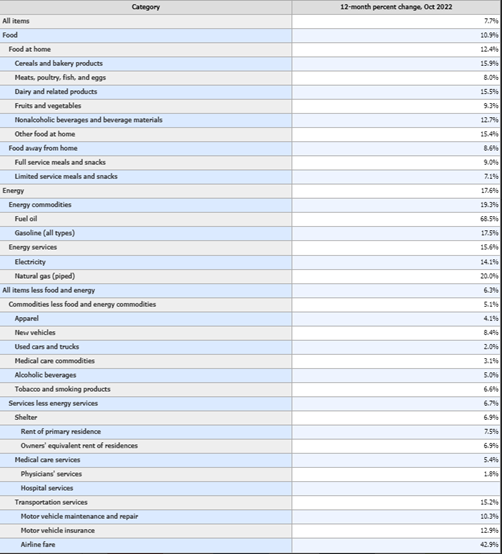

The October Consumer Price Index (CPI) numbers were released last week and they came in lower than expected. The report showed consumer prices had increased 7.7% from a year earlier. That is still very high but was lower than September’s 8.2% yearly increase and the lowest annual increase since January. The closely tracked core CPI was up 6.3% annually which was less than September’s 6.6%. For the month, prices rose 0.4% from September to October which matched the previous monthly increase, while core prices rose 0.3% for the month, half of the 0.6% monthly increases from August and September. The categories that contributed the most to the slowdown were used cars and trucks, apparel prices, and medical care prices. Areas still contributing to higher inflation were housing prices, rents, and energy (see chart). WSJ

Chart: Bureau of Labor Statistics

The Producer Price Index (PPI) is the CPI inflation equivalent for producers. The October number was released this week showing an increase of 8.0% over the previous year but only an 0.2% increase from September, the second monthly increase of 0.2%. Stating the obvious again that an 8.0% annual increase in producer prices is high, but it is much better than the 11.7% increase earlier this year in March. WSJ

The CPI and PPI reports offer optimism that inflation could finally be on a downward trend. They also support the notion that the Federal Reserve could slow its aggressive rate hiking campaign and bring it to a close sooner. That optimism is why stocks and bond prices rose sharply on the days the reports were released. CNBC

The November CPI report is set to be released on December 13th and the Federal Reserve will announce the next day their plans for a rate hike. Investors are hoping the November inflation report shows more good news and the Fed responds accordingly. Fingers crossed…

U.S. - China Summit: President Biden and President Xi Jinping met for a three-hour meeting this week in Indonesia. They stated they wanted to “manage” their differences which is important as the two powers have been embroiled in trade spats and geopolitical tensions in recent years. No big announcements resulted from the talks though it is probably positive that the leaders of the two largest economies in the world had an open dialog that did not seem confrontational. AP News Greg Valliere

Congressional Update: I will keep the political commentary short since I think we could all use a break from the run-up to the election. With that said, what happens in DC is important as it affects the economy, tax rates, and individual financial planning. As the final votes are tallied and the smoke clears, we will give an update on any potential impacts to legislation that affects investors. But for now, let’s take a respite from political ads and rhetoric and enjoy peace and quiet.

Financial Planning Corner:

Year-end Reminders: Can you believe the holidays and year-end are right around the corner? Therefore, I wanted to send out reminders on financial planning items to complete by December 31st:

Required Minimum Distributions (including QCDs); Roth IRA conversions; 529 plan contributions; tax-loss harvesting; charitable donations and gifting transfers.

We coordinate and handle many of these for RSWA-managed accounts but for those of you who have investments elsewhere, get to work! 😊

Quick Hits for the Week:

- How to improve your posture in just a few minutes: pickthebrain.com

- The most powerful rocket ever built, Artemis I was launched this week and is set to fly past the Moon as NASA prepares for future moon landings: NASA

- Fusion is a potentially unlimited clean energy source, learn how it works: VisualCapitalist

- Daily meditation may work as well as drugs to calm anxiety: NPR

- Bad weather is good for you – take a walk in the wind and rain: The Guardian

Iran Hostage Documentary: I recently watched the PBS documentary on the 1980 Iran hostage crisis, Taken Hostage. It was a behind-the-scenes look at what led up to the crisis, and how President Carter and diplomats searched for answers. It also shed light on the plans of the failed rescue attempt in which eight U.S. soldiers died in the Iranian desert. The events of the overthrow of the Shah of Iran and the hostage situation still weigh heavily on U.S. – Iranian and Middle East policy. And the Iranian theocracy formed during that time is fueling the discontent of the people leading to the protests happening today. Worth a watch. American Experience – PBS

Coffee Future Prices are Down, Will Your Cup of Daily Joe Follow? Coffee prices have been increasing for two years. When people spent more time at home during COVID, demand soared, as did prices. Then last winter, coffee crops in Brazil were hit by drought and frost, hurting supply. Coffee futures hit an 11-year high in February of $2.58 per pound. But this fall, the weather has been good and it is expected to continue. As a result, coffee futures prices have dropped by 20% in the last month alone and they now stand at $1.70 per pound. So, will that morning cup be cheaper? Well, maybe, but it won’t be soon. It takes time for future prices to trickle into retail pricing and retailers also have to be willing, or pressured, into passing those savings on to consumers. Still, with the price of coffee coming down, that will help keep a lid (pun intended) on new increases for now. WSJ

Quote: “I like coffee because it gives me the illusion that I might be awake.” Lewis Black

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!