Investors have been patiently (some not so patiently) waiting for their investments to return to and rise above previous levels. For many assets across the investing universe, that wait is finally over.

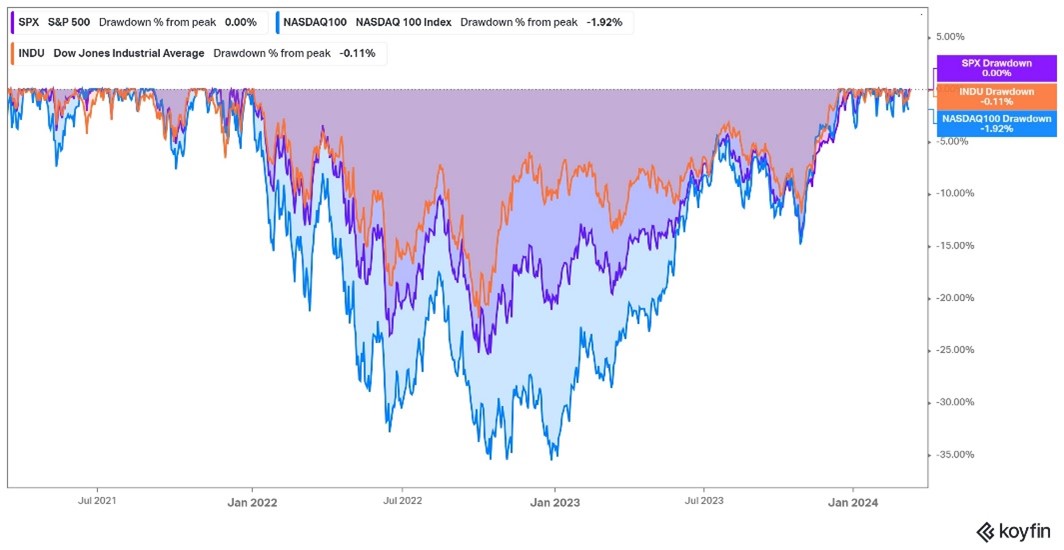

US Stock Indices

After a rough 2022, all three major US Large Company indices (S&P 500, NASDAQ 100, & Dow Jones) reached new all-time highs in mid-January 2024. Markets have climbed steadily to start 2024, keeping pullbacks from those highs to a minimum so far.

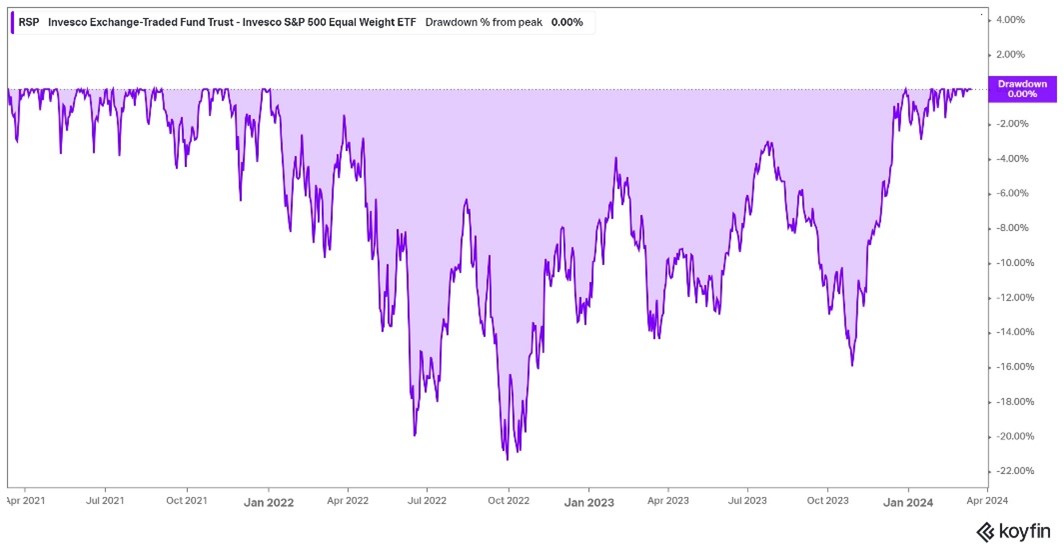

A lot has been said of the giant tech stocks carrying the market on their shoulders, but even the S&P 500 Equal Weight Index, which gives each company an equal representation in the index, is at its all-time high. This shows that the other 493 stocks outside of the “Magnificent 7” have started to participate more in this rally.

