We are reeling from the tragic mass shooting in Lewiston, Maine. Details are still coming out as our newsletter is going to post so we don’t know everything yet. But on Thursday we had employees at home and client meetings cancelled due to lockdowns and safety concerns. I am typing this intro from our Portland office and our building was just locked up and many downtown businesses closed due to the widening area under caution. We are living this as so many Americans have before us.

We have many clients, friends, and employees who either live in Maine or have close ties to the state. Maine is small enough that everyone here is connected in some way, and it is filled with close knit communities. There is no doubt that someone we know will be directly or indirectly affected by this week’s violence. Our hearts go out to those affected and if there is anything we can do for anyone, please let us know.

We try to stay focused on things that affect the economy and markets with our weekly newsletter and try to stay away from politics. But this week I’d like to ask every one of our federal and local political leaders “Is this the best you can do?” For all of our sakes, I can only hope the answer is “No.”

David Smith

On to our weekly newslettter…

Predicting the Future

“According to a new survey, economists see a 63% chance of a recession in the next 12 months”

This headline from the Wall Street Journal seems pretty timely, right? As the Federal Reserve continues to keep interest rates elevated, worker unions on strike, and two international conflicts are happening simultaneously, it seems reasonable to think that the next 12 months will be dicey. But what if I told you that headline was from 12 months ago? Economist Now Expect a Recession, Job Losses by Next Year – WSJ – Oct. 16, 2022

The economists surveyed in that article were not alone. A recession occurring in 2023 was essentially consensus 12 months ago. The bigger question at the time was how bad is it going to be. Since then, GDP has continued to grow, unemployment rates remain near record lows, all while interest rates continue to rise. Pretty much the complete opposite of what economists predicted.

Dimon vs The Feds: JPMorgan Chase CEO Jamie Dimon made headlines Tuesday, ripping the Federal Reserve and central banks around the globe for being “100% dead wrong” on their economic forecasts. CNBC In Dimon’s defense, the US Federal Reserve made one of the worst calls in history, stating that inflation was transitory back in 2021. The CEO pointed out that they were wrong then and believes that they should be “quite cautious about what might happen next year.” It should be noted that Dimon himself doesn’t have the cleanest track record either. In June 2022, Dimon warned investors to prepare for an economic “hurricane.” Bloomberg

What am I getting at here? Forecasting economic conditions is nearly impossible. A lot of smart people have been wrong lately, but it is not a new phenomenon Economic forecasts have been wrong lately, but that’s really nothing new - CNBC. As financial author, Morgan Housel said, “Invest like an optimist, save like a pessimist, and control what you can control.” With that being said, my 6-month price target for the S&P 500 is…

The Myth of 2% Inflation: While we are at it, let’s keep pilling it on the Fed. To be fair, I think they have an impossible job – slowing or accelerating the economy with one blunt tool is like asking a carpenter to build a house with just a hammer. However, some of their goals and tactics rightfully deserve some criticism. One, in my opinion, is their 2% inflation target.

The Fed is data dependent when it comes to making policy decisions, but their stated 2% inflation target adopted in January 2012 has no real scientific or data driven rationale. Rather, it came from an offhand comment by New Zealand’s finance minister back in the 1980s. Council on Foreign Relations

