Apologies for the obnoxious title, but it kind of says it all. That is all investors – and the Fed are focused on at the moment. The Federal Reserve met this week and raised short-term interest rates by .75%, the largest increase since 1994. That raised the range for short-term rates to 1.50% - 1.75%. The committee’s new dot-plot shows rates ending the year at 3.40% implying another 1.75% tightening in the second half of the year. So, they will keep aggressively raising rates in future meetings. Bloomberg

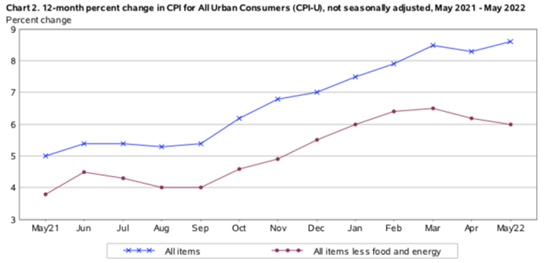

Just last month, the Fed articulated they were going to raise short-term rates by .50% in June and July. So, why get more aggressive one month later? Because the May CPI report released last Friday was terrible in just about every way. The expectation was that the March CPI report was the peak for inflation since it went down slightly in April. Economists and investors expected the downward trajectory to continue in May. Just the opposite happened. The top line number came in at 8.6% which was higher than March as the chart shows.

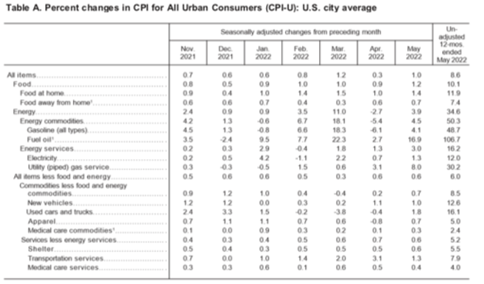

But that wasn’t the only issue. Not only was the top-line number higher, but inflation increases were higher across the board. Energy led the way, but there were increases in food, used and new vehicles, apparel, medical care… just about everything as seen in the next table chart:

Source: Bureau of Labor Statistics data

With inflation increasing and not decreasing, the Fed felt it had no choice but to get more aggressive and raise rates higher. The market's initial reaction was positive but high volatility could continue until future CPI reports start showing inflation coming down.

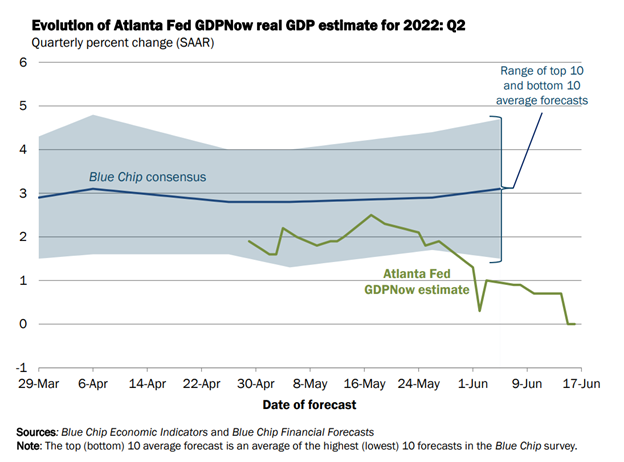

Recession Talk Getting Louder: As short-term rates go higher, borrowing costs move up, reducing the demand for housing and other credit purchases, which should slow the economy. Some lessening of demand is already occurring due to inflation. The May retail report shows that as consumers spent more on food and energy they spent less on other goods. Axios BUT, if consumers pull back too much, companies will also curtail spending, and a downward spiral could occur that eventually leads to a shrinking economy. And the economy is slowing. The Atlanta Federal Reserve’s GDPNow forecast tries to measure GDP in the current quarter. It is not the most accurate report and it can fluctuate widely but it does indicate where things tend to be going. A month ago the reading indicated that Q2 growth was approximately 2.5%. Three weeks later as of June 8th, was down to 0.9% as the chart below shows. Company earnings and job growth are still solid, but as the Fed continues to hike rates, and with the headwind of inflation, the economy should cool. The Fed will only slow or pause hikes once inflation starts coming down, so the next couple of monthly inflation readings are extremely important. GDPNow