A lot has been said of the giant tech stocks carrying the market on their shoulders, but even the S&P 500 Equal Weight Index, which gives each company an equal representation in the index, is at its all-time high. This shows that the other 493 stocks outside of the “Magnificent 7” have started to participate more in this rally.

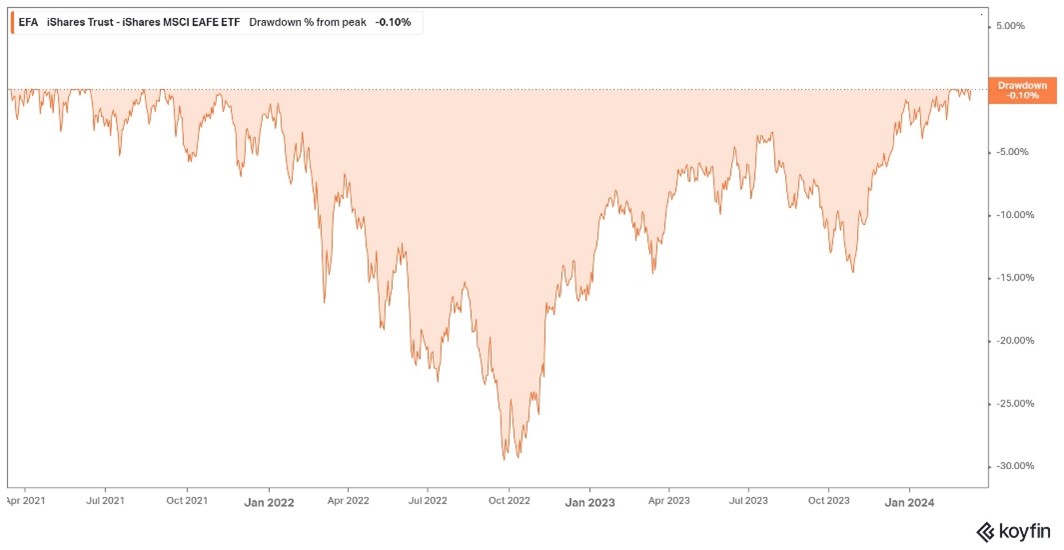

International Markets

US markets aren’t the only ones enjoying new all-time highs. International developed markets, represented by the MSCI EAFE (Europe, Australasia, & Far East) Index, reached their highest point in mid-February.

US markets aren’t the only ones enjoying new all-time highs. International developed markets, represented by the MSCI EAFE (Europe, Australasia, & Far East) Index, reached their highest point in mid-February.

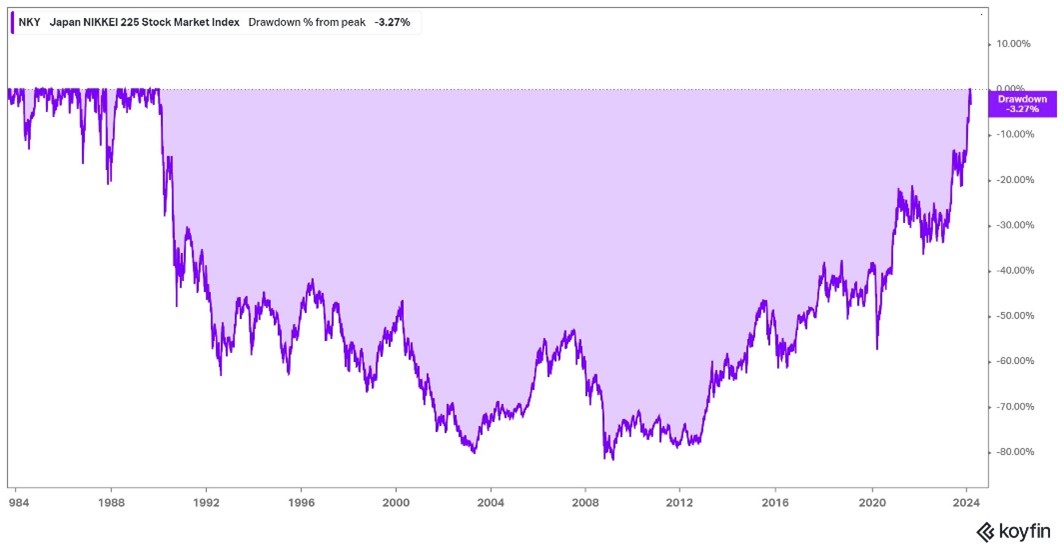

This one may be the most fun to look at. Japan’s NIKKEI Index, last hit an all-time high in 1989(!!). Last month, it finally broke through that barrier after over three long decades.