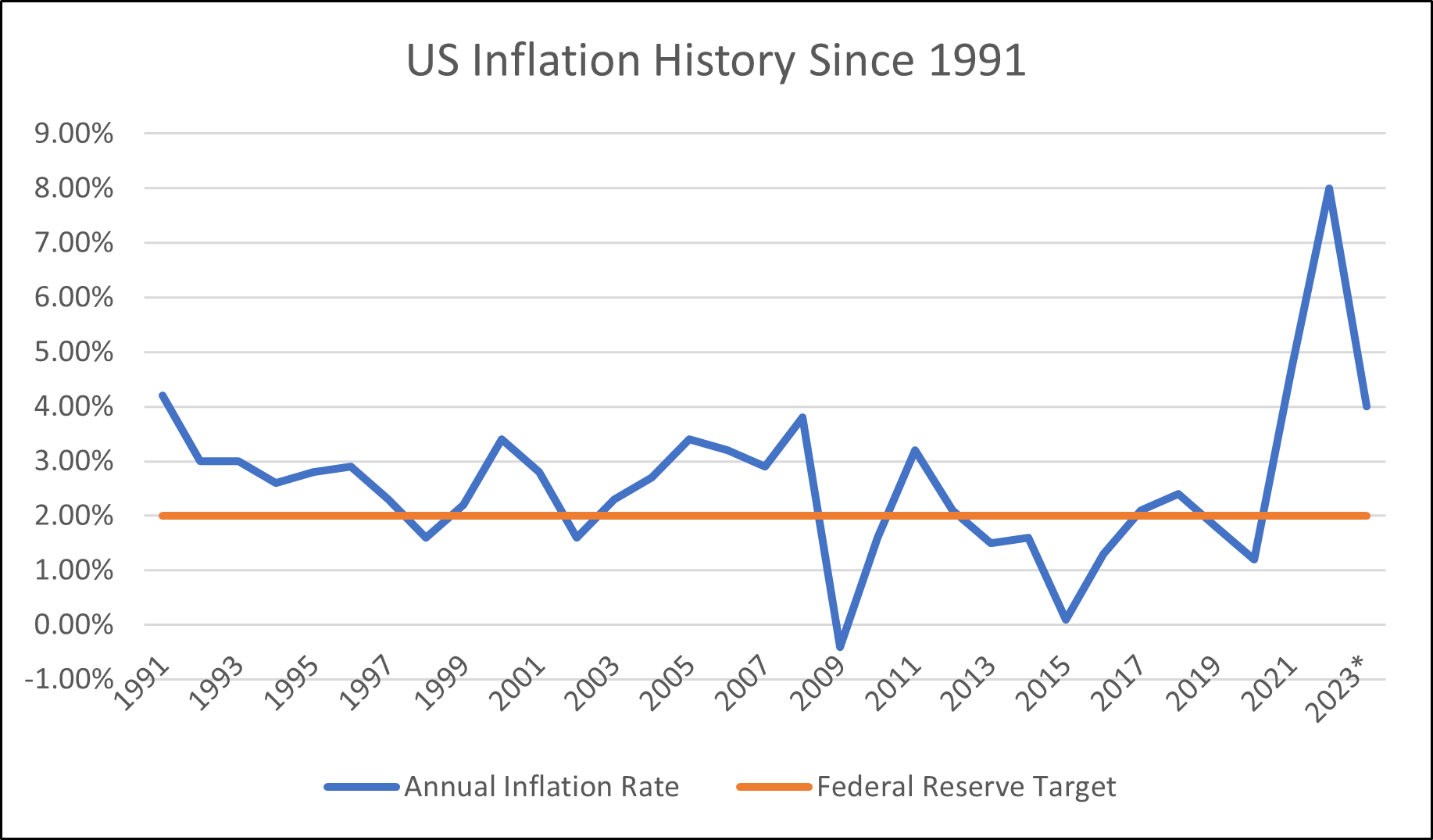

Data: Minneapolisfed.org, USinflationcalculator.com

As the graph above shows, the annual inflation rate has never really met the Fed’s target. It’s not to say the Fed shouldn’t have targets or goals, but many believe that they get too fixated on that number. I tend to agree.

Financial Planning/Investment Strategy Corner:

End of year tax planning: Hard to believe, but it’s already the end of October. That means it is time to start thinking about your upcoming tax bill. Here are a few strategies to lower your taxes for 2023:

- Charitable giving – Many people like to help out their favorite charities during the holiday season. It also can also help you cut down your tax bill for the year.

- Consider Donor-Advised Funds to make your charitable giving easier!

- Qualified Charitable Distributions (QCDs) – Another form of charitable giving, QCDs allow taxpayers who are age 70.5 or older to send funds directly from their IRA to a charitable organization without paying any taxes. Many retirees facing required minimum distributions will choose to give an unneeded portion of their distribution to charity to accomplish their giving and RMD requirement, all while saving on taxes. It is a win-win!

- Read about more reasons to consider a QCD here: Using an IRA QCD: Consider Giving Your IRA RMD to Charity

- Tax loss harvesting – Losing money on investments certainly isn’t as fun to talk about, but realizing some of those losses can be a real boon for your tax picture. Investors with investments in taxable accounts can use realized losses in their investments to offset gains they have also received. Taxpayers can even use their losses to offset up to $3,000 of ordinary income, and any unused losses carry forward for future use. Investopedia

Medicare Open Enrollment: Medicare’s annual fall open enrollment started on October 15th and runs through December 7th. This period allows recipients the opportunity to choose or alter their coverage. Medicare Fall Open Enrollment – What You Need To Know The Big Mistakes People Make in Medicare—and How to Avoid Them Speaking with a qualified Medicare Advisor can also help you determine what plan is best for you. We have professionals we have worked with and referred clients to. Contact us if you would like the names.

Quick Hits:

- Google’s new feature – Remove your phone, email, and home address from search pages CNBC

- Cheaper heating bills this winter – Natural gas prices set to be lower than last winter WSJ

- Looking to take a cruise in 2024? Here are the best cruise lines to consider USNews

- The conflict of reclining airline seats – Some are even asking the government to step in WSJ

Weight Loss Drug Growth: Ozempic and other “weight loss drugs,” such as Wegovy, have been a hot topic this year. Originally formulated to help adults with type 2 diabetes manage their blood sugar, these drugs have gone viral for their potential to help individuals lose weight. Forbes The gain in popularity has caught the attention of America’s food industry, and investors are taking notice. Walmart’s CEO stated that customers taking Ozempic buy less food. Stocks in companies such as Pepsi and McDonalds have seen their stock price decline as a result of this new added risk. Axios

Quote: “The market is often stupid, but you can't focus on that.” John Bogle

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback, and please forward this to a friend! Be well, take care, and stay safe!