2023 provided a salve for investors after a bruising 2022 which saw both stocks and bonds drop precipitously. Many of the sectors that were hit hardest in 2022 rebounded strongly and vice versa. Here is a recap of returns for different segments of the market for 2023:

Stocks:

- Dow Jones Industrial Average - +16.0%

- S&P 500 - +24.5%

- Nasdaq (tech-heavy index) - +44.3%

- Russell 2000 (small companies) - +15.1%

- Ex-US International Developed Markets - +17.91%

- Emerging Markets - +11.9%

Bonds:

- S. Aggregate Bond Index – +5.31%

- S. Aggregate Muni Bond Index - +5.56%

Other Sectors:

- Real Estate Stocks - +11.7%

- Commodities – (-7.91%)

- Oil (also included in the commodities index) – (-7.3%)

- Gold (also included in the commodities index) - +11.4%

2023 – The Year of Surprises: Many economists predicted that the U.S. would go into a recession in 2023. In Q1, inflation was raging, some of the biggest U.S. and foreign bank failures in history occurred, and it looked like they were right. But the economy kept growing, inflation abated, and no recession occurred. In U.S. markets the “Magnificent Seven” group of stocks (Amazon, Apple, Nvidia, Microsoft, Alphabet, Tesla, and Meta) were up an astounding 97% and contributed nearly half of the stock market’s overall gain. But even investors wanting the safety of Treasury Bills, money markets, or CDs were rewarded with returns of up to 4.5%+. Overall, 2023 provided many surprises but in the end, it was a great year for most investors.

Expectations/Predictions for 2024:

A Slowing But Growing Economy: Many economists are expecting the economy to grow but more slowly than last year. Still, this view supports a “soft landing” for the economy meaning that recession will be avoided. Most experts believe the economy will grow from 0.5% to 2.1%. Goldman Sachs OECD

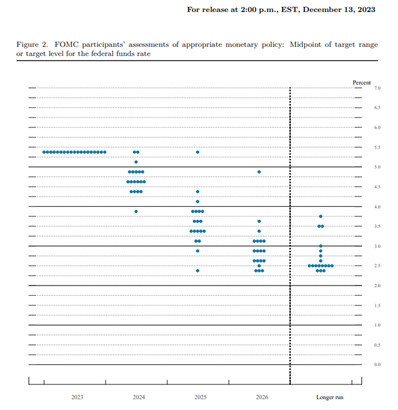

The Federal Reserve Starts to Cut: Most market watchers expect the Federal Reserve to cut short-term interest rates 3-4 times next year. But don’t take their word for it, the rate-setting committee itself expects to cut rates with most members thinking 2-4 rate cuts (see chart below). If inflation growth continues to moderate (as expected), the Fed will start to cut rates to avoid dampening the economy, which will affect investors, savers, and borrowers (more on that later).

Company Earnings Expected to Grow: Analysts are expecting S&P 500 companies to have revenue growth of 5.5% and earnings are expected to grow 11.7%. All eleven sectors are expected to have earnings growth. Earnings drive stock prices though it does not mean stocks will be in lockstep if the earnings grow as expected, but it is a good sign for stocks. Factset

Company Earnings Expected to Grow: Analysts are expecting S&P 500 companies to have revenue growth of 5.5% and earnings are expected to grow 11.7%. All eleven sectors are expected to have earnings growth. Earnings drive stock prices though it does not mean stocks will be in lockstep if the earnings grow as expected, but it is a good sign for stocks. Factset

Oil and Gasoline Prices: The price of oil dropped in 2023 which is surprising given that the world avoided recession and continued to grow. But China drives a lot of global energy prices and their economy limped along. Paired with the fact the U.S. had record oil production and the supply-demand balance favored falling prices. At least one analyst believes gas and oil prices will remain low. MSN

Mortgage Rates Will Drop: As if the lack of housing supply wasn’t enough, 30-year mortgage rates rose to 8% or higher for homebuyers. Fortunately, those rates have started to drop and stand at about 6.90% today. Experts believe the rates will continue to drop and could reach as low as 6.0%. More supply will still have to be created to give those looking to buy a home some relief, but lower rates are a start.

Financial Planning/Investment Strategy Corner:

2024 Lower Interest Rates Coming – Have a Plan: As mentioned above, short-term interest rates are expected to go lower this year. If it occurs, then yields tied to short-term rates will start to drop, such as in CDs, Treasury Bills, and money markets. It’s been easy to sit and wait in high-quality government-backed “riskless” investments earning 5%. This occurred while inflation dropped below 3% thereby earning 2% above inflation (called the real return). Within a couple of years, there is a good chance the short-term investments will yield little if any, return above inflation. Investors should decide how much they ultimately want in their “safe” or emergency fund balances and put together a plan for what to do with the rest. This is especially true for those who hold CDs, which typically roll over into a new CD if the investor doesn’t notify the bank not to buy another one. As a reminder, many investors bought Treasury I – Bonds which will adjust to inflation and will adjust down as inflation drops so be sure to keep an eye on them. On the other hand, borrowers who have been hit by high rates in the last couple of years may have the ability to refinance or lower their borrowing costs. Mortgages, HELOCs, and credit cards may all have lower rates soon, and borrowers should be on the lookout for savings. If you have questions about any of your investments or loans that may be affected in 2024, reach out to your advisor.

Quick Hits:

- 89 hearty soup recipes to keep you warm this winter: Bon Appétit

- How to thrive if you experience imposter syndrome: Psyche

- If you plan on traveling to Europe in 2024, you may need to apply for a new document: Forbes

- Travel ideas for 2024: Conde Nast Traveler CNN Travel

- Here is an interview with Thomas Friedman, one of the foremost experts on the Middle East, and his insights into the conflicts occurring there (we realize Charlie Rose is a controversial figure, but due to the importance of the topic, we have decided to include the interview link in the newsletter): Charlie Rose

- Share and cultivate cozy the Dutch way this winter which they call gezellig: Axios

What “Dry January” Does to Your Body: It is estimated that 15% - 19% of U.S. adults have participated in Dry January in recent years. There is a good chance you may start by feeling worse, not better, but that also depends on how much you normally drink. For the first few days, you can be irritable or depressed because alcohol decreases the levels of stress hormones, but they may rebound after you stop drinking. But most people will start to feel better after a few days, and the benefits include being more hydrated, which reduces headaches and fatigue, plus it can improve your skin. Furthermore, it may reduce harmful free radicals in your blood, which can lower your cholesterol, and improve your heart and liver health. Some research also shows that after a Dry January, drinkers tend to drink less even six months later. Be sure to check with a health professional if you have any questions about going dry.

NYT - What Are the Health Benefits of Dry January? WSJ - Your Guide to Drinking (or Not Drinking) in 2024

Quote: “We spend January 1st walking through our lives, room by room, drawing up a list of work to be done, cracks to be patched. Maybe this year, to balance the list, we ought to walk through the rooms of our lives… not looking for flaws, but for potential.” Ellen Goodman

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!