This one may be the most fun to look at. Japan’s NIKKEI Index, last hit an all-time high in 1989(!!). Last month, it finally broke through that barrier after over three long decades.

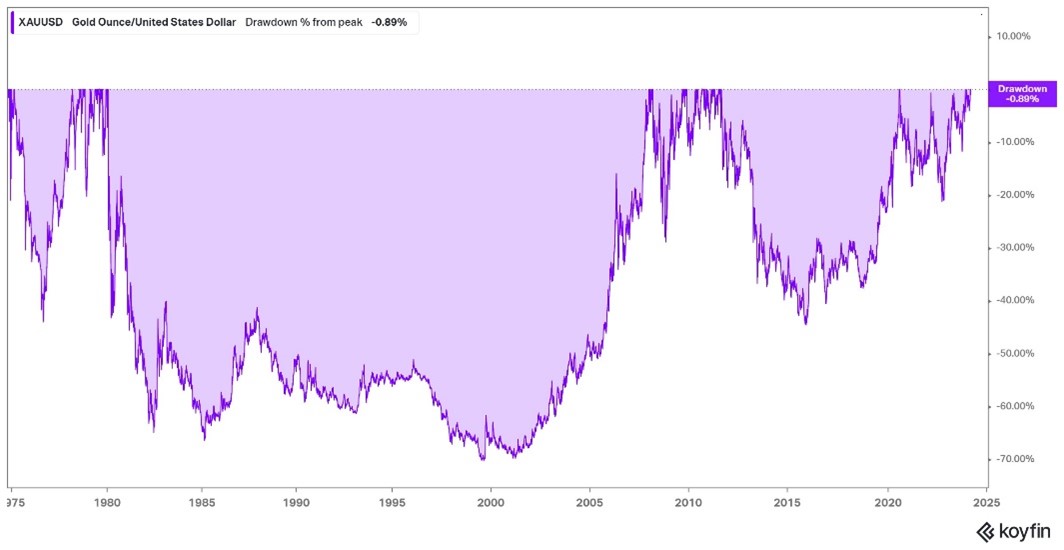

Gold & Bitcoin

Stocks aren’t the only asset class enjoying fresh highs. Gold, usually known more as a hedge against inflation and economic uncertainty, is rallying alongside the other asset classes. Gold experienced a brief high in 2020, but you really have to look back to the early 2010s to find its last sustained peak.

Stocks aren’t the only asset class enjoying fresh highs. Gold, usually known more as a hedge against inflation and economic uncertainty, is rallying alongside the other asset classes. Gold experienced a brief high in 2020, but you really have to look back to the early 2010s to find its last sustained peak.

