As investors sort out what risks lie ahead for financial markets, one that is undoubtedly on most lists is the 2024 presidential election. It is often said that the thing markets hate more than anything is uncertainty. Not knowing who will be running the country come next January seems like a major uncertainty for the markets.

So, what impact does that have on investment returns? Answer: Historically, it has been positive (or at least not negative). And not just by a narrow margin.

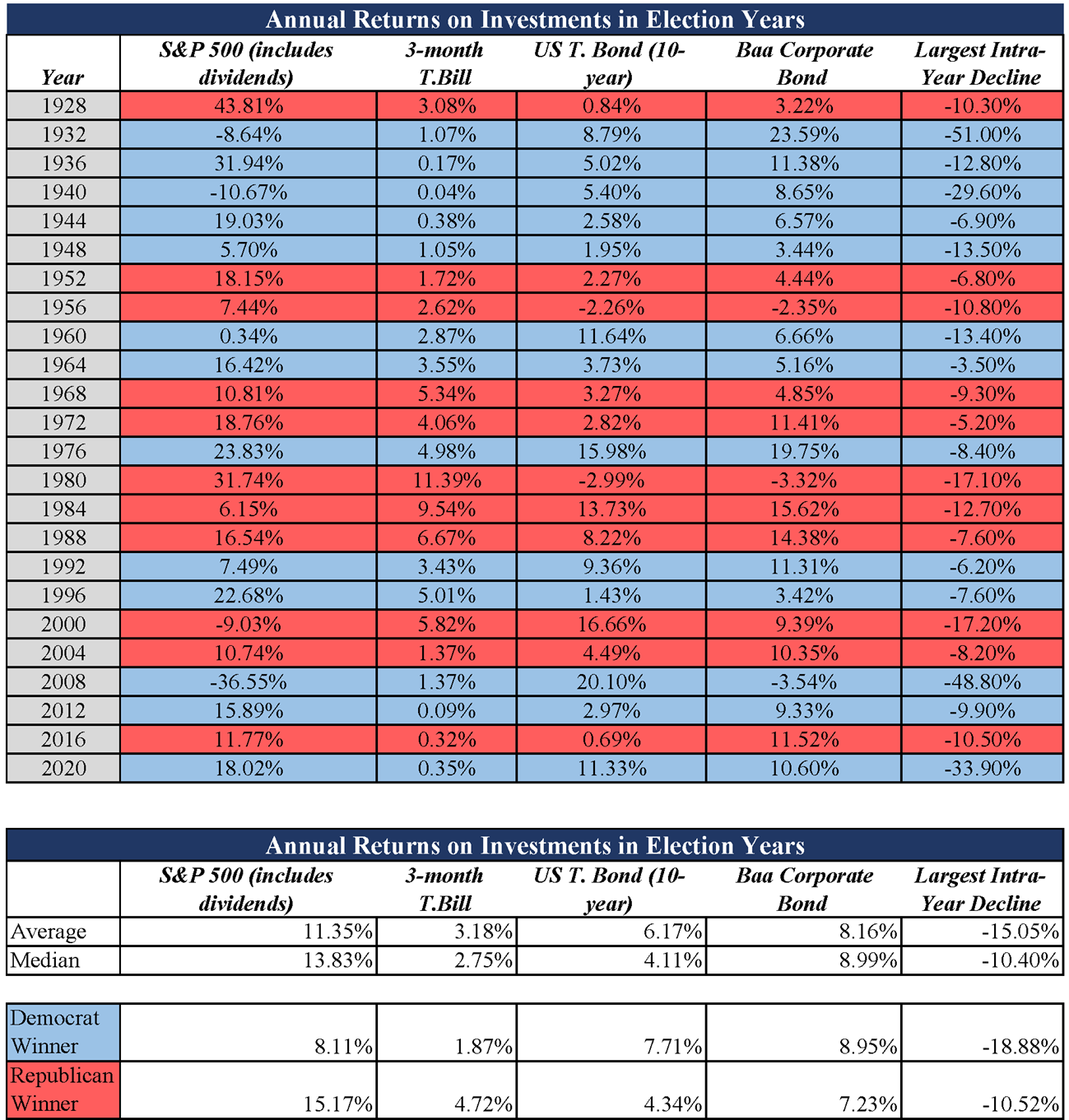

*Historical returns published by NYU Stern School of Business. Red indicates years in which the Republican candidate won, Blue indicates the Democrat candidate won.

