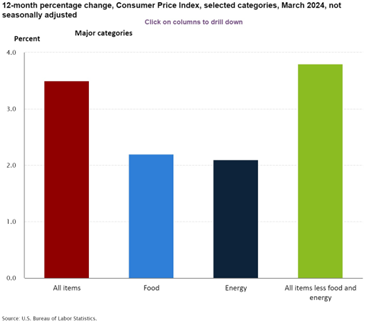

The March inflation report was released this week and came in higher than expected, with core inflation rising 0.4% in March and 3.8% from March 2023 versus estimates of 0.3% and 3.7% respectively. Stock markets dropped and bond yields rose on the news, with the US 10-year Treasury yield crossing 4.5%. March Inflation | cnbc.com

Some components of CPI driving inflation higher from a year earlier are car insurance (+22.2%) and utilities (+5.0%). Consumer Price Index Summary - BLS.gov

Job Market Still Strong: The US Jobs report for March, released last Friday, outpaced estimates adding 303,000 jobs, reducing the likelihood of the Federal Reserve cutting rates in June based on strong economic data. Strong US labor market underpins economy in first quarter | Reuters

Active Atlantic Ocean: Two research groups, Colorado State University and Tropical Storm Risk, Inc., released predictions for an active and hyper-active Atlantic hurricane season in 2024. Atlantic Hurricane Forecast | Yale Climate Connections April Atlantic Forecast | TSR

The researchers point to two significant contributors:

- El Niño dissipating in the atmosphere but La Niña conditions developing. El Niño conditions typically carry upper-level high winds that can tear storms apart, while La Niña conditions are more neutral and favorable for storms. Those conditions historically point to more active hurricane seasons compared to El Niño, with major hurricanes twice as likely to make US landfall.

- Record warm ocean temperatures both at the surface level and to unusual depths, with some observations in April that typically occur in July. Warmer ocean temperatures add fuel to storms.

As we plant our garden this spring and hope for better summer weather compared to last year, our goal this year is to yield ONE tomato. It’s all about setting realistic expectations 😊.

Financial Planning/Investment Strategy Corner:

Indexing Matters: S&P recently analyzed the performance of active fund managers across equity and fixed income markets and compared their performance to their respective benchmarks: SPIVA US Year-End 2023 | spglobal.com.

The findings for the year 2023 vary across asset classes, however, the majority of active fund managers underperformed their benchmark. Among large cap domestic equity funds, 60% of active managers underperformed the S&P 500 Index. Mid cap and small cap funds fared a little better, where 50% and 48% underperformed their benchmarks. With large-cap equities outperforming smaller capital equities, the outperformance may be due to managers tilting out of the benchmark, into larger companies. Fixed income markets saw active managers underperform 59% of fixed income categories in 2023. Looking out over the past 15 years, in both equity and fixed income markets, there were no categories where the majority of active managers outperformed their benchmark. One other concerning finding in 2023, within the active large cap category, there was a negative skew, meaning if a fund manager’s return differed from the median return, they were more likely to underperform. This makes sense intuitively thinking about markets in 2023, where if a fund manager did not own or was underweight the seven stocks that carried market returns through the year, they would have underperformed significantly.

What does this mean for RSWA clients? It means we are aware of how efficient benchmarks are and are cognizant of risks when using active managers in specific asset classes, reviewing a manager’s process and track record before adding it to client portfolios. A manager taking a large out of benchmark position may result in significant underperformance. In our monthly investment committee meetings, we review manager investment performance against benchmarks and peer groups to ensure managers are performing in line with others.

Quick Hits:

- It’s the onions, I swear: Why Do Onions Make Us Cry? | IFLScience

- Maine is ranked among the worst states for telecommuting, with factors like cost of electricity and internet weighing down Maine’s ranking: Ranking claims Maine is among worst states for telecommuting | Mainebiz.biz

- Adding variety to your life could slow things down: Why Time Flies By Faster As We Get Older | HuffPost Life

- America is now recording a record number of bees: Wait, does America suddenly have a record number of bees? | The Washington Post

Quote: “In the spring, at the end of the day, you should smell like dirt.” - Margaret Atwood

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!