The Federal Reserve raised interest rates by .25% this week. That brings the Federal Funds target rate range to 5.00% - 5.25%. In his comments after the meeting, Fed Chair Jerome Powell started by saying the U.S. banking sector is strong and in better shape than it was at the end of March. He also recognized that while inflation is still higher than the 2.0% target, there are recent signs the economy is slowing which include below-trend economic growth and fewer job openings.

In the most important comments, Jerome Powell stated that the Fed will be data-dependent regarding future rate policy. The committee is also going to keep in mind the lagging effects of Fed rate hikes and the potential credit tightening from regional banks due to recent bank failures. Chairman Powell was adamant that rate hikes have not been paused but his comments did open the door for rate hikes to be paused in the future, even as soon as the next rate policy meeting on June 13-14. Lastly, one interesting comment he made was that while he felt the odds of avoiding a recession were actually better than having a recession he wouldn’t completely rule one out the possibility of having one.

So Far the Economy is Holding Up: Q1 GDP showed the economy growing by 1.1% which was less than the 1.9% expected. There was a significant drag on the numbers, however, due to reduction in inventory. Consumers appeared fine in Q1 and increased spending by 3.7%. With 70% of the U.S. economy being driven by consumers, that will help keep the economy growing. And nearly 80% of the companies that have reported Q1 earnings have delivered better than expected numbers. That is higher than the usual amount of companies beating expectations. ADP also reported strong hiring for April. Many economists felt Q1 would be very soft or even show a contracting economy. But low unemployment, solid job growth, and strong consumer spending, with company earnings holding up, point to a solid economy. Axios CNBC – ADP Private Jobs Growth

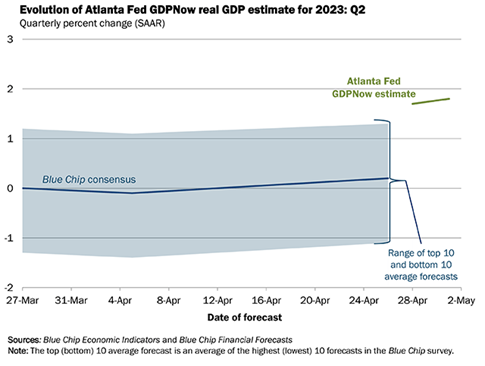

What About a Possible Recession Mentioned in the Media? Despite Q1 GDP growth, things could change for the economy as there are headwinds. The aggressive Fed rate hikes over the last year are still working their way through the economy and it may be several months until the full effect is felt. There have been three large bank failures and some regional banks may dramatically slow loan growth to protect their deposit base. Lastly, job listings fell to their lowest level in two years, and are still strong by historical standards, but the momentum is slowing. The economic contraction economists expected in Q1 didn’t materialize and now they think a mild contraction could happen in Q2. But that could be pushed out further or not happen altogether. The GDPNow Indicator of the Atlanta Fed is showing that up until May 1st, the economy was growing at 1.8% (see Chart Below). GDPNow The pandemic and post-pandemic economy is not traditional by any standard and it is making predictions very difficult. But the clearest sign of a potential recession would be a surge in unemployment which hasn’t occurred. AP News – Job Openings AP News – How Will We Know if the U.S. Economy is in a Recession?

Debt Ceiling Update: Not much to report on the U.S. debt ceiling issue being resolved. Treasury Secretary Janet Yellen has stated that as early as June 1st the U.S. could risk being unable to pay its debts. As of now, the White House is trying to gather Congressional leaders for a meeting on May 9th to discuss solutions. We will keep you posted with any updates and ramifications. ABC News

5th Anniversary of the RSWA Newsletter! In late April 2018, Dave Robinson wrote “Coffee Notes” and I followed it up a week later with “The Friday Buzz.” It has been coming out weekly ever since and a couple of years ago we changed the name to the current one. Today is the start of year 6 and I believe today’s edition is number 261 (but who’s counting? 😊)! Over that time the newsletter membership has continued to grow and we sincerely thank you for reading, sharing, and your suggestions!

Financial Planning/Investment Strategy Corner:

Planning Retirement Account Withdrawals Before the Looming Tax Hike (in 2026): In 2018, federal lawmakers lowered taxes, but due to legislative procedures, they were not made permanent. Unless Congress passes new legislation, federal tax rates will be higher for the 2026 tax year. For retirees living off IRA or 401(k) assets, this means we are potentially in a “low-tax window” that can be used now, so you have a smaller tax hit later. Taking larger retirement account distributions in the years leading up to 2026 and/or executing Roth conversions while staying in your current tax bracket may lessen your overall tax bill. If you have any questions about your retirement account distributions or Roth conversions, please contact your advisor. CNBC

Quick Hits:

- Experts say arthritis is not inevitable as you age. Here’s how to reduce your risk:

- How to train your brain to increase your attention span: Fast Company

- Which jobs will be most impacted by ChatGPT? Visual Capitalist

- People are getting fed up with all their subscriptions and pulling back:

- If you are celebrating Cinco de Mayo, here are some recipes to enjoy:

Travel Like Royals: Watching the British Coronation this weekend and want a taste yourself? How about staying in a castle next time you visit Britain or Europe? Maybe next time you go overseas you can live like a Royal! NYT – 6 British Castles Where You Can Stay Like Royalty on a Commoner’s Budget (The castles are Hever Castle; Scone Palace; Thornbury Castle; Glenapp Castle; Amberley Castle; and Forter Castle.) Celtic Castles Ryanair

Quote: “I don’t drink anymore for Cinco de Mayo. I celebrate with Mexican food, or as it’s known in Mexico: ‘food.’” Comedian, Craig Ferguson

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!