Out of the previous 24 presidential election years, only 4 (17%) have accompanied a negative return for the S&P 500. In those particular years, major events were transpiring that likely had a much greater impact than the election – Great Depression, World War II, Dot Com Bubble, & Financial Crisis. Ultimately, the stock market is driven by company earnings. Therefore, economic and inflation trends have historically had a much greater impact than election outcomes.

This doesn’t mean that the election has no impact on markets. As indicated in the “Largest Intra-Year Decline” column, the added uncertainty usually leads to choppiness throughout the year. Reuters points out that election years tend to start out the year with some volatility and it picks up again as Election Day draws closer. Reuters – US Elections Toss Twist At Markets Fixated On Fed, Economy

Bitcoin ETFs Now Live

The long-anticipated Bitcoin ETFs are now here. Last week, the Securities and Exchange Commission (SEC) approved ETFs containing Bitcoin to be listed and traded on major US exchanges. While many of the same risks remain for Bitcoin (high volatility, speculative/uncertain future), this breakthrough will make Bitcoin easier to buy and potentially lower fees for investors. Barrons

RSWA Webinar, Fritz Meyer Replay:

Yesterday, we had the pleasure of hosting economist Fritz Meyer on a webinar where he shared insights on happenings in the economy and financial markets and what that could mean for investors. We appreciate all that joined us. For those unable to join (or would like to watch it again), be on the lookout for a replay link being sent to your inbox, or reach out to a member of the RSWA team to get the link and password.

Financial Planning/Investment Strategy Corner:

Secure Act 2.0 – Updates for 2024: Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act back in December 2022, that introduced changes to retirement savings plans – pushed back RMD ages, lowered RMD penalties, expanded Roth funding options, and more. While some changes went into effect immediately, some were delayed until 2024 & 2025. Here are the updates starting this year: RSWA CNBC

- 529 to Roth IRA transfers – Owners of 529 college savings plans can transfer unused funds in their 529 to a Roth IRA for the beneficiary of the 529 account. Limitations do apply (see our article linked above), but this gives parents/owners of the 529 account an opportunity to kick start their beneficiary’s retirement savings.

- Student debt relief – Companies can now “match” employee’s student loan payments with contributions to their workplace retirement accounts. This helps employees paying off student loans to still participate in their 401k match even though they aren’t contributing to the plan themselves.

- Roth 401ks will no longer have RMD requirements – This change simply aligns Roth 401k rules with Roth IRA rules by eliminating the RMD requirement for owners of Roth assets in their 401k plan.

Quick Hits:

- More conflict in the Middle East – Houthi Rebels attack ships in the Red Sea, US & UK counter with strikes on Houthi-controlled parts of Yemen NBC News Reuters

- After being postponed for months due to the writers’ and actors’ strikes, the Emmy Awards were given out this past weekend. Check out all of the winners here: 2023 Emmy Award Winners List

- Many communities throughout Maine and New Hampshire were faced with flooding after back-to-back storms last week. In the Seacoast, Route 1A and Hampton Beach took the brunt of the impact. The damage caused is pretty staggering WMUR WMUR

- In the market for an EV? Here is how to get the biggest tax break on your purchase: WSJ

Quote: “A plan is only useful if it can survive reality. And a future filled with unknowns is everyone’s reality.” – Morgan Housel, The Psychology of Money

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!