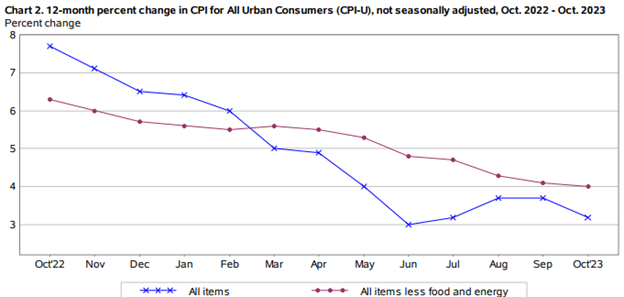

The Consumer Price Index (CPI) for October was released this week. There was no increase in prices from September to October and the rate of inflation for the trailing twelve months was 3.2%. The numbers came in lower than most had expected. Price increases have been slowing down in recent months. If the CPI data from the first five months of this year is annualized, the rate of increase was 5.1%, while doing the same for the last five months gives you an increase of 2.8%. Slowing inflation has been a steady trend for the last year (see chart below). Wall Street had a big day after the release of the news with both stocks and bonds rallying. Many experts now believe the Fed is done hiking rates for this cycle. CNBC WSJ

Chart: Bureau of Labor Statistics

Retail Sales Down: Consumers cut back on spending in October after splurging over the summer. Retail sales fell 0.1% last month while in September they were up 0.9%. Even though the October number was a little higher than expected, it confirmed that consumers are starting to tighten their belts. This could be due to higher interest rates on credit cards, mortgages, and auto loans, and may also be attributed to student loan payments starting back up on October 1st. If consumers slow their spending, it will ultimately lead to a slower economy since consumer spending represents seventy percent of the economy. AP News

Government Funding Passes House: The U.S. House of Representatives passed a short-term funding bill for the government. It is expected to pass the Senate and be signed by the President. The bill provides funding for some federal agencies until mid-January and for others, such as the Department of Defense, until mid-February. The House bill passed with a bipartisan vote of 336-95 with 93 Republicans voting against it foreshadowing a potential fight early in the new year. AP News WSJ

Best of 207 Voting Ends Today! Today is the last day to vote in the Best of 207. Thank you to those of you who have considered us and voted – it is very much appreciated! Results will be announced in February. Best of 207 – RSWA

Financial Planning/Investment Strategy Corner:

IRS Raises Tax Brackets and Contribution Limits for 2024: Tax brackets and the standard deduction were increased by 5.4% for 2024. The income thresholds for paying capital gains tax at different rates were also raised. The federal estate tax exclusion amount was raised to $13.61M and the annual limit on tax-free gifts will be $18,000.

Workers will also be able to contribute $500 more to their 401(k)s and similar workplace plans for a total of $23,000 (plus $7500 more for those 50 and older). And the contribution limit for IRA accounts was raised to $7000 (plus $1000 for those 50 and older).

It’s important to be aware that some tax rates do not receive inflation adjustments. The net investment income (NII) tax of 3.8% will continue to kick in at income of $200,000 for individuals and $250,000 for married couples. Also, the $10,000 limit for deducting state and local taxes and the $3,000 limit on capital losses that can be deducted from income will remain the same and are not adjusted for inflation. WSJ IRS 2024 Brackets IRS 2024 Contribution Limits

Quick Hits, The (Mostly) Thanksgiving Edition:

- The Ultimate Guide to Thanksgiving: NYT Williams Sonoma Food&Wine

- Ideas and recipes for your Thanksgiving gravy (Apple gravy, anyone?): Taste of Home Food Network

- Wine ideas for the big meal: Forbes Unraveling Wine

- Thanksgiving dessert ideas and recipes: WashPost Taste of Home

- Book ideas for the long weekend: Time NH - Water Street Bookstore ME - Longfellow Books

- If you’re going to fall down, this is the right way to do it: WSJ

Ideas for a Zoom Thanksgiving: Our kids currently span eight time zones, so the Smith family is having our meal together over Zoom. I decided to ask ChatGPT for ideas for the event and thought I’d share them with everyone who may be doing the same:

Courtesy of ChatGPT: Conducting a Zoom family Thanksgiving meal can be a creative and enjoyable experience, even when physical distance keeps loved ones apart. Here are some best practices and ideas to make the virtual celebration memorable:

- Plan in Advance: Coordinate a specific time for the virtual gathering that works for everyone.

- Share the meeting link and any necessary instructions in advance.

- Virtual Potluck: Coordinate a virtual potluck where each household contributes a dish to the Thanksgiving meal. Share recipes and cooking tips beforehand.

- Virtual Backgrounds and Decor: Encourage participants to use Thanksgiving-themed virtual backgrounds or set up a festive physical backdrop. Coordinate on a color scheme or theme for a cohesive look.

- Online Games and Activities: Plan virtual games or activities like online trivia, Pictionary, or charades to engage everyone. Consider a virtual Thanksgiving-themed scavenger hunt.

- Thanksgiving Toast: Start the virtual gathering with a Thanksgiving toast to express gratitude and set a positive tone.

- Virtual Dinner Prayer: Begin the meal with a virtual prayer or a moment of reflection, allowing each household to share their thoughts.

- Share Family Traditions: Encourage family members to share their favorite Thanksgiving traditions or memories, fostering a sense of togetherness.

- Cooking Together: Cook specific dishes together virtually, sharing cooking tips and tricks in real-time.

- Thanksgiving Playlist: Create a collaborative Thanksgiving playlist that everyone can contribute to and play during the virtual gathering.

- Share Recipes: Exchange recipes for favorite Thanksgiving dishes in advance so everyone can enjoy the same meal.

- Virtual Photo Booth: Set up a virtual photo booth with Thanksgiving-themed props for a fun and memorable photo session.

- Gratitude Round: Go around the virtual table and have each person share something they're thankful for.

- Keep it Relaxed: Understand that technical issues might occur, and not everything will go perfectly. Embrace the imperfections and enjoy the time together.

Remember, the key is to foster connection and gratitude during this virtual celebration. With a bit of creativity and planning, a Zoom Thanksgiving can be a wonderful way to stay connected with family and friends.

I think ChatGPT did a pretty good job!

Quote: “The month of November makes me feel that life is passing more quickly. In an effort to slow it down, I try to fill the hours more meaningfully.” Henry Rollins

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!