2023’s Resilient Labor Market: The labor market added 216,000 jobs in December, higher than analysts expected for the month, and added to a stronger job year than most economists expected. Under the hood of the report showed potential weakness though, with the labor participation rate falling 0.3%. Downward revisions to the job gains in October and November also indicated a slowing labor market. US Jobs Report | Bloomberg

Bear Market Indicator: The stock market rally in 2023 could be facing resistance in 2024 according to one indicator. 2024 has started lower for stocks, with the S&P 500 down -0.13% through the first five days. The First Five Days indicator shows that if the S&P 500 is positive, the index on average rises +14.4%, and 83.3% of the time the year finishes with gains. With the index down through the first five days, the indicator shows the average index return is 0.3% and the percentage of positive returns for the year is 53.8%. In the past two years the First Five Days indicator has shown to be true where in 2022, the indicator pointed to a negative outlook with stocks falling 2%, while in 2023 the indicator rose 1%. No indicator is a crystal ball and trading on short-term trends and averages can get investors into trouble trying to time the market. Overall, remaining invested in a diversified portfolio typically produces better long-term results. A Bad Omen for The New Year | Investors.com Technical indicator January Barometer 2023 | Fidelity

FAFSA Rollout Troubles: In 2023, the Free Application for Federal Student Aid (FAFSA) form implemented updates that Congress voted on three years ago. The updates led to a three-month delay in the form, made available on December 30th, and still, individuals have reported trouble accessing and completing the form. Now that the form is available, a larger, more serious problem was revealed where the income allowance formula is not adjusted for inflation, a new requirement. With the income allowance not adjusted for inflation, more of a family’s income is included, resulting in lower benefits for students and potentially disqualifying students from Pell Grants, work study, and other financial aid. Initially, the Department of Education said the fix would be made for the 2025-2026 FAFSA form, to avoid further delays this year, but they are still evaluating options. FAFSA Mistake | NPR

RSWA Quarterly Webinar, Fritz Meyer on January 18th at 5:00 PM: As we have for several years now, we will kick off the year with Fritz Meyer, noted economist and market strategist. Fritz will give a recap of 2023 in the markets with an eye on what to expect for 2024. I personally enjoy Fritz’s slides, particularly if he uses the slide with how wrong analysts’ sector forecasts usually are: Register Now!

We encourage you to download and register with Zoom ahead of time to seamlessly join the webinar. Some of our attendees from our last webinar had issues getting in because of Zoom’s new registration procedure. If you register on Zoom beforehand, there should be no issues.

Financial Planning/Investment Strategy Corner:

Where Did All the Money Go?

As we enter a new year, reviewing your 2023 budget and spending may be a worthy endeavor as we reflect on where we can save more in 2024. With inflation higher over the past few years, some consumers have blamed that for blowing out their budget, but it may be something more: Lifestyle Creep. In a recent survey of different generations, the question was posed of how much salary one would need to be happy. Millennials responded by saying they would need an average salary of $525,000 a year ($525,000 a Year to Be Happy | businessinsider.com).

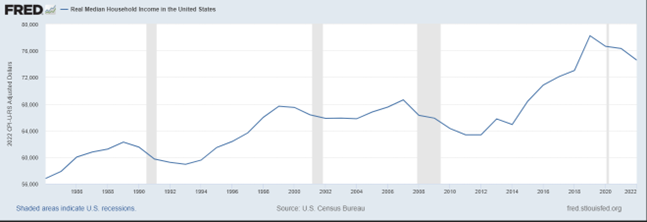

Looking at real median household income, in 2022, the value is $74,580. Inflation is not the cause of some survey respondents saying they need nearly 7 times more than annual household income, it’s likely lifestyle creep. Don’t blame Millennials or our current society because the survey response was nearly the same thirty years ago. In The Overspent American by Juliet Schor, in a survey response from 1994, households earning $50,000 a year said they would need nearly $200,000 a year for “total fulfillment.” I remember the book from college, it wasn't a new book at the time, but college is getting to be longer and longer ago. (The Overspent American | nytimes.com). The book goes over how society has given us different reference points for what we think we deserve to be able to spend, based on how we view ourselves in comparison to others. This is nothing new, just a societal observation and may not apply to everyone.

In terms of budgeting tools as we enter this year, just using the back of an envelope to track your necessary expenses (food, housing, insurance, etc.) can help individuals determine how much they need and what they may be able to cut. At times, fear may be what holds us back from starting a budget: How to make an easy budget, no app required | The Washington Post.

Quick Hits:

- I think it’s just building a nest but sure: Mouse secretly filmed tidying man’s shed every night | The Guardian

- 2024 is a Leap Year: 10 quirky leap year traditions you didn’t know existed | Salon.com and full of astronomical events to look forward to in 2024 | WPFO.

- With tax incentives to install heat pumps and seeing them more and more, I liked this visual of how they work: A fridge but in reverse? | The Guardian

- This was a longer read about the decline in cousins due to lower birth rates and how special connections we have with them may be missed: The Great Cousin Decline - The Atlantic The Great Cousin Decline (msn.com)

Quote: “You don’t have to see the whole staircase; just take the first step.” -Martin Luther King, Jr.

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!