That is the question on the minds of investors. And one that doesn’t have an easy answer. You don’t have to look far to find supporting evidence that the US economy is on shaky ground:

- Three major bank failures and more potentially on their way FDIC – Failed Bank List

- Inflation is still stubbornly high US Bureau of Labor Statistics

- The US Federal Reserve continues to raise interest rates to slow the economy

- New companies announce layoffs daily

- The looming debt ceiling

Despite these headlines, the US has avoided a recession thus far. In fact, the National Bureau of Economic Research (NBER) – the organization that defines US business cycles and declares recessions – shows that none of their recession indicators suggest that the US economy is in a recession Apollo. Their indicators include real personal income less transfers (PILT), nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production.

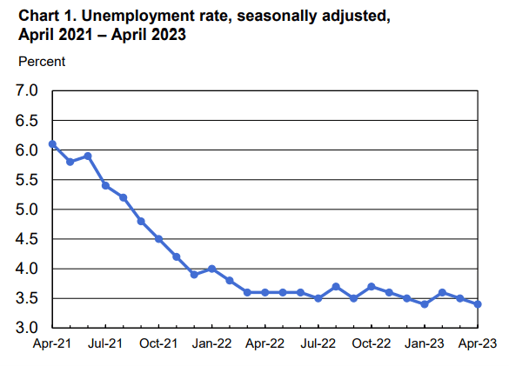

How is this possible? The unemployment rate remains near historic lows Bureau of Labor Statistics and US households are still flush with cash Reuters. These factors allow the resilient US consumer to continue to spend and support the economy. Atlanta Fed GDP Now

Source: Bureau of Labor Statistics

The takeaway? The US economy seems to be balancing on a knife’s edge. The impact of the Fed’s interest rate hikes and recent bank failures are still making their way through the economy, but if consumers remain strong, the US could avoid (or at least lessen the impact of) a recession.

A Check-In on Global Economies

So that is the state of the US economy; what about other economies across the globe?

- Europe – Facing similar challenges as the US – policymakers continuing measures to slow inflation while trying to avoid recession IMF

- China – Economic growth appears to be much stronger in China versus other parts of the world, but this outlook hasn’t translated to Chinese stock performance due to growing political tensions Schwab

- Emerging Economies – GDP growth is expected to slow due to higher interest rates and slower growth in the US and other developed nations S&P Global

The Obligatory Monthly CPI Data Report

The latest consumer price index (CPI) data was released Wednesday morning. On an annual basis, the inflation rate was 4.9% (or a 0.4% rise for the month of April). This number is slightly lower than estimates and shows a continuing trend of lower inflation for the US. CNBC

Financial Planning/Investment Strategy Corner:

The Rise of ESG/Sustainable Investing – What is it? Why is it becoming popular?

A growing number of investors are asking for more than just good returns from the companies they invest in. They want to invest in companies that share the same values as them and focus on more than just profits. ESG investments, such as ESG funds, allow investors to invest in funds containing companies that match these criteria.

ESG stands for Environmental, Social, and Governance. ESG investing screens investments based on their corporate policies and encourages companies to act responsibly. CNBC Investopedia

- Environmental screen – addresses how a company’s policies affect the planet – greenhouse gas emissions, carbon footprint and intensity, renewable energy usage, etc.

- Social screen – covers issues affecting company stakeholders – employee treatment, diversity and inclusion, ethical supply chain sourcing, lobbying efforts, etc.

- Governance screen – relates to board independence, business ethics, and leadership effectiveness – executive compensation, diversity of the board, enforcement of ethical business practices, etc.

ESG funds screen and eliminate companies that don’t meet set criteria, meaning the pool of stocks and bonds available for investment is reduced. This limited investment base can affect ESG fund performance. The performance returns may vary from traditional stock and bond portfolios that invest in the broad market over periods of time.

Quick Hits:

- What impact does your diet have on the environment?

- Tis the Season to be Sneezin’ – Tips for coping with seasonal allergies - NHMagazine

- Curious about what bird is singing in your backyard? Use this guide to help you identify them by their call – 50 Bird Species and The Sounds They Make (it is also a great way to confuse your cat)

- The weather is finally warming up, which means outdoor dining is here! Here are some spots to try:

- Portland – Portland Old Port

- Portsmouth – Portsmouthnh.com

- Boston – Boston Chefs

- Issues facing youth sports are not the participation trophies, but participation rates - WSJ

Millennials Are Doing Better Than You Think

Aside from loving avocado toast, Millennials, defined as people born between 1981 and 1996 by the Brookings Institute, may be best known for one characteristic – being broke. As The Atlantic put it, “They are wheezing under the burden of college debt, too poor to buy houses or start families, and were sucker punched by a hostile economy that bears no resemblance to the one their parents enjoyed as young adults.” That language may be a little harsh, but recent data shows that Millennials are bucking those trends as more and more are becoming homeowners, business owners, and investors. The Atlantic – The Myth of the Broke Millennial Rent Café – Millennials Switch To Owner Majority

AI – A Risk or An Opportunity?

Aside from the recession buzz, AI may be the hottest topic of 2023. It certainly has its fair share of diehard believers, but plenty of cynics worry about its potential impacts(including Warren Buffet – The Street). Though it has been getting a lot of attention recently due to the release of ChapGPT, AI has been a part of our everyday life for quite a while – remember this guy?

Other common day-to-day AI technology includes navigation (GoogleMaps), facial recognition, autocorrect, and customer service chatbots. The potential benefits are immense - increasing efficiency, automating tasks, and even doing some tasks much better than humans TechTarget. However, there are still plenty of risks and dangers that will need to be addressed Builtin.

Quote: "If you’re a mom, you’re a superhero. Period." —Rosie Pope

Happy Mother’s Day! We hope it is full of love, flowers, and, most importantly, chocolate!

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!