The Consumer Price Index (CPI) for July was released this week and came in a little lower than expected. The index rose 3.2% from a year ago and the core CPI (ex volatile food and energy) for the last year was up 4.7% also below expectations. Both measures were up 0.2% from the June reading. Most of the monthly increase was due to shelter/housing costs which were up 0.4% for the month. Some areas such as used vehicle prices (-1.3%) and airline fares (-8.1%) dropped considerably. The relatively mild inflation helped push up real wages by 0.3% (the increase of wages above inflation) providing workers more purchasing power. This was a great report for the Federal Reserve which has been aggressively fighting inflation for almost a year and a half and provides ammunition for them if they decide to pause or stop raising short-term rates. The report was great for investors as well and markets reacted favorably. CNBC

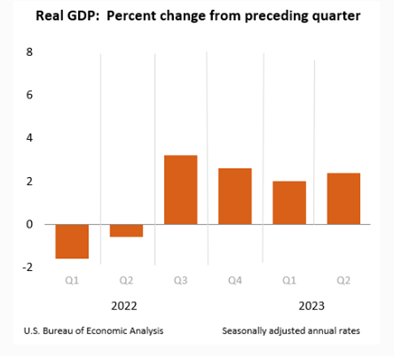

GDP Still Solid: Real Gross Domestic Product (GDP) for Q2 was estimated at 2.4%. GDP is the comprehensive measure of economic activity in the U.S. and an indicator if the economy is growing or contracting. Real GDP is the measure of GDP adjusted for inflation/deflation. The estimate for Q2 came out at the end of July and will be updated over the following months for accuracy. You can see from the chart below that Q2 GDP was in line with the previous few quarters which showed a growing economy. BEA

So what is the expectation for Q3? According to GDPNow, the Atlanta Federal Reserve’s estimate on current economic activity, the economy is still strong. Their most recent estimate is that the economy is growing at 4.1%. The economy is vast and complex, so this number is imperfect but still indicates strong growth and that the Federal Reserve’s aggressive rate hikes have not abruptly stopped economic growth – at least not yet as they have a lagging effect. But the strong growth so far has led to the stickiness of inflation as demand for goods and employees remains strong. The inflation data, GDP, and job growth are all indicators the Fed will be watching as they implement monetary policy over the next few months. GDPNow

Financial Planning/Investment Strategy Corner:

Upcoming Changes to 401k Catch-Up Contributions: The Secure Act 2.0 passed last year by lawmakers included changes for 401k plans starting in 2024. Next year, participants 50 and over making $150,000 or more will only be allowed to make catch-up contributions in Roth 401ks. The change does not impact regular deferrals, only catch-up amounts which the limit for 2023 was $7,500. The IRS will announce the 2024 catch-up contribution amounts this October. Participants that have to fund the catch-up amount as Roth assets will now pay taxes on those contributions but the growth and future withdrawals will be tax-free. This may ultimately help many savers as many tax experts believe tax rates will increase over time, so having more assets in tax-free accounts will result in paying less taxes in the future. We’ll watch to see if there are any updates or legislative changes before implementation in 2024 but if you have questions on how the changes will impact your financial plan, please reach out to your advisor. WSJ Kiplinger’s

Quick Hits:

- How to remove your personal info from Google with the ‘Results About You’ tool: Wired

- Getting stuck indoors by the bad weather? Here are the best shows and movies to watch at home for August: TV Guide Rotten Tomatoes

- Did you know that 1/6 of the world’s land surface is owned by the British Royal Family? The Catholic Church is a very distant second: The World’s Largest Landowners – Madison Trust Co.

- Zucchinis are coming in, here are some recipes to enjoy the harvest: Allrecipe Well+Good

- How to get rid of distracting thoughts: LifeHack

Last Call for the Casco Bay Cruise: The summer cruise next week is once again proving popular as we are closing in on 90 attendees. There is still room so feel free to register and bring family or friends and we’ll have some food, snacks, and drinks for everyone. It is Thursday, August 17th and boarding starts at 4:30 PM and it leaves at 5:00 PM. We look forward to seeing you on the Bay!

Lowering Your Blood Pressure by Not Moving? If you were to ask people what is the best exercise to lower their blood pressure most would answer cardio/aerobic exercise or high-intensity interval training (HIIT). But a recent study compared aerobic exercise, dynamic resistance, HIIT, isometric exercise, and combined training methods for effectiveness in lowering blood pressure, and isometric exercise was the best. Common isometric exercises are wall sits, planks, and glute bridges. Most researchers don’t suggest abandoning other exercises for a few wall sits, but rather working some isometric exercises into your favorite exercise routine. MedicalNewsToday CNN

Get a Grip: It turns out the strength of your hand grip is a good marker of your overall health and potential longevity. As we age, we naturally lose muscle mass and those who retain more have better life outcomes. It makes sense that if you are stronger you are probably more mobile and stable and able to participate in more activities. Therefore, grip strength becomes an overall good biomarker not only for strength, but for cardiovascular fitness, disease, and mental health. So hit the weights a little and enjoy opening those pickle jars! Cleveland Clinic – Health Essentials

Quote: “I’ve had a lot of worries in my life, most of which never happened.” Mark Twain

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!