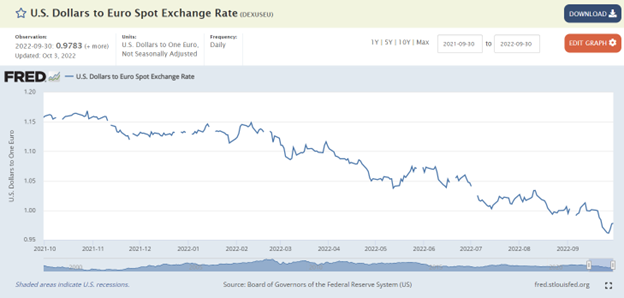

Dreaming of a European vacation? If so, now may be the time to go as much of the world is on sale. The U.S. dollar is the strongest it has been in 20 years and that means almost everything is cheaper for overseas American travelers in dollar terms. For example, the average pint of beer in a British pub costs about four British pounds. The Guardian A year ago, after converting to dollars, the pint cost a U.S. tourist the equivalent of about $5.60. Today, it is about $4.52, which is about 20% cheaper than a year ago. And the savings just don’t apply to beer but any costs in the country, such as hotels, trains, cabs, rental cars, museum tickets, etc. The same goes for the European Euro and the Japanese Yen. All are down about 20% to the dollar and the chart below displays how over the last twelve months, the Euro exchange rate has fallen versus the dollar. So, book those overseas trips now and lock in the rates. MarketWatch Bloomberg

Why the Strong Dollar: There are a few reasons why the U.S. dollar has strengthened against other currencies. A big reason is global investors. The U.S. started raising interest rates faster than other developed countries. Therefore, dollar-denominated cash and bond investments are yielding more than many other developed countries. Also, due to the size of the economy and stability of the country, dollar-denominated assets are seen as a safe haven during economic and geopolitical uncertainty – and we have had plenty of that this year. For these reasons, global investors have been piling into U.S. bonds and in the process selling their home countries' currency and buying dollars, thereby driving up demand for dollars. BBC

The Ripple Effect of a Strong Dollar: Winning along with international travelers are American consumers as U.S. companies import cheaper goods from overseas such as raw materials, energy, and possibly even televisions and European food and wine. Lower prices should help the U.S. with inflation. What are the downsides? Any U.S. companies that export goods overseas will either have to raise prices or lose profits if they receive 20% less in dollars in the currency conversion of the sale. This can hurt many U.S.-based multinational corporations which report earnings in dollars. And the U.S. tourist industry can expect fewer travelers from abroad because costs will be 20% higher for foreigners to visit. Lastly, a very strong dollar hurts many other countries. Most commodities are priced in dollars since it’s the world’s reserve currency. For example, even with the price of oil skyrocketing earlier this year, most countries are paying an additional 20% premium on top of that to buy the oil in dollars – ouch! This applies to many raw materials and food as well. And many emerging countries have bonds priced in dollars and those interest payments are more expensive now too. The ripple effects are many and if the dollar continues to rise, it could destabilize many countries or industries which, at some point, negatively impacts the U.S. economy. NPR

The Fed is Starting to Take Flak for Aggressive Tightening: The Federal Reserve has made no bones about the fact it will do everything in its power to bring down inflation even if it causes pain. But there have been signs of the economy slowing, such as September's Manufacturing Purchasing Managers Index which came in at the lowest reading since the early days of the pandemic at 50.9. PR Newswire Any reading above 50 means manufacturing orders are expanding and any below means they are contracting. The latest report shows U.S. manufacturing is barely growing. Economists believe it takes 6-12 months to receive the full effect of rate increases so the most recent hikes have yet to hit the economy. With economic growth slowing in the U.S. and around the world, this has caused some to start criticizing central banks and the Fed to slow down the hikes, including the United Nations (WSJ), and a very prominent and animated professor Jeremy Siegel. CNBC

Big Start to October, But…: Due to the manufacturing report both the stock and bond market rallied big to open the fourth quarter which came on the heels of a horrific end to September. We have had volatility in the stock and bond markets all year with some months being down big and other months being way up. We’ve said it before and will state it again, investors should expect that volatility will remain until the data shows broad declines in inflation. Our next snapshot on inflation will be next week when the September inflation numbers are reported.

Financial Planning Corner:

Health Savings Accounts – Triple Tax-Free Beauties: If you are covered by a high-deductible health insurance plan, you may have the ability to contribute to a Health Savings Account (HSA). These are the only investment vehicles in which contributions are tax-deductible, assets in the account grow tax-free, and withdrawals are tax-free if used to pay for eligible health care expenses. And, if you are over the age of 65 you can use an HSA like a retirement account and take withdrawals for non-medical expenses but you do have to pay income tax on the withdrawals. For 2023, individuals can contribute $3,850 (plus an additional $1,000 for those over 55) and families can contribute $7,750. If you have questions about HSAs, please contact your advisor. WSJ

Quick Hits for the Week:

- How to make and keep friends in adulthood: NYT

- To combat the labor shortage, virtual cashiers based in South America, Pizza ATMs, and robots making coffee are in Toronto and may be on their way to the U.S. soon: NPR Planet Money

- Here are 7 tips to declutter your life: NYT – Wirecutter

- October may be the best time to get the flu shot and COVID booster and info on how long booster immunity lasts: ABC News HuffPost

- Which countries drink the most beer per capita? Hint: The U.S. isn’t even in the top 15: VisualCapitalist

How to Get Rid of Knots in Your Neck, Shoulders, and Back: I have a knot at the top of my back that always seems to be there. I’m not alone as many people have similar knots from sitting over computers, posture, etc. I came across the linked video on YouTube which demonstrates several stretches and exercises that help alleviate muscle knots, and I have to say, they worked pretty well. So give them a shot and let me know what you think. You Tube

The Science-Backed Strategies That Will Help You Eat Better: Researchers are trying to uncover the reasons people make healthy food choices. They have found that when some set a goal to just eat better, it usually doesn’t happen. What they have found that helps is setting one or two simple goals, making a grocery list, shopping online, not eating alone, and getting a good night’s sleep all significantly contributing to healthier eating. WSJ

Quote: “In the entire circle of the year there are no days so delightful as those of a fine October.” Alexander Smith

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!