Why Gas Prices are so High – and May Not Come Down: Producers of oil and gas are producing as much as they can with their current capacity but not investing in new projects to produce even more. Why not at these high prices? Oil producers and refiners tend to think in terms of decades since the capital investments take years to yield anything and even longer to financially pay off. When there have been frequent boom and bust in energy (remember when the price of oil went negative just 25 months ago?) and when much of the world openly speaks of attaining zero carbon economies, there is not a lot of incentive to invest. With this backdrop, energy companies have decided to keep their profits for now and not invest, much to the chagrin of consumers and policymakers. Axios And it's not just oil producers in the U.S. but also the refiners. The CEO of Chevron stated recently that he thought there will never be another new refinery built in the U.S. He is probably right. Although existing refineries have added capacity over the years the last new significant refinery was built in 1976! Institute for Energy Research Why? It takes 5 – 7 years to build a new refinery at a cost of $5B - $15B. Profitable Venture With Russian oil off-limits for much of the West and no new supplies coming online soon, energy prices could continue to stay high for a while – or go even higher. NYT And here is a visual chart showing what drives gasoline prices at the pump: Visual Capitalist

Financial Planning Corner:

Bear Market Got You Down? Investment and Financial Planning Strategies Can Help: It has been a horrendous start to the year for both stocks and bonds. But what to do? Many want to act, sell out and wait on the sidelines but trying to time the market is incredibly difficult and rarely successful. But there are things you can do that can help your portfolio and taxes such as rebalancing, tax-loss harvesting, Roth conversions, and reducing concentrated stock positions. At RSWA, we utilize all these strategies and more so something good can come out of the markets being bad. Read our blog article about the strategies and feel free to share with friends and family concerned about what to do with their portfolios when they are down. And if you have questions, please reach out to your RSWA financial advisor. RSWA Blog – Bear Market Got You Down? Here’s 7 Investment and Financial Planning Strategies for When Stocks Are Down

Quick Hits for the Week:

- If you’re going to Paris for the first time in a few years, there are new sights to see: NYT

- Côtes du Rhône may be a great wine to buy right now: WSJ The Wine Society - Ultimate Guide to Côtes du Rhône wine

- How to actually improve your work-life balance: Healthline

- We have entered the era of the billion-dollar athlete and there are now six: Forbes

- An insightful interview with an American icon, Tom Hanks: NYT

- The seven habits that lead to happiness in old age: The Atlantic

RSWA Webinar Series - Fritz Meyer: Our good friend Fritz returns next month! With all that has happened in the markets since Fritz presented in January, we thought the timing was right for an update. So mark your calendars for Thursday, July 21st at 4:30 PM. An invitation will be going out soon. Be sure to share it with friends and family who may want to listen in.

Non-Alcoholic Drinks: The hot new thing in booze, are beers and liquors with, well, no booze. Non-alcoholic (N/A) are all the rage and command multiple shelves now at the local liquor store. They are also popping up on restaurant and bar menus. I have to admit on a hot summer day, I like the taste of a cold beer, but now I have the option of no alcohol. I’ve started sampling a few different kinds. My favorite is the Heineken 0.0% and recently I tried ParTake IPA, which I thought was decent too. I tried a N/A gin and tequila and found those so-so though it won’t stop me from trying others in the future. I gathered a few lists to peruse, and if you find one you really like, let me know so I can give it a try. Liquor.com Food & Wine – Beer Food & Wine - Spirits

Running Backwards is a Thing: Some competitive runners are running backward as a way to train different muscles, improve their posture, or even recover from a running injury. There is also evidence to suggest that it burns up twice the calories as running forward. I have to admit when I first saw this article it seemed a little outlandish. But after reading it, maybe not so crazy. I haven’t tried it yet but may give it a whirl at some point. NYT – People Are Running Backward. What Could Possibly Go Wrong?

Quote: “Stock markets have predicted 9 out of the last 5 recessions! And its mistakes were beauties.”

Nobel laureate and economist Paul Samuelson, in a September 1966 column in Newsweek.

Enjoy the weekend. Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!