Book – Amazon

Quote: “Almost all the results that you want are a lagging measure of your habits. Fix the inputs and the outputs will fix themselves." James Clear, author of Atomic Habits

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!