For many retirees and pre-retirees, the cost of future medical expenses is a primary worry. In a survey conducted by Principal, they found that 64% of respondents cited health care expenses as a contributor preventing them from feeling financially comfortable in retirement. There is good reason for that. It is no surprise that as we age, we are more likely to need more medical attention. With an aging population in the US, the cost of these medical costs has been on the rise.

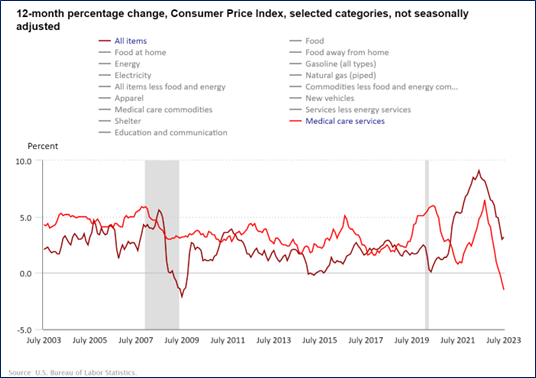

The chart below shows the pace of price increases in medical care services (light red) vs. the aggregate of all categories (dark red). Despite a recent reprieve over the past couple of years, medical care services inflation has handily outpaced general inflation over the past 20 years – 3.5% per year vs. 2.5% per year.

Planning ahead won’t eliminate these rising costs, but it is the best way to neutralize the impact on your financial plan. Here are some planning tips:

Take advantage of a Health Savings Account (HSA) – HSAs may be the best tool available to individuals and families saving for future medical expenses. The tax advantages and flexibility they provide are unmatched. Take a look at our blog article to learn more about all of the benefits of an HSA and how to make the most out of your account - Health Savings Accounts (HSAs) – More Than Just Health Savings.

If you are paying IRMAA surcharges, see if you are eligible for a refund – Individuals on Medicare may be familiar with IRMAA (Income-Related Monthly Adjustment Amounts). Medicare Part B & D premiums are based on taxpayer’s income from two years prior, meaning your 2023 premiums are based on your 2021 income. For many individuals, a lot can change in a two year period. If a Medicare recipient’s income is lower than it was two years ago, they may be able to get a refund on their surcharges. WSJ -

Paying Extra for Medicare? See if You’re Due a Refund

Make sure you are in the best medical plan for your needs – Having the correct coverage can save you money on premiums and/or out-of-pocket costs. Nerd Wallet – How to Choose Health Insurance Medicare Coverage Choices

The government is trying to help – One of the key components to the Inflation Reduction Act passed last year targets rising drug prices. A part of the plan is to negotiate prices between manufacturers and Medicare. The first 10 drugs subject to these negotiations were announced this week CNBC - 10 drugs subject to Medicare price negotiations CNBC - 3 most-used drugs on the Medicare price negotiation list.

A bit of economic news:

Markets and the Federal Reserve continue to digest data to indicate where economic growth is heading.

- Jobs Data Released

- Second-quarter GDP growth revised lower – US gross domestic product increased at 2.1% in Q2 – revised down from 2.4% reported last month. CNBC

Quick Hits:

- Peer pressure in the checkout aisle – Debated “round-up campaigns” lead to higher fundraising, more weariness WSJ - Just Like Tip Prompts, Requests for Donations at Checkout Are Everywhere

- September is here! Here are some activities to enjoy in New Hampshire this month NH Magazine

- Known nationally for lobster & lighthouses, but we know Maine has much more to offer Mainebiz - Maine’s National Profile Goes Beyond Lobster and Lighthouses

- What does & doesn’t work when it comes to reducing your carbon footprint Washington Post – Myths About Tackling Climate Change

- Investing in Bitcoin, other cryptocurrencies, may get easier. US courts pave the way for Bitcoin exchange-traded funds CNN CNBC

Personal data breaches on the rise – what you can do about it – I honestly don’t know my own blood type, but I am sure a hacker out there somewhere does. I have received a record number of letters in the mail this year letting me know that my personal information was compromised, and I’m likely not alone. According to the World Economic Forum, organizational data compromises impacted over 392 million people globally in 2022. These breaches usually happen at a company level, so you likely won’t be able to avoid them. However, there are ways to keep the impact to a minimum, which include: changing your passwords, monitoring your accounts and credit, setting up a credit freeze & fraud alerts, utilizing identity theft protection services, and more. Here are some helpful resources:

- What Really Happens In a Data Breach (and What You Can Do About It) – PC Mag

- What To Do When You Receive A Data Breach Letter - Forbes

- 7 Steps To Take After Your Personal Data Is Compromised Online – Fulton Bank

- Here’s What You Should Do After a Data Breach - Experian

Quote: “There's two times of year for me: Football season and waiting for football season.” – Darius Rucker. We are finally at football season! Go Colts!

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!