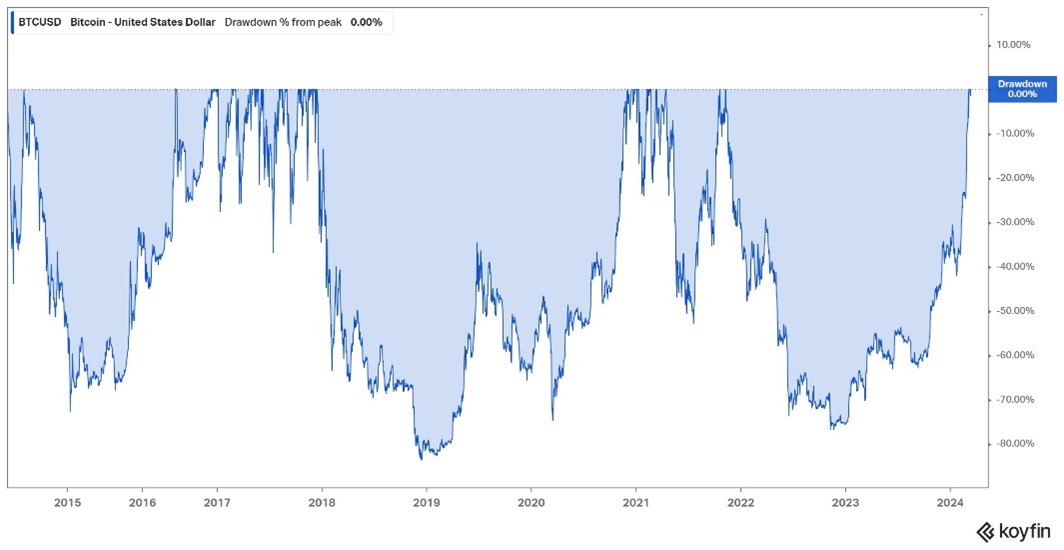

I have to mention it. Bitcoin is back at its highest value after its second 70+% drawdown in 5 years. I personally still don’t know what to think about the “asset class” but it is hard to argue against the resiliency it has had.

I have to mention it. Bitcoin is back at its highest value after its second 70+% drawdown in 5 years. I personally still don’t know what to think about the “asset class” but it is hard to argue against the resiliency it has had.

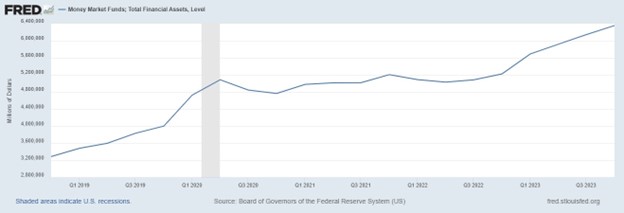

Money Markets Funds

Lastly, while investors across the globe seem to be pretty comfortable taking risks at the moment, the amount of assets in money market funds keeps rising steadily as well.

*Disclaimer: Yes, I conveniently left out some asset classes not at all-time highs: emerging market stocks, US small cap stocks, US bond indices, & more. Not everything can be at a high all at once, unfortunately.

Financial Planning Corner:

HSAs – The Under Loved Savings Plan

Health Savings Accounts came onto the scene in 2003, but despite being around for 20+ years, they have failed to reach the same level of appreciation and adoption as their saving vehicle counterparts (401(k)s, 403(b)s, IRAs, etc.). This is quite unfortunate, as they provide some of the best tax benefits and flexibility.

To be eligible to contribute to an HSA, an individual must be covered under a high-deductible health plan, have no other health coverage, not be enrolled in Medicare, and not be claimed as a dependent on someone else’s previous year’s tax return. This does shrink the number of individuals who can participate, but if you do meet those criteria, an HSA could be a good option.

A few key benefits HSAs provide:

- Tax savings - HSAs are triple-tax-free, meaning an individual doesn’t pay tax on the money when they contribute, the gains grow tax-deferred, and withdrawals are tax-free if used for qualified medical expenses.

- Flexibility – You have control of the amount you contribute, there are no required minimum distributions in retirement, and the funds can be used for a wide range of medical expenses.

- Check out our blog article for a full list of benefits, strategies, and 2024 contribution limits: Health Savings Accounts (HSAs) – More Than Just Health Savings

Contributions to an HSA can still be made for the 2023 tax year until April 15th. For 2023, individuals can contribute $3,850 ($7,750 for families), and individuals aged 55 or older can contribute an additional $1,000. Speak with your advisor or tax preparer to see if an HSA makes sense for your plan!

Quick Hits:

- We Still Don’t Believe How Much Things Cost – Although the rate of inflation has slowed, Americans still can’t wrap their heads around higher prices WSJ

- Need Saint Patrick’s Day plans? – Here are some things going on in the Portland area Portland Press Herald and across New Hampshire NH Magazine

- The Health Benefits of Guinness – So you don’t feel bad about that Guinness you have on Sunday Liz Earle Wellbeing

Tiny Home Village to Tackle Raising Housing Costs – Last month, I had the pleasure to meet and hear from Maggie and John Randolph, who are building an affordable housing community in Dover, NH. On a lot that was originally slated to be subdivided for 7 houses, they are building 44 free-standing one-bedroom tiny houses that include all essential amenities (even space for a washer & dryer). Perhaps the best part is the affordability. Rents will be capped at 30% of a full-time employee’s pay and are designed for individuals in transition from “traditional” apartment living to eventual home ownership. Business Insider NH Business Review

Quote: "Only Irish coffee provides in a single glass all four essential food groups: alcohol, caffeine, sugar, and fat." – Alex Levine

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!