“Earnings season” has started which is when companies begin to report their Q3 2023 earnings. So far, 2023 has not been a great year for earnings, but analysts are expecting companies in the S&P 500 to report year-over-year earnings growth for the first time since Q3 2022. Analysts are not only estimating earnings growth over the last twelve months but over the last ten years companies have beaten estimates by over 6% which could mean earnings could come in even higher. Since investors are forward-looking, analysts will be most focused on what executives are saying about the outlook for earnings next year. FactSet

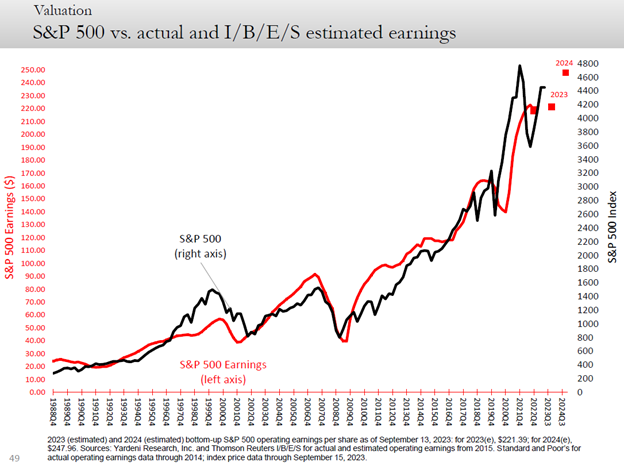

Earnings Drive Stock Prices: The correlation between stock prices and company earnings is well known. Yes, short-term events will always weigh on stock prices but over the long term, earnings are what matter, and stock prices follow earnings as the chart below shows. The chart below has red boxes representing analysts’ estimates of earnings for the full year 2023 and next year. As you can see, there has been little growth in earnings this year but next year earnings are expected to grow 11% - 12% based on analysts’ expectations. Yardeni Research Even if that comes to fruition, it doesn't mean stocks will rise 11% - 12% since other factors come into play such as how much investors are willing to pay for each dollar of earnings (the Price-Earnings ratio or PE ratio), the attractiveness of other investments such as bond yields, and monetary policy of the Federal Reserve. But the good news is if earnings do grow that much next year it will be a positive for stocks.

Social Security 2024 COLA Adjustment: 71 million Americans receiving Social Security checks will see their benefit increase by 3.2% next year. The Social Security Administration ties the Cost of Living Adjustment (COLA) to the Consumer Price Index (CPI) for Urban Wage Earners and Clerical Workers which is calculated by the Department of Labor. The COLA is provided to help the benefit keep up with inflation for retirees who rely on it. The increase for 2023 was a whopping 8.7% which reflected the high inflation experienced at that time. The Fed has been raising rates for over 18 months in the hope of lowering inflation and the lower COLA for 2024 reflects the fact that inflation pressure has been reduced. Kiplinger Social Security

Lower Prices at the Pump? After a surge in prices over the summer, gasoline prices are heading lower. Last week, the average price of a gallon of gasoline was $3.63 which was almost 6% lower than a month ago. Prices spiked high enough over the summer that drivers in the U.S. and Europe cut down on their driving trips to save money. Remote work also offers an option to cut down on driving when gas prices rise. The lessened demand has depressed prices and analysts are expecting the price of gasoline to continue to drop over the next few weeks. WSJ

Financial Planning/Investment Strategy Corner:

The Four Questions to Answer Before Retiring: Last week, we had the honor of hosting retirement expert, Alan Spector, for the webinar “Retirement Beyond the Financials.” He covered many topics during the webinar, including the biggest retirement myths and challenges, but he also reviewed the four questions you need to answer before retiring:

- Do I have enough (money)?

- Have I had enough (of work)?

- Do I have enough to do?

- Do others want me home 24/7?

If you can’t answer yes to the above questions, there is more work to do before taking the retirement plunge. There were many more tidbits of advice and data during the webinar and we have received great feedback from those who attended. If you haven’t received the replay information and would like to watch it, please reach out to anyone on the RSWA team to receive the link. And feel free to share it with anyone who may benefit from the webinar.

Quick Hits:

- The best ways to roast your favorite autumn vegetables: Pocket

- The psychology behind scary movies: Axios

- As sanctions continue to bite, Russia is running out of pretty much everything: Newsweek

- Massage chairs are becoming popular, here are some things to look for and reviews if you’re looking into buying one: VeryWellFit

- Where do the ultra-rich spend their holidays? Visual Capitalist

- How trauma can be a catalyst for personal growth: WSJ

Benefits to Eating Dinner Early? Americans are making dinner reservations earlier than they were before the pandemic. There has been an increase in 5:00 PM dinner reservations at the expense of later reservations at 8:00 or 9:00 PM. According to experts, eating earlier in the evening may lead to better blood sugar control, and weight management, and help you sleep better. Studies show that eating too close to bedtime increases the likelihood of obesity five times. It also leads to an increase in cravings which may be due to changes in appetite hormones caused by the circadian clock which reduces the energy burned after evening meals. So maybe it’s a good idea to bump those dinner reservations to an earlier time. Prevention Axios

The Good and Bad of Exercising Twice a Day: Many pro athletes exercise twice a day but now many non-professionals are doing it too. Many best practitioners will do a hard workout in the morning, such as cardio or weightlifting but later in the day incorporate pickleball or yoga classes for exercise with social aspects or relaxation to end their workday or start their evening. If someone is working the same muscle groups the same day or too often then it can lead to injury or burnout. But if done correctly, it can be a great way to stay fit, and active, and add to your overall well-being. WSJ – Working Out Twice a Day Isn’t Just for Overachievers

Quote: “Running out of meaning is actually more often the problem than running out of money.” Alan Spector commented about the plight of many people lacking meaning during retirement on the RSWA “Retirement Beyond Financials” webinar last week.

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!