The Federal Reserve paused hiking rates this week for the first time in 11 meetings. That was expected by investors. But the Fed indicated that it expects to raise rates two more times this year, which was a surprise. Stock markets were down immediately after the announcement but rebounded the following day. The Federal Reserve members released their projections for economic indicators, they raised their expectations for core inflation for the year and therefore, also raised their expectations for more than one rate hike this year. CNBC The Federal Reserve

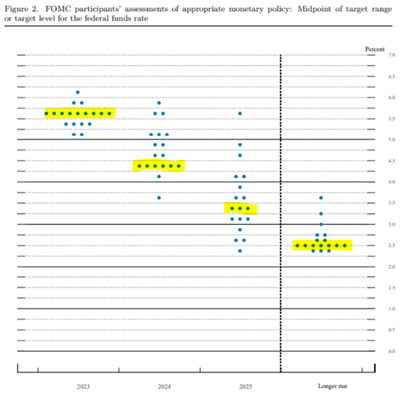

Fed Funds Rate Projections: The members of the Fed rate-setting committee voted on where they felt short-term rates were headed over the next couple of years. In the chart below, each dot represents how each member voted on their future views of the Fed Funds rate with yellow highlighting the median projections. There are a couple of important things to note in the chart. First, the further the projections go out, the wider the dispersion on where each member thinks rates are headed. With independent thinkers, you are bound to get differences in opinions but the size of the difference is what’s striking. In 2025, the range of projections is for rates to end up somewhere from 2.4% – 5.6%. Even throwing out the one outlier of 5.6%, the range becomes 2.4% - 4.9%, still quite large. This brings home the point of the uncertainty surrounding the path of future rates. The highly experienced members of the Fed have more information than anyone regarding inflation and the economy, if they can’t somewhat agree on where rates are heading, how can anyone else? Secondly, almost none of the members think rates will get to their long-term rate projection of 2.5% by 2025. Therefore, it appears most members must feel it will take at least two years to get there, meaning that inflation will continue to be high through 2024.

Core Inflation Remains Sticky: The overall inflation rate has fallen dramatically over the last year according to the CPI reports released this week. May’s inflation reading for the last year was 4%, down from 4.9% in April. And the month-to-month increase from April to May was only 0.1%. But core inflation, which excludes the volatile food and energy sectors, came in at 5.3% for the last twelve months and rose 0.4% from April. Core inflation is much more sticky due to factors such as rising wages and input costs that are not as easily reversible. While the drop in overall inflation is positive, central banks are focused on controlling sticker core inflation to maintain price stability and sustainable economic growth. CNBC

Financial Planning/Investment Strategy Corner:

June 15th Was the Deadline for Paying Quarterly Estimated Taxes: If you are a freelancer or entrepreneur who doesn’t have taxes withheld from your paychecks, your taxes are due each quarter. The U.S. tax system is a “pay-as-you-go” system and you will pay penalties of 0.5% on your unpaid tax balance for not staying current. This applies to not just business owners and the self-employed but also to those who receive sizeable investment income or employees who don’t have enough withheld from their paychecks. The Q2 payment was due June 15th this year. If you missed it, you can pay it but make the next one for Q3 which is September 15th. If you are unsure of how to make a payment or if you should make quarterly payments, check with your accountant or reach out to your financial advisor who can help. CNBC

Quick Hits:

- It’s mosquito season, so here are reviews on the best repellents: Good Housekeeping NYT - Wirecutter

- Have you ever fancied living in a lighthouse? Now’s your chance as the government is auctioning or selling ten of them at bargain prices: NPR

- Humidity in the air contains electricity, and these researchers think we can capture it for 24/7 renewable energy: USA Today; or maybe we can just beam solar power from space: WSJ

- Some researchers say people are “not over-fat, but under muscled” and muscle is the cornerstone to longevity: Worth

- Six ways to deal with someone who wronged you, and how forgiveness can help your well-being: Greater Good Magazine

- How to handle jet lag on those long flights this summer (or anytime): Axios

Can Money Buy You Happiness? The old saying that money can’t buy you happiness may not be correct. Some money experts say that “If money doesn’t buy happiness, you’re spending it wrong.” Spending for immediate gratification on material things and gadgets usually does not bring long-term happiness. Whereby, focusing your spending on experiences such as travel or family activities can lead to long-lasting happiness. When you can relive a memory over and over, such as travel, that is the key. But some material possessions help with happiness if it involves a longer-lasting activity you enjoy, such as buying a mountain bike or sail boat that is used frequently leading to happy memories. The key is being mindful and setting aside a portion of spending for gratifying experiences. Big Think

Meditation Tips for Those Who Think They Can’t: Numerous studies highlight the benefits of meditation and mindfulness. But many struggle with it in practice. Some struggle to clear their mind but experts say just try focusing on breathing, sounds, or your body. Apps can also help facilitate and there are many good ones out there. Also, don’t try to hold yourself to too high of a standard. Just do your best even for just a few minutes a day and you will reap benefits. Vox – A Guide to Mediation for People Who Think They Can’t Meditate

Quote for Father’s Day: “Average fathers have patience. Good fathers have more patience. Great fathers have an ocean of patience. ” Reed Markham

Bonus Fun Quote For Father’s Day: “She got her looks from her father. He’s a plastic surgeon.” Groucho Marx

To all you fathers out there, have a very enjoyable weekend with your families!

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!