Companies are reporting 2022 Q4 earnings and, so far, the news is not that bright. As earnings are announced, it is causing some major moves in individual company prices and the market as a whole. Inflation and a slowdown in consumer spending are negatively impacting the bottom line of many companies. Analysts are predicting an earnings contraction of approximately 3.5% for Q4. Last year back in June, the forecast was for 8.5% earnings growth for Q4, so the double-digit reversal shows just how quickly things have changed for the economy. Since June, the Federal Reserve has raised rates precipitously and consumers have become more cautious about spending. AP News

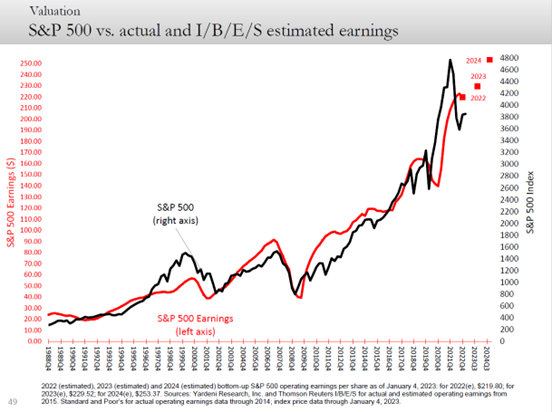

Company Earnings Drive Stock Prices: We like to pull out the chart below now and then to remind investors that earnings drive stocks. Period. Over the short-term, daily news, geopolitical events, and new legislation, all impact the daily or weekly movement of stocks. But long-term, it all comes back to the big E - earnings. The chart shows how earnings went stratospheric during the pandemic as homebound consumers spent and generous government handouts supported the spending. Stocks followed those earnings higher. As inflation has taken its hold and the Federal Reserve raises rates to slow the economy, stocks are following accordingly. Analysts are still expecting full-year 2023 earnings to be higher than 2022, and 2024 earnings to be higher still. Yardeni Research, Figure 23, Slide 17

Big Layoffs – It’s a Tech Thing: It seems like a day doesn’t go by without hearing about another tech company announcing sizeable layoffs. That must be an omen for the overall economy, right? Well, maybe not, at least, not so far. Technology companies went on a hiring boom during the pandemic. They now seem to be reversing those recent hires. Firms outside of tech in finance or even conglomerates have also started announcing layoffs, but they are much more modest than tech layoffs and represent a much smaller portion of the companies’ workforce. Mostly the large layoffs are contained to technology. The Federal Reserve is focused on the low unemployment rate and the potential for wage inflation, and layoffs might prevent high wage inflation. But the technology sector only represents about 2% of overall employment. As employment numbers roll out in the ensuing months we’ll see if the layoffs are keeping a lid on wage growth. Axios AOL

Fed Meets Next Week: The Federal Open Market Committee (FOMC) meets next week and will discuss monetary policy. The markets expect a short-term rate hike of .25%. At the last meeting in December, the FOMC raised rates by .50% after raising them by .75% at the four previous meetings before December. If the Fed follows through on a smaller rate hike for the second meeting in a row, it may signal that we are getting close to the end. But we will have to see the Fed's comments after the meeting to determine if the end is nigh for rate hikes. Yahoo Finance

Financial Planning/Investment Strategy Corner:

Tax Returns Could Be a Bit Smaller This Year: Some pandemic-era tax breaks are expiring which may lead to lower tax refunds for some tax filers. The enhanced child and childcare tax credits along with an additional deduction for charitable giving are all expiring. Some items may help tax filers such as buying an electric vehicle, but if you rely on your tax return for some spending, be prepared it could be a little less this year. Axios

Help/Hug An Accountant This Tax Season: For those that use an accountant, get them your tax information and paperwork as soon as possible. The number one complaint we hear from the accountants we work with is that they struggle to get their work done because they are waiting for paperwork. We help clients and accountants by facilitating the tax paperwork exchange, hopefully making the processes smoother and reducing the end-of-tax season crunch. Personally, I don’t think we appreciate accountants enough. They handle the thankless task of deciphering the complex tax code and making sense of it for those of us who don’t want to file our taxes ourselves (including me). So, hug your accountant this tax season - just watch the pocket protector.

Cash is King: I have heard the phrase, cash is king, for decades. It really is king when you have an emergency and need cash fast. We work with clients to have an appropriate emergency fund so it's there when they need it. But we are fielding questions from clients on where to invest those funds now that interest rates are higher. If funds are in a low-interest-bearing checking account, sometimes a financial institution will have a higher-yielding savings or money market account. A lot of money markets are paying rates annualized at 4.00% or even higher. Keep in mind, savings and money market rates fluctuate with short-term interest rates so these rates can change. You will also want to check any other terms for investing in them. Certificates of Deposits (CDs) are another option though but they have to be held for a certain amount of time or there is a penalty for withdrawing early. But CDs could still be an option. If you have a lot of cash you are sitting on, look around for options to get the best rate you can. It’s good to be the king! WSJ Schwab Money Market Funds

Quick Hits:

- Holed up for winter? Here are some books and shows to get you through: Barnes & Noble – Best New Books January 2023 The Wrap – Best New Shows to Stream in January 2023

- In the future, planes may be powered by sustainable fuels, or even the air itself: NYT

- A happy memory can help you fall asleep: WSJ

- People love chocolate, because of how it melts in your mouth: Healthline

- Bill Gates is very optimistic about the future and thinks those born 20 years from now (and further out) will be better off than those today. Charlie Munger agrees and thinks people complain too much: CNBC – Bill Gates CNBC – Charlie Munger

- Five things to learn about coffee, including don’t drink it first in the morning, and sipping it a little at a time like those living in the Blue Zones may be helpful to maintain energy throughout the day: Well + Good

Who Has Five Minutes to Walk? Many of us have jobs in which we sit every day for hours on end (such as when writing a weekly newsletter!). But sitting too much is bad for our health. Standing desks can help as can periodic breaks. But one study demonstrated that just walking five minutes every half hour significantly lowered blood sugar and blood pressure. A little bit adds up. Even if you walk five minutes every hour that’s 40 minutes of walking a day. Add a 15-minute walk at lunch and you are almost at an hour of walking for the day. Let’s get moving! Healthline

Quote in Honor of the 2023 Lunar New Year: “Wealth and rank are what man desires, but having contentment is the greatest wealth and highest rank." Confucius

.png?width=418&height=276&name=FAI%2001.27.23%20(2).png)

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!