The Federal Reserve held its last meeting of the year regarding the determination of short-term interest rates. As expected, the Fed held steady and did not raise rates. The Fed has held rates steady at the range of 5.25% - 5.50% where they’ve been since July. Officials are hesitant to declare victory over inflation but stated inflation had fallen faster than they projected. The projections for the rate-setting committee show they expect three rate cuts next year. Immediately after the announcement, the stock and bond markets both rallied. WSJ Bloomberg

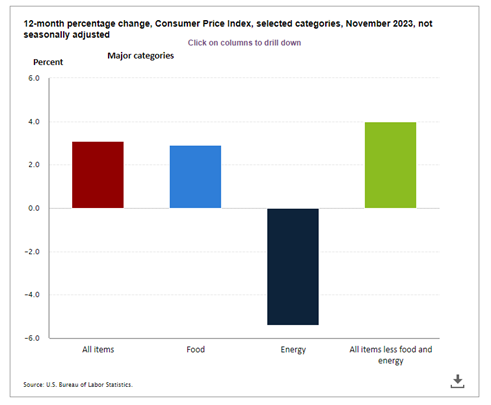

November Inflation In-Check: The Consumer Price Inflation (CPI) report came out for November and overall prices rose 0.1% from the previous month and are up 3.1% over the last year. Core CPI which excludes volatile food and energy rose 0.3% over the same period and is up 4.0% for the past twelve months (see chart). Though not the big inflationary drop that occurred in October, the good news is that inflation didn’t increase and held steady. BLS WSJ

For Market Participants, Inflation is Yesterday’s News: Readers of our newsletter know the big economic news for the last two years has been inflation which we have written about extensively (some would say, ad nauseam! ). Expectations for inflation over the next five years are now only 2.08% overall (see chart). That is very close to the Fed’s 2.0% inflation target. The expectations for lower inflation have helped fuel the stock rally this year and the recent drop in bond yields. Some parts of the economy are even showing signs of deflation, or falling prices. CNBC Market participants have moved beyond high inflation unless a surprise comes along. They are now focused on the underlying strength of the economy and, of course, when the Federal Reserve may start cutting rates. Axios

Chart: St. Louis FRED

COP28 Climate Summit Breakthrough: Representatives from over 200 countries agreed to lessen the effects of climate change by reducing the use of carbon energy. It was the first time the world representatives have been so clear about the need to transition away from fossil fuels. The deal calls for big increases in renewable energy capacity, reducing coal use, and accelerating technologies such as carbon capture. The world’s biggest emitters of carbon, the U.S. and China, both agreed to the pact. Countries must now return home and implement policies to support the agreement which can be difficult. The world is increasingly using renewable energy and the agreement may speed up usage even further, though the full economic impact may not be known until (or unless) national policies start to be implemented. Reuters Axios

Financial Planning/Investment Strategy Corner:

Roth Conversions for Estate Planning: Before 2019, when heirs inherited an IRA, they were able to stretch the withdrawals over their lifetime. However, after Congress passed the Secure Act of 2019, the inherited IRA funds now have to be distributed within ten years. This has created a tax problem for many of the heirs who are inheriting IRA accounts in their 50’s and 60’s which can be peak earning years. The IRA withdrawals, which are considered earned income by the IRS, are frequently being taxed at very high rates. This somewhat defeats the intent of those leaving funds for loved ones, as they receive fewer assets to use for their benefit. One potential solution for those leaving assets is to convert tax-deferred IRA accounts to Roth accounts. Funds converted from tax-deferred IRAs to Roth IRAs are taxed as income, but many retirees have very low income and would pay either no income tax or a low income tax rate on converted funds. When the Roth IRA funds are eventually passed on to the inheritors, the assets still have to be withdrawn over ten years, but the withdrawals will be tax-free as long as the Roth IRA account has been opened for at least five years. Before deciding on Roth conversions for estate planning purposes, one must determine that it works within the investors' own financial planning, and then it may be a viable estate planning tool to consider. CNBC

Quick Hits:

- Chart of Countries/Regions CO2 Emissions since 1950 (Guess who’s the biggest contributor?): Visual Capitalist

- Look up in the sky! The Geminids meteor shower is here this month: Space.com

- For better health, these studies state to eat more beans, nuts, and whole grains: NYT

- Take a look into the Excel World Championships (Yup, no joke): WSJ

- A six-foot-long skull of a ferocious extinct marine dinosaur has been discovered in England: BBC

- Say no to unwanted holiday invitations to benefit your mental health: Good News Network

- Last minute holiday gift ideas: Engadget Forbes NYT – Wirecutter

Multitasking = Bad; Focus = Good: In our fast-paced world, many of us try to multitask to get more done. However, one study suggests that only 2.5% of the population multitasks effectively. According to one psychologist, multitasking can kill your productivity by up to 80%. Most people confuse multitasking with “task switching” which is actually what they are doing. Task switching, is considered incredibly inefficient for the brain and can be mentally fatiguing by decreasing focus and increasing stress. To be most efficient, spend the most time on what produces results – 80% of the results come from 20% of your activity (Pareto Principle). After you identify the activities that get the most results, remove, delegate, or defer the less impactful activities. Lastly, leverage systems, processes, and technology, which can make your life easier while increasing your productivity and performance. Fast Company

Best of 2023: If you have some downtime over the holidays, here are some “best of” lists that may help entertain you:

- Best Movies: IMDB IndieWire - 50 Best Movies of 2023 According to Global Critics

- Best Books: The Guardian - Best Books by Category NYT - Ten Best Books of 2023

- Best Podcasts: Time – Best Podcasts of 2023 New Yorker - Best Podcasts of 2023

- Best Audiobooks: Literary Hub - The Best Audiobooks of 2023

Quote: “The three stages of career development are: 1. I want to be in the meeting, 2. I want to run the meeting, 3. I want to avoid meetings.” Jay Ferro, Business Leader

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!