We know you are not tired of hearing about the Federal Reserve (note sarcasm… 😊), so before we get to our other articles, a quick central bank update. The Fed met this week and did not change short-term interest rates. They stated they would make decisions meeting by meeting, and they still saw three rate cuts this year which was the same as in December. Stock markets reacted positively to the announcement and the Fed chair’s press conference comments. CNBC Now, onto other news…

Big Economic Development Covered Widely in the News – Real Estate Commissions Set to Change: How you pay real estate agents to buy or sell houses has been the same for decades but is about to drastically change. The National Association of Realtors (NAR) reached a $418M court settlement to settle legal claims that the industry conspired to keep agent commissions high. This has the potential to drastically change how home buyers and sellers pay agents. Some are comparing this to when air fares were deregulated in the late 70’s which disrupted the industry and paved the way for discount airlines. No one quite knows how things will unfold. Some speculate that commissions for buying and selling agents may be negotiated beforehand, and possibly paid, before a home sale. If commissions are reduced, there is also a good chance that many agents will leave the industry to pursue more lucrative careers. The new rules are going to go into effect this summer and we’ll have to see how the changes unfold. WSJ AP News

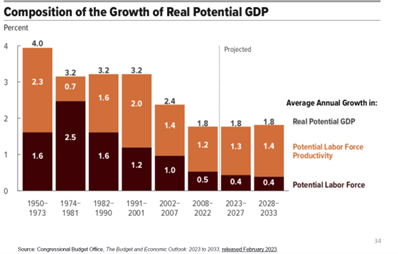

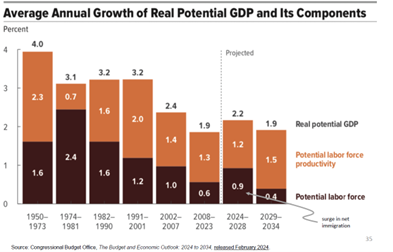

Big Economic Development Not Covered Widely in the News – CBO Changes GDP Guidance: The Congressional Budget Office (CBO) provides nonpartisan economic analysis for the U.S. Congress. It released its annual report on long-term projections for the U.S. economy. This year, it has significantly upwardly revised the growth rate of the economy. In last year’s report, it projected the real gross domestic product (GDP - growth above inflation) would grow 1.8% annually over the next decade (see first chart below). The 1.8% GDP growth rate has been the prediction of the CBO for many years. But in this year’s report (second chart), they projected the economy would grow 2.2% annually for the next four years and then 1.9% after that. A 0.4% increase may not sound like much but in percentage terms that equates to a 22.2% increase! The 0.1% increase from 2029 until 2034 equates to a 5.5% increase, while smaller, is still significant. The CBO cites higher net immigration starting in 2022 of working-age adults as a big reason for the anticipated increase. A bigger GDP generally translates to higher individual incomes, corporate earnings, and government tax receipts. It also reduces the federal deficit as a percentage of the economy, a closely watched metric. As the Congressional budget battles unfold, expect to hear politicians referring to the report and using it for their budgetary arguments. This represents a big change in economic expectations that seemed to go unnoticed in the press. Congressional Budget Office Investopedia – What is GDP?

End of an Era – Negative Interest Rates: This week, the Bank of Japan (BOJ) raised the short-term interest rate from a negative rate below zero to a range of 0.0% to 0.1%. That doesn’t sound like a big move, but it signals the end of negative interest rates and the end of an era. During the 2010s, central banks around the globe were fighting very low inflation and sometimes even deflation. The banks employed policies never used before such as asset-buying programs and negative interest rates. The BOJ’s move, along with all the other significant central bank moves in the last couple of years will affect all markets, as investing is globally intertwined. We’ll be watching for how things change for investors, but it certainly feels like we are entering a new investing era. CNBC Asia Times When Japan Ends Negative Rates

Financial Planning/Investment Strategy Corner:

Fair Isaac Corporation – Keeping Score Since 1956: The Fair Isaac Corporation, formerly Fair Isaac and Company, may not sound familiar but I bet FICO Score does. Billy Fair and Earl Isaac, an engineer, and a mathematician, created a formula to calculate consumer risk and it has been used widely ever since when consumers buy a car or apply for a credit card or mortgage. Wikipedia FICO Score FICO scores can range from 300-850 and the higher the score, the lower the perceived credit risk of the consumer. The National Average FICO score dipped 1 point, however, for the first time in a decade. Potential causes for this decline include missed payments and rising debt levels for consumers. Axios Credit Scores Dip It’s too soon to tell if this is an anomaly or a trend but here are some tips on keeping your FICO score in tip-top shape. How To Get and Keep a Good Credit Score

Tax Deadline Approaching and Extensions: The tax filing deadline of Monday, April 15th (and Wednesday, April 17th if you live in Maine or Massachusetts) is coming right up! If you need to file an extension, you will need to do so before the deadlines which will allow you until October 15th to file. Keep in mind that extensions are for your federal return and you may need to make state payments and file forms for state returns. If you don’t get your paperwork to your accountant before early April, many accountants will put you on an extension, so get your paperwork in now! Also, remember to make your IRA/Roth and HSA contributions and work with your accountant on your allowable limits.

Special 2023 Tax Filing Maine Extension: Tax Filers living in Maine seacoast counties adversely affected by the severe winter storms have received an extension to June 17th from both the IRS and the state of Maine. IRS Maine.gov But there is a catch – most accountants I have spoken with are ignoring that and still trying to get everyone to file by the April deadline. Their feeling is if someone drags their feet on getting them info in April, they will do the same in June, so they’d rather get it done now. With that said, if you are affected by storms and need the extension, bring it up to your accountant immediately to see if they are willing to extend your filing. Keep in mind, that they may not be able to accommodate an extension as many take long vacations in May and June after the grueling hours of tax season.

Quick Hits:

- Large offshore wind farms may be coming to the New England coast soon: NHPR

- New research assisted by AI, suggests that Viagra may be good for the brain and to help ward off Alzheimer's disease: WSJ

- Love this story! Some skiers are still chasing powder in the 80’s and 90’s: NYT

- How does ultra-processed food affect our brains and bodies? Maine Public

- The gray whale, extinct for 200 years in the Atlantic, was sighted in New England: NEAq

The Star of March Madness is Caitlin Clark: The NCAA Tournaments for men and women’s basketball kick off this week. Capturing the attention of fans for the better part of the month, it is arguably the biggest sports event in the U.S. And the biggest star of this year’s tournament month is not a man, but a woman, senior Caitlan Clark of the Iowa Hawkeyes. Read about this transcendent hoops star in the making. ESPN

Quote: “Basketball is a beautiful game when the five players on the court play with one heartbeat.” Dean Smith, University of North Carolina Hall of Fame basketball coach

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!