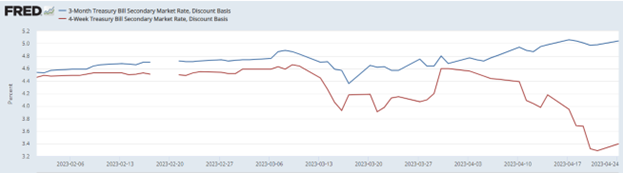

When will we hit the debt ceiling? That is the question everyone is asking. Now that the tax deadline has passed, it looks like we may hit it sooner than originally anticipated. Tax receipts were weaker than expected, some estimates say that the 2023 tax receipts were 35% lower than 2022. It was expected for them to be lower but not by that margin. Originally, many were estimating that we would hit the debt ceiling sometime in August and now it looks more like June. The US bond market is illustrating the worry that the Congressional debt ceiling negotiations are causing. The 1-month and 3-month Treasury bills usually track each other closely but they have diverged to the largest gap of all time. The two charts below show this. The first is the 1-month Treasury compared to the 3-month Treasury over the last 10 years. The red line is the 1-month, and the blue is the 3-month. You can see how correlated the two are. You can also see the large difference in the last couple of weeks. The second chart is a closeup, showing the same data from February 1st to April 24th of this year. What does this indicate? Treasuries are usually considered one of the safest investments to own. And when there is instability, money flows into Treasuries often reducing the yield. The 1-month Treasury is showing this, but the 3-month is not, in fact the 3-month yield has risen indicating that the market thinks the 1-month is safe, but the 3-month might not be as safe. The Hill (msn.com)

The debt ceiling negotiations are heating up in Congress and will continue until the debt ceiling is raised. What we don’t know is when that will happen and what each side will get/give up making sure the US doesn’t default on its debts. I am sure that we will be writing about this topic many more times over the next few weeks – so stay tuned. (axios.com) Reuters

Financial Planning/Investment Strategy Corner:

Market Timing: After the year we had in the markets in 2022 and the uncertainty we are facing, the idea of market timing is getting some press. We do not believe in market timing. We believe that the best way to invest is to have an asset allocation that aligns with your goals and your risk tolerance and to stick with it. An adjustment to your asset allocation should be driven by where you are in your financial life cycle. An example is that many will reduce their equity exposure as they near retirement because the time before they are going to need to withdraw funds is shorter. There have been some interesting studies on market timing. One by JP Morgan shows that if you missed the 10 best market days over the last 20 years, your returns would drop from 9.4% to 5.21%. And that in the past 20 years 7 of those best days happened within about 2 weeks of the 10 worst days. The case for (always) staying invested (jpmorgan.com)

Generational Risk Tolerance: I am not a social scientist – but things like this always interest me. How the different generations think, act, and invest is being studied like everything else. And you can understand if you look at the history of the markets why Millennials might be more fearful than the older generations. If the only recession (other than the flash recession of the pandemic) was the Financial Crisis of 2008/2009, you may be less likely to be willing to ride out the markets. And the studies are showing this is true. Fearful Millennials Missed Stock Market Rally With Shift to Cash | The WealthAdvisor

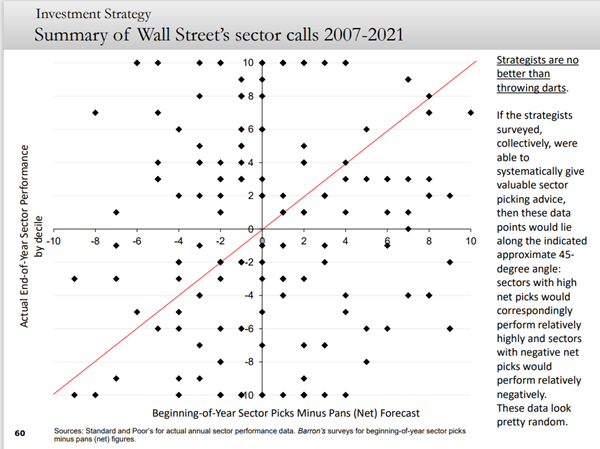

One More Market Timing Note: One of my favorite slides from Fritz Meyer’s endless deck of slides is the comparison of how the best and brightest minds on Wall Street do each year when choosing which sector will outperform the market. This graph shows the sector picks from 2007-2021. If the picks were accurate, they would all line up along the red line. What you see is the best and brightest not even coming close to being able to pick the sector that will outperform.

Quick Hits (Food Edition – maybe I’m hungry?):

- I have to admit, I don’t like salmon, but I will be making these for my husband. These air fryer salmon bites are so easy and tasty, even kids love them | TechRadar

- I am definitely trying this - I love pickled anything. baby wedge salad with avocado and pickled onions – smitten kitchen

- Check out the MLT! It might be the creamy beet pesto that makes me curious. 13 Delicious Sandwich Recipes (getpocket.com)

- I completely agree with this list! Essential Kitchen Gear and Tools You Need Two (or More) Of (seriouseats.com)

- UMaine and Blueberries! Wild Blueberry Research and Innovation Center - UMaine News

End of Life Planning: As financial advisors, we try to help our clients plan for all the parts of their financial life. This includes the joys and the sorrows. Our hope is that we can help minimize the financial anxiety that comes with both. The joys of life can be fun to plan for, but just as important is the planning for the sorrows. End of life planning can consist of estate planning: what is going to happen to your assets, who will take care of your loved ones, and who will make your decisions when you no longer can. It can also include the planning of how you would like to experience the end of your life. This is not a conversation we are all comfortable having but these articles might help. End-Of-Life Doulas | HuffPost Life End-Of-Life Workers | HuffPost Life

One Short Travel Note: Out of the 16 weekend getaway locations in this article, 5 of the 6 New England states are included. And Sarasota too! 16 Best Cities For A Weekend Getaway In The U.S. That Are Totally Unexpected (timeout.com)

Quote: I have always loved this quote, “I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.” Maya Angelou

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!