Back in the early 90s the U.S. fiscal deficit hit a then-record $290 billion (those were the days!). It was headline news and Ross Perot, an independent third-party presidential candidate in 1992, running his campaign almost solely on the theme of reducing the deficit, captured a surprising 19% of the vote. Institutional bond investors voted with their wallets, demanding higher yields for their bond purchases, and were deemed “bond vigilantes.” As a result, bond yields skyrocketed. Unless the federal government became more fiscally responsible, those higher yields would be the price to pay for issuing new bonds and make the deficits even larger and more difficult to reduce. Administrations got the message, tightened their belts, and not only were deficits reduced but by the end of the decade there had been some budget surpluses. For many years administrations feared the bond vigilantes. They were so feared and powerful that Bill Clinton‘s adviser James Carville once said he would like to be reincarnated as “the bond market.” After the Great Financial Crisis, bond yields dropped precipitously for over a decade, and even with very large federal budget deficits, the bond vigilantes were nowhere to be found. WSJ

But a couple of months ago bond yields started climbing. And climbing. And climbing. In mid-July, the 10-year U.S. government bond yield was 3.75%. This past Wednesday morning, the yield stood at 4.88%, a 30% increase in yield. Yet there was almost no data that strongly suggested yields should move higher, including inflation (more on that later). So, are the bond vigilantes back?

Several factors may be fueling the rapid rise in yields. The Federal government announced auctioning a large number of bonds recently and the recent Congressional budget deal keeps spending levels elevated. The U.S. dollar has also been rising versus foreign currencies and there are rumors some countries may sell U.S. bonds to buy the home currency to rebalance them. So the markets are contending with a lot of supply of U.S. Treasuries with possibly more to come.

As for buyers, they may be on the sidelines. The Fed talks about keeping short-term rates higher for longer and possibly adding another rate hike in November. With the Fed-Funds rate range at 5.25% - 5.50% and possibly going higher, many investors have decided to buy short-term bonds and sit tight until receiving a better offer from long-term bond yields.

Lastly, with higher bond yields, markets have become more volatile. The stock market in particular has reacted very negatively to higher yields. In a more volatile environment, investors may be asking to be compensated more since short-term rates offer a viable alternative. Some say the bond market is too big now for bond vigilantes to hold sway. But in light of what is currently happening, it appears the bond vigilantes may be trying to make a comeback. Bloomberg Reuters WSJ

Core Inflation In Check? The Personal Consumption Expenditures Price Index (PCE) is the inflation metric favored by the Federal Reserve. The August reading was an increase of 0.1% for the month. If the last three months’ PCE-Core price increases are annualized it comes in at 2.2%, which is slightly above the Fed’s target of 2.0%. Granted, overall inflation was higher due to energy prices increasing, but it may be that core inflation has returned to a more normalized value. Axios

Congressional Update: The government shutdown was averted for another month and a half, but the Majority Leader of the House is gone. One will have to be found before budget talks resume.

Frontrunners Quickly Emerge to Replace McCarthy – Greg Valliere

RSWA Webinar October 12th at 5:00 PM – Retirement Beyond the Financials: RSWA will be hosting retirement expert Alan Spector as he discusses retirement’s challenges, myths, and opportunities. He will also present his 10 Secrets for Creating and Living a Fulfilling Retirement. We are looking forward to this very popular presentation and it is open to everyone so please share the link with anyone interested. If you haven’t received an email invite, please reach out to anyone at RSWA and we will get one to you.

Financial Planning/Investment Strategy Corner:

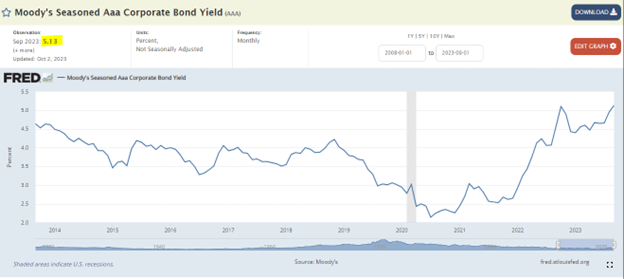

Yields Are Back: As mentioned above, the 10-year U.S. government bond is yielding approximately 4.80%. It has been over 15 years since government bond yields were this high. Despite the recent history and political dysfunction, U.S. government bonds are considered a “riskless” asset due to the strong financial position and political stability of the U.S. government (please play along and don’t send angry emails!). But there are other bonds in the markets, especially those by highly rated companies, many of which have been around for decades or even over a century. What are these bonds paying? For the highest-rated companies, it is about 5.13% (see the yellow highlight in the chart):

The yield is only slightly higher than government bonds because they have very strong balance sheets with little chance of default. But there are only two companies rated this highly: Johnson & Johnson and Microsoft. Bing Search There are so few because investors prefer companies to spend capital to increase earnings and revenue rather than keeping a lot of cash on the books.

Many other companies fall in the highest tier of corporate ratings which is called “investment grade.” They are not as highly rated as JNJ and MSFT but they still have strong balance sheets. The lowest tier of investment grade is BBB and those company bond yields are approximately 6.57%, which is much higher than government bonds (see the yellow highlight in the chart):

The BBB companies do have a higher chance of default so investors have to be more careful and balance the risk trade-off for higher yield. But the point of all this is that yields have increased dramatically for bond investments. At RSWA, while we opportunistically buy U.S. Treasury bonds we also buy diversified bond portfolios in mutual funds and ETFs that invest in corporate bonds to take advantage of some of the greater yield opportunities now being offered in the markets.

Quick Hits:

- Five hacks for living to 100: Axios

- Depending on your return, how long does it take to double your money? Visual Capitalist

- How to reduce or stop your junk mail forever: Wash Post

- Did you know the amount of money consumers charge to the Delta Airlines AMEX cards is almost 1% of the country’s GDP? Are airlines really credit card companies that offer flights? Fast Company

- It’s fall produce time, so enjoy these pumpkin recipes: NYT-Cooking

- What are the best wines under $20 for fall 2023? Outside the Wine Box

The New Science on Making Habits Stick: Trying to change a sleep, nutrition, or exercise habit is easy for a day but tougher over time. Recent research is uncovering how long it takes a new habit to form. Something simple like washing your hands more may only take a couple of weeks, but more complicated habits, such as consistently going to the gym, may take four to seven months. But the key to making a new healthy habit stick is to make it simple, repeatable, flexible, and fun. Another key is to set the right expectations, such as you may feel worse when you first start before the benefit kicks in and your body adjusts. WSJ

Quote: “Anger is an acid that can do more harm to the vessel in which it is stored than to anything on which it is poured.” Mark Twain

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!