March Consumer Price Inflation: March inflation data was released on Wednesday with core CPI, excluding food and energy, rising 0.4% last month, slightly lower than February’s 0.5% rise. Year over year core inflation rose 5.6%. If we include food and energy prices, CPI ticked up 0.1% in March, slower than its 0.4% gain in February. Year over year overall CPI rose 5% and it was the first time in two years that core CPI measures rose faster than overall CPI. There’s always a debate about which measure is the best for inflation with one side arguing that core inflation excludes month-over-month volatile price swings in food and energy categories; while opponents will quip “You can’t eat core inflation.” With inflation falling month over month it may mean the Federal Reserve pauses rate increases or goes for one more. Additionally with the recent turmoil in banks and the potential for reduced lending, leading to lower economic output, this report may give the Federal Reserve reason to pause. The next Federal Reserve meeting is May 3rd. Consumer prices | Axios US Core CPI March 2023 | Bloomberg

Bank Failures and Buffett: While the article headline may be offputting, the ‘Oracle of Omaha’ believes that depositors should not worry as they have always been protected during bank failures. Warren Buffett highlights that some banks simply do “dumb” things from time to time to boost earnings and take outsized risks but the fear and panic for bank depositors is unnecessary. In recent meetings with clients, we’ve highlighted the waves of banking crises that we’ve lived through from the savings and loan crisis of the 1980s and 1990s to the Great Financial Crisis in 2008, with banks and shareholders suffering, however, depositors are always covered up to the FDIC insured limit. Buffett Bank Failures | CNBC

Financial Planning/Investment Strategy Corner:

Americans can be pessimistic? The University of Chicago conducted a financial opinion survey in March 2023 and one of the questions was: “Do you feel confident or not confident that life for our children’s generation will be better than it has been for us?” Just 21% of interviewees said yes. Morningstar recently looked at household income over time and compared it to the number of occupants of households over time and while household incomes have not risen in step across all income quartiles over time, the number of members of households has fallen, leaving more income on average per person. There may be issues with this measurement but I thought it was an interesting way to look at the data. Are Americans Too Pessimistic About Their Financial Futures? | Morningstar

In his letter to JPMorgan shareholders, Jamie Dimon sounded awfully optimistic about the current position of the U.S. economy and the U.S. economy for years to come. With low unemployment, rising wages, and ’10 years of home and stock price appreciation,’ the current economy is displaying many positive data points. Dimon also thinks that these trends should continue, with U.S. GDP likely more than doubling 20 years from now. 'Sunny' Dimon | Axios Jamie Dimon's Letter to Shareholders | JPMorgan Chase & Co.

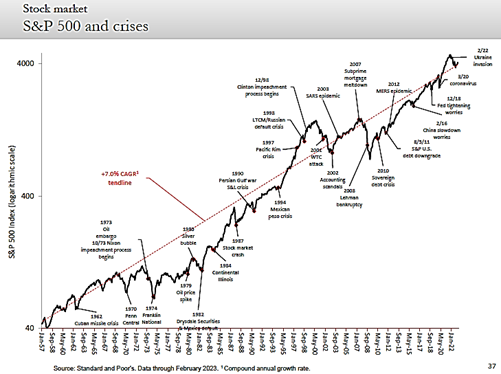

As watchers of our Fritz Meyer webinars have come to realize, during each crisis that we experience there may be a period of time where the market dips and in the moment it may seem like the market will never recover. While not all crises are equal, over the long run, the stock market continues to rise and shakes off the dips along the way (see chart).

At RSWA, we recently reviewed our long-term forecasts for each asset class’s 10 year expected returns which we use for financial planning projections. We do this annually, and as part of the exercise, we review multiple projections from a variety of sources and work out reasonable expected returns going forward. This process removes the potential for short-term biases as our focus is on long-term market returns.

Quick Hits:

- With any new technology, I always enjoy how creative and funny people can be. With all the news about ChatGPT and artificial intelligence recently, creating historical selfies seems like the best use so far. AI generates 'selfies' | Metro News

- An interesting history of the grapevine (and full of good puns). History of Grapevines | The Economist

- A few of my favorite spice blends. 7 Essential Spice Blends | Food and Wine

- The Basque region of Spain (ask me for pictures) is a beautiful place. I never knew the origin or the history of Picasso’s ‘Guernica’ painting until recently, right around the 50th anniversary of Picasso’s death. 50th anniversary of Picasso's death | Firstpost

- It seems like every week there are new images released from the James Webb telescope. Recently it was from within our solar system (James Webb Rings | Smithsonian) and this week there were images from a young supernova. Super Nova | CBS News

- We recently adopted two feral barn cats but this is a longer read about feral horses and a rescue in West Virginia. Saving the Horses of Our Imagination | The Sunday Long Read

Quote for your day:

“The man who is a pessimist before 48 knows too much; if he is an optimist after it, he knows too little.”—Mark Twain

Thank you for reading RSWA Financial Advisor Insights! We welcome feedback and please forward this to a friend! Be well, take care, and stay safe!